Hello. When contextualized with growth expectations, do Indian equities still rank as the most expensive globally? We’ll investigate, and then close with Gupshup, a round-up of the most important headlines.

BTW: What percent of the global elephant population lives in India? (Answer at bottom)

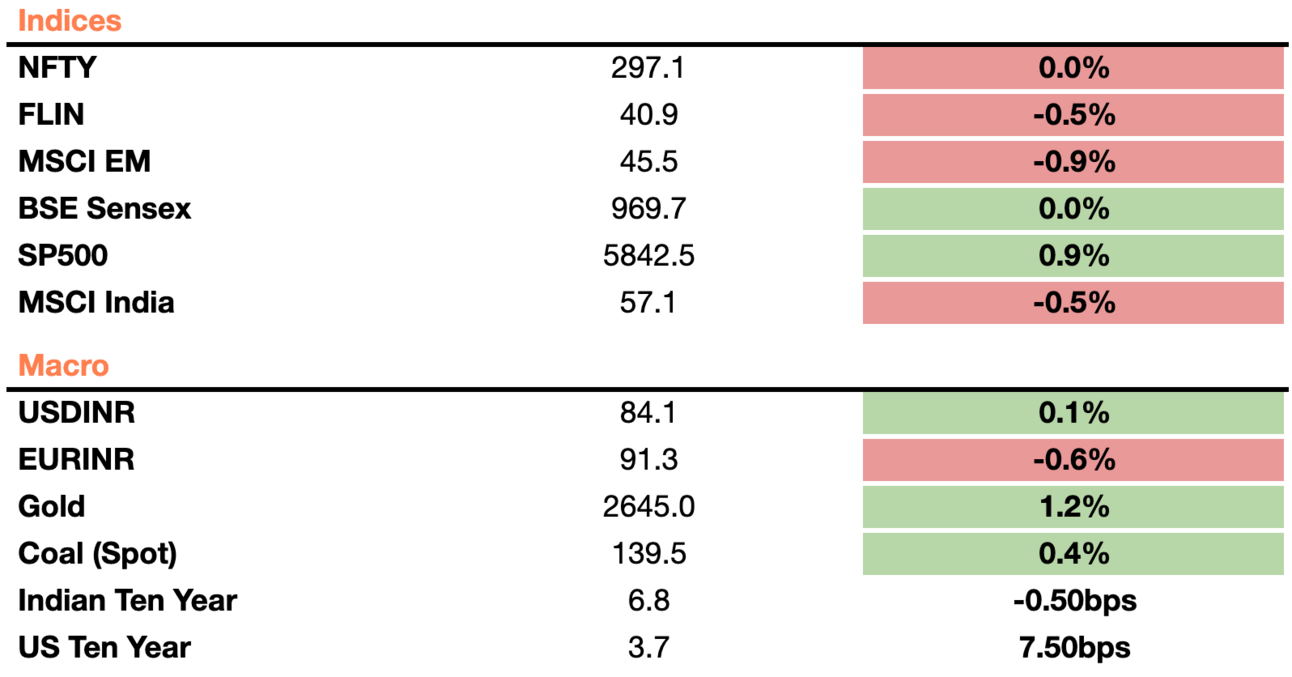

Markets

Read here for an appendix on the above.

Analysis

When Contextualized With Growth, Indian Equities Seem Affordable

Hyderabad, India. Photo by Raghavendra V. Konkathi on Unsplash

India’s price-to-earnings ratio (P/E ratio) reveals its equities are the most expensive anywhere in the world. But while a high P/E ratio suggests optimism, it can be misleading without factoring in growth potential. The P/E ratio, in isolation, only reflects the price investors are willing to pay for each rupee of earnings today, not what those earnings will become in the future. This is where the PEG ratio becomes crucial, as it contextualizes price relative to the expected earnings growth rate.

The PEG ratio, which divides the P/E ratio by the expected earnings-per-share growth rate, has averaged double digits over the past five yea₹When compared globally, India's PEG ratio shows that the price investors are paying for $1 of future earnings is relatively reasonable, despite the high P/E ratio.

The PEG ratio (Price/Earnings to Growth) for India currently is 2.16x, which is 2.4 times higher than its 5-year average. This elevated PEG is driven by an anticipated growth rate of around 8 percent, well below the 5-year average of 14 percent. Despite this slowdown, the price-to-earnings ratio remains over 26x (and a 12-month forward PE ratio of nearly 29), maintaining the PEG ratio above 3.

