Israel becomes first OECD country to sign investment pact with India. India’s chief economic advisor says Trump’s tariffs knock 0.5 percent off India’s growth. India’s finance minister raises concerns about rising bond yields.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

Macro

Indian state-owned refiners want to revive discounted Russian crude purchases but face fewer cargo offers as supplies shift to China and Middle Eastern competition rises. Despite US pressure, officials reaffirm India will keep buying Moscow’s oil, citing economic benefits.

India’s oil demand growth is set to outpace China’s this year, Trafigura said, driven by urbanization and rising incomes. China’s consumption is slowing outside petrochemicals, with stockpiling masking weakness, raising concerns about how global markets will absorb extra supply.

India’s benchmark indexes closed slightly higher Monday, lifted by auto stocks after tax-driven price cuts, though IT weakness capped gains. The Nifty 50 rose 0.13 percent to 24,773.15, and the Sensex added 0.09 percent to 80,787.3, with small-caps and mid-caps also advancing.

Equities

Hero MotoCorp, India’s largest two-wheeler maker, has appointed Harshavardhan Chitale as its new CEO effective January 5, 2026. He will replace acting CEO Vikram Kasbekar, who will continue as Chief Technology Officer after Niranjan Gupta’s earlier resignation.

PhysicsWallah has filed for a $437 million (₹38.5 billion) IPO, aiming to raise funds for coaching centers, tech, and acquisitions. Backed by WestBridge and Hornbill, the ed-tech firm grew revenue 49 percent last year while narrowing losses significantly.

Alts

Dabur is turning toothpaste into a battleground of nationalism, urging Indians to reject U.S. brands like Colgate amid worsening trade ties. Modi echoed this push, urging citizens to favor “Swadeshi” goods, as ads increasingly spotlight “Made in India” products.

India’s low-cost airline SpiceJet has fully repaid $24 million (₹2.1 billion) to Credit Suisse, owned by UBS, settling a long-running legal dispute dating back to 2015. The payment fulfills terms of a 2022 settlement agreement between the companies.

Policy

Xi Jinping and Vladimir Putin will join a BRICS virtual summit on Sept. 8 to discuss Trump’s trade policies, while Modi skips and sends India’s foreign minister. Brazil convened the meeting to rally emerging economies behind multilateralism.

India is cautiously responding after Trump softened his rhetoric, calling ties “special” and Modi a “great prime minister.” Officials welcomed the tone but await clearer signals, as disputes over tariffs and Russian oil imports still strain US-India relations.

India is likely to finalize a trade pact framework with Qatar in early October, as it seeks to offset the impact of U.S. tariffs. Trade Minister Piyush Goyal may visit Doha on Oct. 6 to conclude negotiations.

Become the go-to AI expert in 30 days

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

Reach out to [email protected] to reach our audience and see your advertisement here.

