Hello! Welcome to the inaugural edition of the Samosa Capital newsletter.

This is your go-to weekly publication for a concise and insightful summary of Indian markets, business, and finance. In just five minutes, we'll provide you with everything you need to stay informed about the world's fastest-growing emerging market.

You are receiving this email because you previously subscribed to fifty50 by shreyas sinha. Samosa Capital is the latest content vertical launched by fifty50 media. Don’t care for this newsletter? No worries! You can unsubscribe at the bottom of this email.

Today, we’ll discuss developments in the Indian equities markets, the Reserve Bank of India’s failed bond buyback plan, and a private equity fund that just did the impossible for the second time.

Markets

Equities | Last Close | 1 Week | YTD |

|---|---|---|---|

NFTY | 270.16 | 1.28% | 3.86% |

FLIN | 38.08 | 2.75% | 9.27% |

MSCI EM | 1099.79 | 1.95% | 8.21% |

SP500 | 5313.64 | 1.77% | 12.04% |

MSCI India | 53.17 | 2.80% | 9.25% |

Other | Last Close | 1 Week | YTD |

|---|---|---|---|

USDINR | 83.291 | -0.26% | 0.11% |

EURINR | 90.497 | 0.40% | -1.79% |

Gold | 2385.5 | 2.80% | 15.05% |

Coal (Spot) | 143 | -2.12% | 8.42% |

Indian 10YR | 7.095 | -4.70bps | -8.30bps |

U.S. 10YR | 4.375 | -9.00bps | 43.90bps |

Quick Appendix: NFTY is a weighted average of the largest 50 companies listed in the National Stock Exchange of India by market capitalization. FLIN, or Franklin TSE India ETF, tracks large and mid-cap companies, weighted by market cap, to give international investors exposure to Indian markets. MSCI EM is an index that captures large and mid-cap companies across 24 emerging market countries and covers 85% of the free float-adjusted market capitalization in each country. SP500 is the index of the 500 largest companies listed in U.S. stock exchanges by market cap. MSCI India is an index that covers 85% of the Indian equity universe.

