Today, we discuss India’s first-ever long-term first-ever long-term liquefied petroleum gas (LPG) deal with the US, and how it is far more consequential than it might seem.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

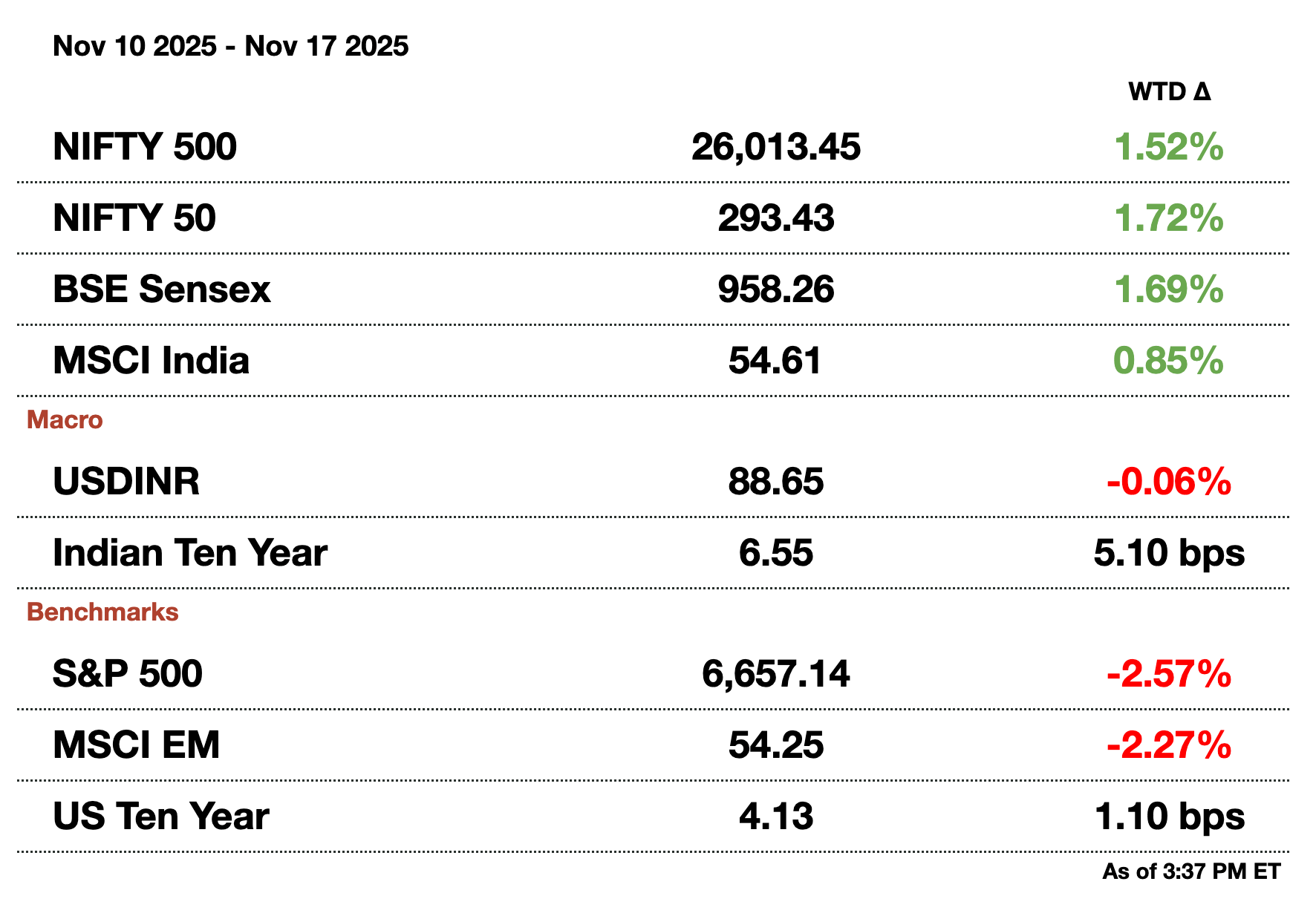

Macro

India's trade gap is $41.7 billion (₹3.7 trillion) due to US exports plunging. Economists, prior to tariffs, expected the gap to be $30 billion (₹2.7 trillion) but the 25 percent increase led to a massive drop. Labor-intensive sectors like jewelry, leather, and textiles are being hit the most.

Global Brent oil benchmarks have slumped 15 percent this year, buoyed only by India and China. Unsold shipments from the UAE, for example, are now being snapped up by Indian refiners and Chinese processors. There is still a large amount of supply and the two countries seem to be the only demand centers.

Along with silver, the government has now restricted imports of platinum jewelry until next April.Gross exports of metals fell by 30 percent in October to just $2.2 billion (₹195.4 billion). The restriction helps protect domestic producers at the cost of metals traders.