India’s PEG ratio reveals a broad equity valuation cheaper than the United States. Brokerages expect companies in the NSE Nifty 50 Index to report flat or low single-digit profit growth for the September quarter, with earnings potentially rising at the slowest rate in over four years, according to Jefferies Financial Group (excluding oil and gas).

Still, India’s real GDP growth is the highest among emerging markets.

Some tailwinds for stronger corporate earnings in India are as follows:

Low leverage Indian companies maintain relatively low leverage, with an average debt-to-equity (D/E) ratio of 0.5x. This implies that equity investors own about two-thirds of the average Indian company, meaning returns are driven more by company-specific factors than by the amplification of leverage. Notably, the D/E ratio has decreased from nearly 1.0x in 2014, indicating that return on equity (ROE) has increased, even though, all else being equal, ROE would typically decline as leverage falls. In contrast, U.S. companies tend to have a D/E ratio closer to 1.0x, suggesting that if Indian firms increase their use of debt, ROE and valuations could rise sharply. This is due to two key factors: first, as debt constitutes a larger portion of a company's capital structure, the relative share of equity shrinks, leading to higher returns on a smaller equity base for the same level of earnings. Second, higher leverage is often associated with significant capital expenditures aimed at enhancing future growth, which in turn boosts cash flow and profitability.

Growing Digital Infrastructure As of 2023, about 55 percent of India's population, or 821 million people, are internet users, leaving nearly 45 percent still offline and presenting substantial growth opportunities compared to the higher penetration rates in China and the U.S. This increase in internet access serves as a strong tailwind for Indian businesses, especially in the tech sector, which has some of the highest valuations globally. India ranks third in the world for unicorns, many of which are internet-based.

Macro

The US, UK stick with Indian investments and bilateral trade even after Canadian accusations against India mounted. US State Dep. Rep Matthew Miller sees India as an incredibly strong partner and as a key to creating free Indo-Pacific relations and trade. The above statement was soon after Canadian PM Trudeau contacted US officials. Other Western countries have also tiptoed around the issue in lieu of preserving strong economic ties. (BBG)

September’s trade gap narrowed to $20.8 billion (₹1.7 trillion) off of slowing gold imports - the deficit was 20 percent smaller than expected. (Business Times)

Equities

Cochin Shipyard was oversold by over 2 times. The government is selling 5 percent of their stake in the largest shipbuilding and maintenance facility in India. (Economic Times)

Reliance Industries is issuing bonus equity in a 1:1 form to all investors who hold Reliance stock by October 28th. (Livemint)

Alts

Elon Musk and Starlink notch a win as government rebukes satellite broadband auction in favor of allocation. This gives a cheaper entrance for foreign players, something Modi is trying to entice particularly in the growing demand for wireless services. That being said, access to satellite broadband will not be given for free with some pricing being done. Local players preferred an auction to create a larger moat but also to “even the playing field” with terrestrial services given those are auctioned. (BBG)

Vedanta has managed to raise its debt market value back to 98 from 50 cents on the dollar in 2022. The transformation for the mining company was a result of rising metal prices, increased bank financing from credit growth, and increased willingness on the part of Indian investors to take risks. India’s junk bonds as a whole are outperforming every other Asian country. (BBG)

Blackrock and Jio are in talks for a private credit JV. Private credit is the act of creating internal loans to various companies. Blackrock is looking to create a 50-50 JV with Ambani’s Jio to lend to everything from conglomerates to startups. (Reuters)

Policy

Trudeau says Canada tried to exercise quiet diplomacy but had to resort to public relations with India and Modi. This admission comes after Canada and India both removed all diplomatic officials from each other’s countries due to growing tensions over the killings of Sikh Canadians accused of being terrorists. India has strongly denied any ties to the killing of Nijjar which resulted in 4 Indian nationals being arrested. (BBG)

There is some risk of Canada charging Indian government officials post-diplomatic expulsions. While India has vehemently denied all allegations, there is a risk of consulates and visas shutting down while senior officials are called into Canadian courts. There are 427,000 Indians studying in Canada and 1 million non-resident Indians as well. (BBG)

Trust deficit among members of the Shanghai Cooperation Organization is damaging economies and diplomacy, according to Minister Jaishankar. The SCO includes Eurasian countries in addition to China, Russia, India, and Pakistan. Jaishankar, at the recent SCO meeting in Islamabad, called for a lack of separatism and extremism to result in more trade and diplomatic gains. The visit was the first in a decade when an Indian official visited Pakistan.

Oh, and 60 percent of the global elephant population lives in India.

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 84.05 Indian Rupee