Today, we explain why, after years of trying to bring down inflation, now India is confronting an unusual macroeconomic puzzle where inflation is too low.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

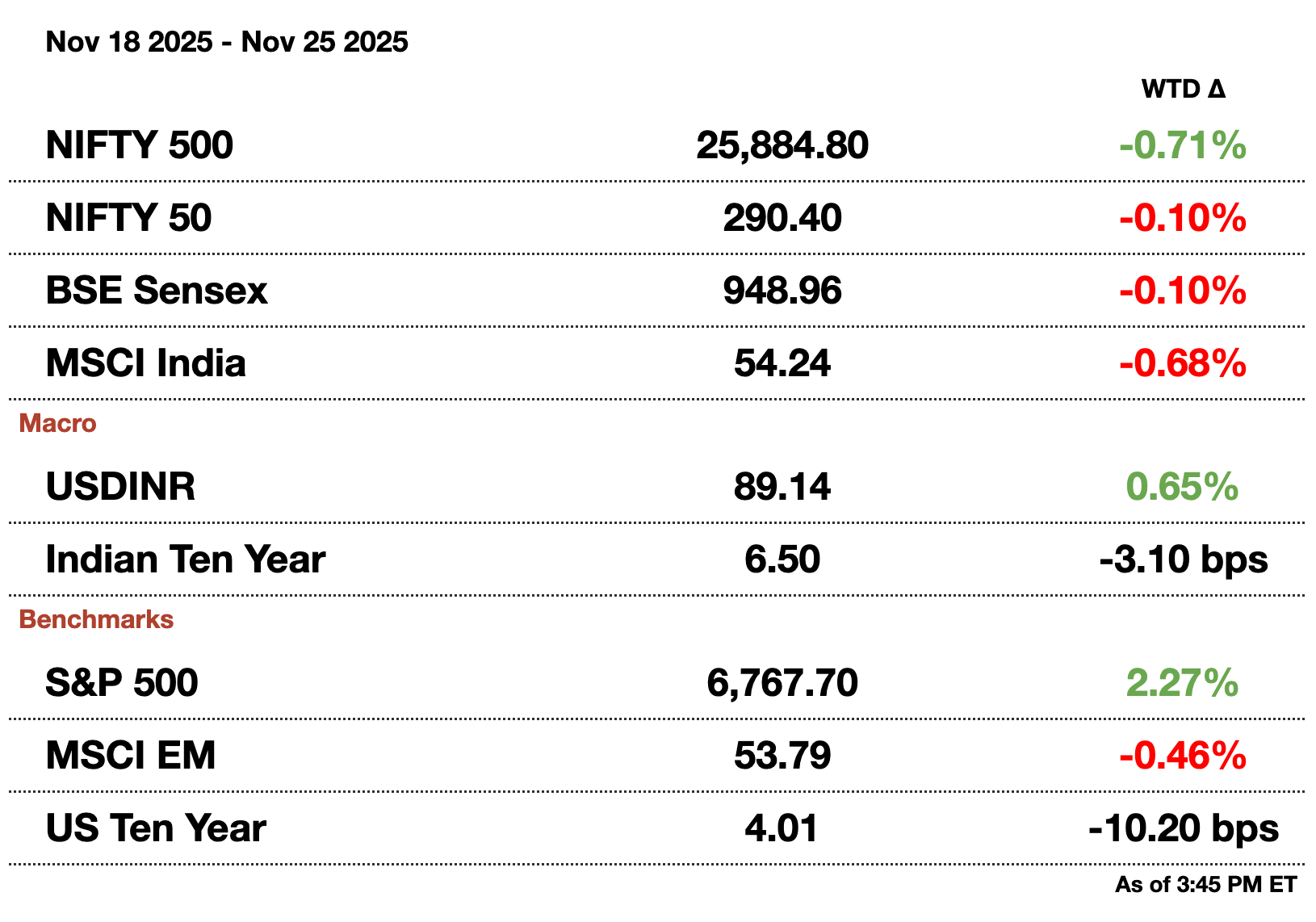

Macro

Bonds rallied after Malhotra said a 25 basis point is warranted in the December meeting. Economists now see rates going to 5.25 percent with inflation remaining benign. The stock market did not react and yields on 30-year bonds continue to rise which would require open market purchases to cool.

4 new labor reforms make it easier to hire, fire, provide social security, and reduce compliance on businesses. This reduces the compliance burden on companies which could lead to faster growth, but this might increase the cost of hiring since there will be increased retirement benefits that have to be factored into wages.

China's soy supply glut is raising exports to India. China shipped 71,000 tons in October and 2025 has already seen 3x the number of imports that 2024 had. Chinese soybean oil is trading at a discount to South America while reaching India in just 10 days.