Equities

The BSE's gauge for newly listed firms is lagging the Nifty by 10 percent this year. The gauge tracks recent IPO performance, showing that 40 percent of the 108 companies in the index are trading below listing price now. This is with $21 billion (₹1.9 trillion) raised in the equity markets y-t-d.

Defense companies are up 25 percent this year from new contracts and earnings growth. An example is Bharat Dynamics which saw profits rise 76 percent y-o-y plus a new defense ministry contract worth $236.5 million (₹21 billion).

Hygenco might sell a 49 percent stake for $125 million (₹11.1 billion) to help realize its green goals.The company is investing $2.5 billion (₹222 billion) into hydrogen projects over the next 3 years.

Alts

Nomura is probing its Indian rates trading desk for inflated profits. The probe centers on how the firm valued its Strips trades. Strips are bonds that have their coupons and principal amounts separated. The market, huge in the US, sees $28 billion (₹2.5 trillion) of volume which is over 6x higher than just 5 years ago.

Grant Thorton is studying a minority sale or merger with US operations for its $2 billion (₹177.6 billion) Indian unit. For the government, this is big since the administration wants more competition to just the Big 4 accounting firms. There are some preliminary discussions being held with private equity firms with the floor value firm at $2 billion (₹177.6 billion).

Indian insurers are asking for banks to accept government bonds rather than cash collateral. Rising local yields have forced more margin to be put up for bond derivative trades which severely reduces return. There are $13.6 billion (₹1.2 trillion) worth of bond derivative trades with insurance companies using them to regulate their liabilities and rate exposure.

Naidu, on and off-leader of Andhra Pradesh, expects a 15 percent annual growth rate for his state. He is planning proper policies on labor and taxation, following models built by Singapore and Dubai, in addition to foreign investments which he expects a $1 trillion (₹88.8 trillion) of in the next decade.

India's top tech colleges (IITs) see opportunity with H1-B curbs.In the past, graduates have near exclusively gone abroad to work but changing regulation and growth in domestic firms makes staying home easier.

Policy

Former Bangladeshi PM Hasina, hiding in New Delhi, has been sentenced to death in her home country. A 3-judge panel found her guilty of ordering the killing of students and use of law enforcement agencies on the public. Hasina called the ruling politically biased. Dhaka and Delhi have an extradition agreement, and this puts pressure on Modi to send her back.

A Kashmiri resident suspected to be in the New Delhi bombing was arrested. The National Investigation Agency said the suicide bomber himself was from Faridabad and the new accomplice helped purchase the car used in the attack.

The Bihari victory signals populist spending will continue as a way to win elections.There was a $112.61 (₹10,000) grant for women which was meant to incentivize new businesses but also curry favor for the BJP. Expect a similar strategy for West Bengal and Tamil Nadu next year.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Reach out to [email protected] to reach our audience and see your advertisement here.

Bottled LPG in India

India Locks First-Ever American LPG Deal

India just locked in its first-ever long-term liquefied petroleum gas (LPG) deal with the US, and it’s more consequential than it looks. State-run refiners IOC, BPCL, and HPCL collectively agreed to import 2.2 million tons of American LPG in 2025 accounting for almost 10 percent of India’s total LPG imports next year. For comparison, the US supplied less than 0.6 percent of India’s LPG in 2024. The contract will bring regular cargoes from Phillips 66, Chevron, and TotalEnergies, priced off Mont Belvieu.

LPG has been India’s fastest-growing fuel over the past decade, rising 74 percent as Modi pushed rural households off biomass and into cleaner cooking fuel. Domestic production cannot keep up, so India has relied heavily on Qatar, UAE, and Saudi Arabia. The new US deal reduces single-region dependence, taps into America’s shale-linked LPG surplus, and reinforces energy diversification.

India is also deep in negotiations with Washington to unwind the Trump-era tariffs that hit more than half of Indian exports. Those duties were partly retaliation for India’s decision to keep buying discounted Russian oil. New Delhi wants relief without opening sensitive domestic markets, and Washington wants a more “balanced” trade relationship. Increasing US energy purchases gives India a clean way to rebalance flows without touching politically difficult sectors. Though Commerce Secretary Rajesh Agarwal says the LPG deal is not formally part of negotiations, it clearly strengthens India’s position.

For the US, the deal fits neatly into its broader Indo-Pacific strategy. It embeds American energy deeper into India’s import mix, provides a stable outlet for US Gulf Coast LPG exports, and strengthens supply-chain ties with a key counterweight to China. Energy flows are one of the fastest ways to harden a strategic partnership without waiting for slower-moving defense or tech agreements.

The open question is whether a second Trump term widens or narrows this alignment. Tighter visas, more aggressive tariffs, and a harder line on trade deficits could add friction. But Trump also values bilateral dealmaking and often rewards partners who buy more US goods. India increasing American LPG purchases gives New Delhi leverage in any renegotiation and helps pre-empt accusations of unfair trade.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.