1. Israel Becomes First OECD Country to Sign Investment Pact with India

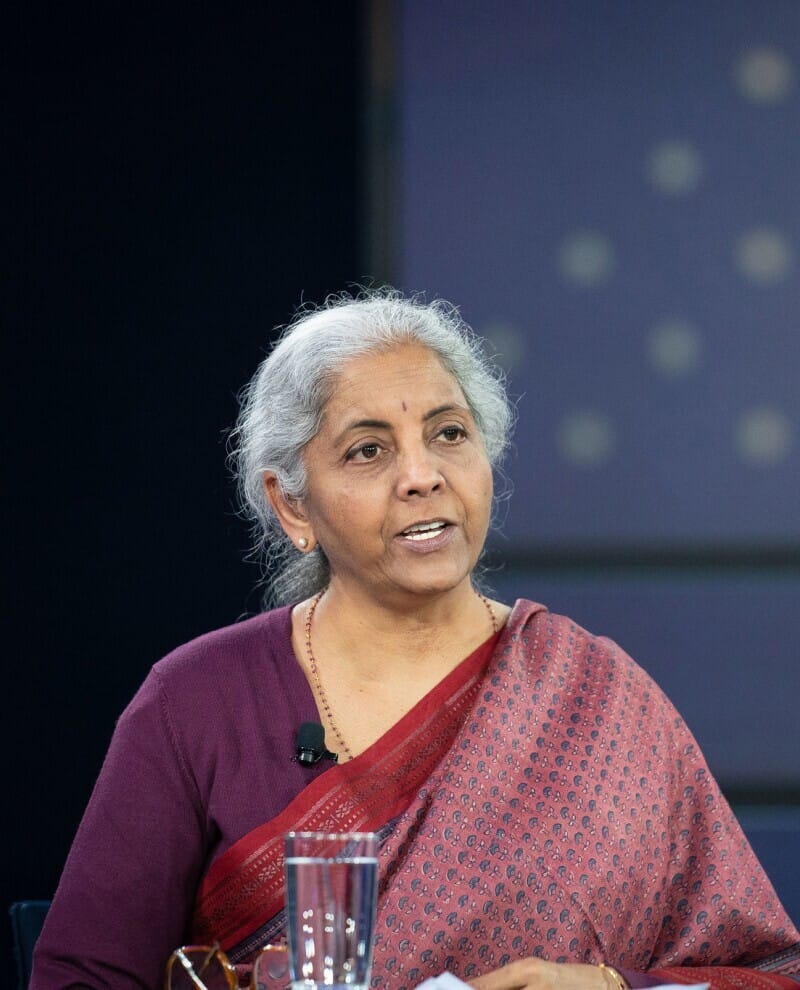

Finance Minister Sitharaman

The deal, signed in New Delhi by Indian Finance Minister Nirmala Sitharaman and her Israeli counterpart Bezalel Smotrich, is designed to protect and promote mutual investments while expanding opportunities in both markets. Israel’s Finance Ministry highlighted that the pact makes Israel the first member of the Organisation for Economic Co-operation and Development (OECD) to conclude such an agreement with India, underscoring the strategic depth of their financial relationship.

The deal is about making sure both sides follow fair rules for investors. That means protecting them from having their assets unfairly taken, keeping regulations transparent, treating everyone equally, and laying out clear steps for compensation if losses happen.

Economic ties between the countries have been steadily strengthening. In 2024, Israel’s imports of goods and services from India, excluding diamonds, totaled $1.6 billion (₹140.8 billion), while exports to India reached $3.1 billion (₹272.8 billion). Cooperation already spans defense, technology, and civilian infrastructure, most notably the Adani Group’s acquisition of a majority stake in Haifa Port, one of Israel’s largest.

The agreement comes at a politically sensitive moment for Israel, as some European nations weigh sanctions over its war in Gaza. For India, the deal reflects Modi’s broader push to diversify trade partnerships amid tariff-related tensions with the U.S. and to secure stable access to global markets.

Both sides see the accord as a framework that will not only encourage business but also reinforce their longstanding strategic ties, ranging from security to innovation.

2. Trump’s Tariffs Seen Knocking 0.5 percent Off India’s Growth

India’s chief economic advisor V. Anantha Nageswaran

India’s chief economic adviser, V. Anantha Nageswaran, warned that Trump’s steep tariffs could shave half a percentage point off the country’s GDP this year, underscoring the mounting risks to Asia’s third-largest economy.

The 50 percent duties, which Trump imposed in August to punish India for its Russian oil purchases, are the highest in the world (shared only with Brazil) and threaten to make Indian goods uncompetitive against rivals like Vietnam and Bangladesh. Labor-intensive industries such as textiles, gems, and jewelry are expected to bear the brunt, putting exports and jobs at risk.

“If the additional penal tariff is short-lived, the impact may be contained at 0.5 percent to 0.6 percent of GDP,” Nageswaran told Bloomberg TV. “But if it continues into the next fiscal year, the risk will be far larger.”

Despite the headwinds, Nageswaran stuck to the government’s growth forecast of 6.3 percent–6.8 percent for the year ending March 2026, pointing to strong 7.8 percent growth in the April–June quarter, recent tax cuts, and the lowest inflation in eight years. He said the goods and services tax overhaul, which lowered levies on most consumer items last week, could itself add 0.2–0.3 percentage points to growth.

3. India’s Finance Minister Raises Concerns about Rising Bond Yields

Finance Minister Nirmala Sitharaman said on Friday that surging bond yields were making government borrowing increasingly expensive, despite low interest rates.

India’s benchmark 10-year bond yield jumped 19 basis points in August, the steepest monthly rise in three years, and settled at 6.4651 percent on Friday. The RBI has cut its repo rate by 100 basis points in 2025 and held it steady at 5.50 percent last month.

“It is not affordable at the time when interest rates are otherwise low, bond yields becoming unsustainably high has a big bearing on the government,” Sitharaman told CNN-News18.

The comments come days after New Delhi slashed taxes on hundreds of consumer items, a move expected to cost $5.5 billion (₹480 billion) in revenue. That has fueled market worries about whether the government can meet its fiscal deficit target.

Sitharaman reaffirmed, however, that the deficit would be contained at 4.4 percent of GDP this year without cutting back on the planned $127 billion (₹11.21 trillion) in infrastructure spending. “Capital expenditure will not come down. It will be completed as stated in the Budget,” she said.

She also said the stake sale in IDBI Bank would conclude this financial year, with bids likely to open between October and December.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.