The IMF is reclassifying the rupee as following a crawling peg versus a "stabilized arrangement".The change in label is due to increased volatility compared to last year when the rupee was soft-pegged near 86. There is no real market impact but the reclassification gives an external assessment to rupee management.

Equities

Zetwerk, a fabricated metal product manufacturer, is planning a $750 million (₹66.8 billion) IPO. The offering includes a mix of new and existing shares with a larger portion likely to be a fresh issue.

Beaten-down software stocks are back in focus due to appealing valuations. Rising deal activity, cost-cutting efforts, and a weaker rupee are drawing bargain hunters to the sector. There have been concerns that AI would erode back-office services, but the global AI trade has shown signs of fatigue.

High-frequency trading firms' profits continue to rise with HRT leading the pack. HRT made $246 million (Rs.22 billion) this year which was up 156% y-o-y. Global players like Optiver and homegrown firms like AlphaGrep and Graviton also showed growth on the year.

Defense stocks, a star in 2025, fell after a Tejas aircraft crashed at a Dubai airshow.The accident weighed on Hindustan Aeronautics but also weighed on export prospects for local companies.

Alts

Tata, parent of Jaguar Land Rover, sees Indian EV sales rising from 5 to 30% in 5 years. The CEO reiterated that cheap tech is lowering battery and overall car costs to let more entrants into the market. This year, 5% of car sales were EVs though this is expected to become 30%.

Indian banks might finance Russian oil trade in dirhams and yuans.The change in currencies and increased due diligence into tankers makes it possible for shipments to continue even though banks were wary of financing trade just last month. There is still a $7 (Rs.616) discount on Russian urals compared to other options for refiners.

Policy

India is partnering with French company Safran to make air-to-ground weapons. Bharat Electronics was chosen as the Indian company which will design the new HAMMER system. This is the latest tie up between the two countries with this past year seeing $7.2 billion (Rs.640 billion) in deals for fighter jets.

More than $10k in debt? We can help.

Debt happens. Getting out starts here.

Millions of Americans are tackling debt right now.

Whether it’s credit cards, loans, or medical bills, the right plan can help you take control again. Money.com's team researched trusted debt relief programs that actually work.

Answer a few quick questions to find your best path forward and see how much you could save. answer a few short questions, and get your free rate today.

Reach out to [email protected] to reach our audience and see your advertisement here.

India Needs... Higher Inflation?

After years of trying to bring down inflation, now India is confronting an unusual macroeconomic puzzle where inflation is too low. For an emerging market that aspires to rival China, undershooting its 4% inflation target is more than an academic issue; it constrains nominal GDP growth, weakens monetary transmission, and complicates trade dynamics at a moment when the rupee is already the worst-performing Asian currency this year. The RBI now faces the uncomfortable reality that monetary policy has stayed tight for too long, and that the framework guiding its inflation forecasts has repeatedly failed to capture the structural cooling underway in prices.

The strain is increasingly visible in markets. The rupee’s slide to a record low (exacerbated by the central bank’s temporary reluctance to intervene) reflects expectations that a policy inflection is approaching. Lower rates naturally weigh on the currency, but the speed of depreciation also signals deeper concerns. India remains without a trade deal with the United States, faces 50% tariffs on key exports, and continues to grapple with a capital flow environment that rewards economies offering clearer forward guidance. If the RBI is indeed preparing to shift its stance, the rupee’s weakness is functioning as the first real-time test of market acceptance.

The comparison with the US post-GFC period is instructive. Jerome Powell and Janet Yellen struggled with inflation that refused to lift despite ultra-accommodative policies, repeatedly describing the dynamic as a “mystery.” India is now experiencing a similar disconnect, albeit from the other direction: projections have consistently overestimated inflation, and the latest reading has already invalidated the RBI’s October forecasts. With price growth hovering well below target and growth momentum softening, the case for a durable shift toward accommodation is mounting.

Such a shift would mark a critical break from the RBI’s cautious posture in October, when policymakers opted for a neutral stance and emphasized vigilance rather than stimulus. But neutrality is no longer neutral when inflation is nearly half the target. The economy demands a decisive pivot toward an easing bias with a communicated preference for sustained reductions. Market sentiment would adjust accordingly which in turn revives credit demand for inflationary growth.

Though the rupee would be under pressure, the RBI can smooth volatility with intervention similar to 2024. That intervention would have to be light since the bank cannot simultaneously commit to looser financial conditions and lean heavily against the currency’s natural adjustment.

The RBI also has to insulate policy from diplomatic uncertainty surrounding the rupee. The US is aiming for a trade agreement to extract concessions linked to supply chains and Chinese/Russian policy. Modi’s deal will have to be sold domestically, meaning the RBI cannot wait for a bilateral agreement taking months to perfect. What it must do is acknowledge its inflation error, recalibrate its model, and adopt a framework consistent with a low-inflation equilibrium. December’s meeting is now a referendum on whether the RBI is willing to adjust to the demands of the economy.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.