Indian Equities Face Largest Outflows Since June 2023

© Bloomberg

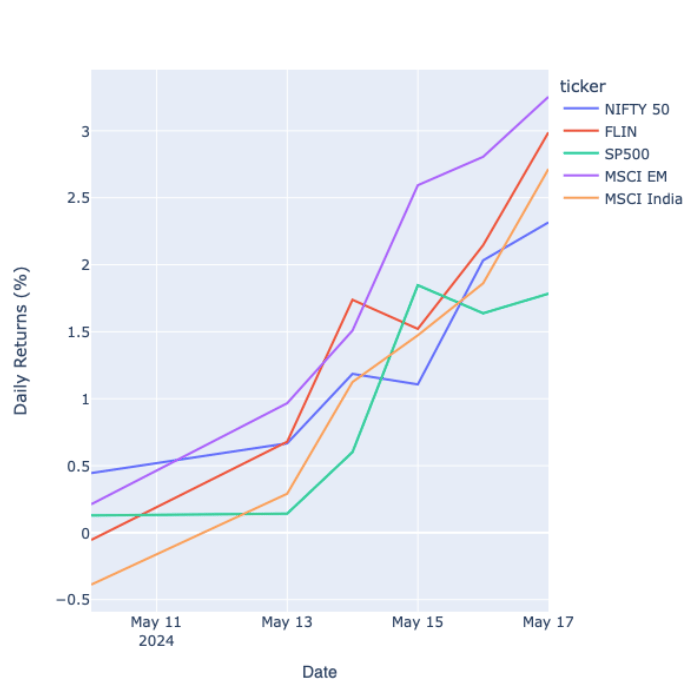

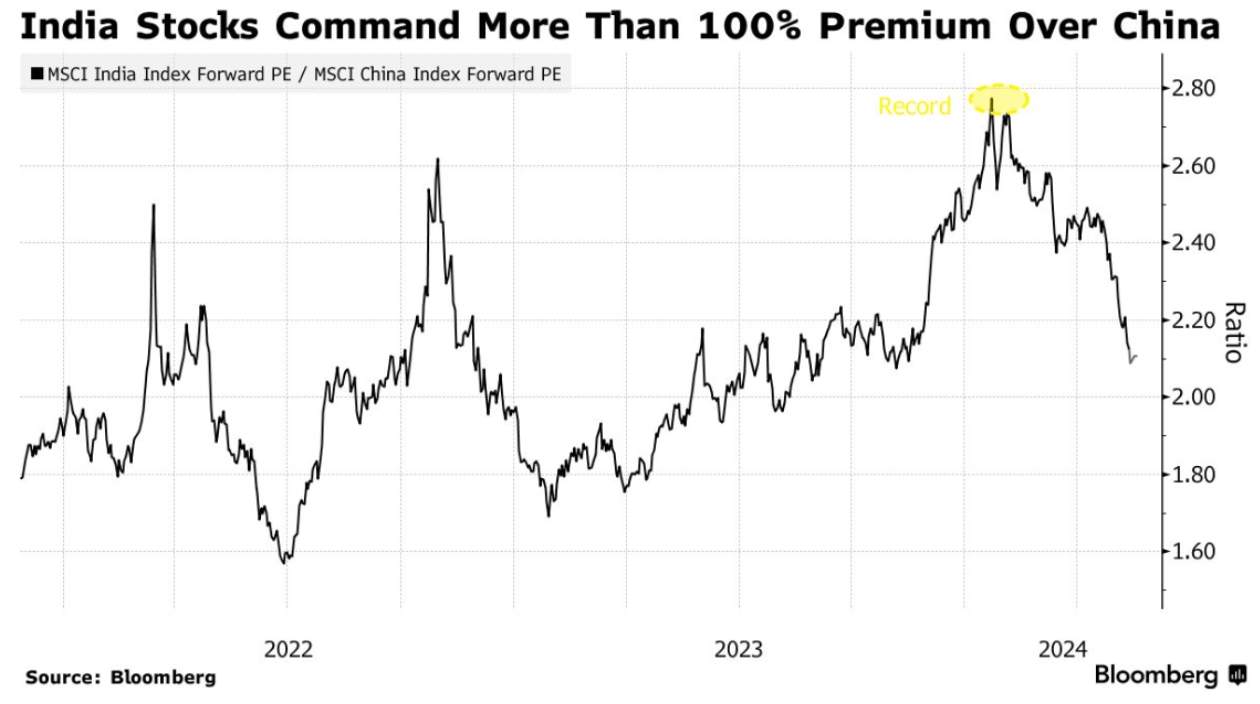

While Indian equities experienced gains this week due to higher-than-expected earnings, the stock market has still underperformed in various metrics in the last few months due to global investor pullback. Most US investors revolve between China and India for a plurality of their emerging market allocation, and now Chinese stocks seem cheaper.

As seen in the figure below, provided by Bloomberg, Indian PE divided by Chinese PE is still over 2.00, showing a greater than 100% price premium. While not a fully fair valuation, global investors have pulled back $3.5 billion from India’s stock market in May for the largest monthly outflow since June 2023. While China seems cheap, speculation that the national government is going to prop up real estate markets has also driven froth for China.

Of course, uncertainty has increased in India with lower-than-expected voter turnouts in national elections as well as heavy losses for PM Modi in the south. The fewer seats gained in India’s parliament, the lower the odds of the BJP passing their promised “Mission 2047,” a gargantuan spending and infrastructure plan to make India a developed country in 23 years.

While the short term appears hazy, India’s long-term equities outlook stays strong. Citi downgraded China while upgrading India with predicted growth of more than 6.5%-7% over the next decade as digital and physical infrastructure strengthens.

India Buyback Plan To Address Banking Liquidity Deficit Fails

India’s banking system is at a liquidity deficit of around 1.5 trillion rupees, which the Reserve Bank of India (RBI) attempted to address with two bond buyback plans, and a third scheduled for tomorrow, May 21. A liquidity deficit in the banking system can restrict loan issuance, potentially hindering economic growth.

This liquidity shortfall in the banking sector is primarily due to reduced spending amid the ongoing election, coupled with higher-than-expected tax revenues. Here’s how the two are related: The Indian government holds its funds in an account at the RBI. If the government were to allocate these funds to private sector projects, the money would transfer from its RBI account to private banks' accounts held by private sector companies who won the contracts to spend the money. Thus, a cash build-up by the Indian government causes a liquidity deficit for the country’s banks.

RBI plans to buy bonds from investors to increase banking liquidity and reduce its cash surplus.

However, this buyback plan is encountering obstacles with the RBI’s stake in keeping interest rates high and is looking to purchase the bonds at higher yields (lower prices). Investors are seeking lower yields (higher prices) on their bonds.

RBI has repurchased $1.51 billion (126 billion rupees) worth of bonds, a fraction of the $12 billion (1 trillion rupees) it offered to buy during the two auctions thus far. Tomorrow, the RBI will aim to purchase $7.2 billion (600 billion rupees).

Raising $1 BN for an India-focused PE fund is uncommon. Kedaara Capital Has Done It Twice.

Kedaara Capital raised $1.7 billion for its India-focused venture fund, the second time it has done so. This is typically uncommon for smaller independent funds and comes after Kedaara raised a combined $2.4 billion between 2011 and 2021. This reflects a growing interest to diversify away from China and towards India.

Blackstone has almost $50 billion in assets under management in India, planning to invest an additional $25 billion over the next five years. India is Blackstone’s third largest market for investing, behind the United States and the United Kingdom (The Hindu). KKR has deployed $11 billion over the last two decades, while co-founder Henry Kravis promised an additional $10 billion to invest at a faster rate. Goldman Sachs plans to invest $4 billion by 2029.

While Indian PE-VC activity declined 35% between 2022 and 2023, from $62 billion to $39 billion (returning to pre-pandemic levels, following global trends, India’s share in Asia-Pacific PE-VC investments has grown 5 percentage points, from 15% to 20% (Bain). Asia-Pacific PE funds raised just $100 billion in 2023, the lowest in a decade.

A Preqin 2023 investor survey found India and Southeast Asia as the two best EMs for investing.

Kedaara was co-founded over a decade ago by three McKinsey alum: Nishant Sharma, Manish Kejriwal (former India head of Temasek Holdings Pte.), and Sunish Sharma.

Macro

Indian Finance Minister Says Youth Consumption Will Underpin 30 Years of Rapid Growth for India (BBG)

Consumption consists of around 60% of India’s economy (68% in America, for context)

Population growth, advancements in service employment, and less risk-averseness than in previous generations will assist youth spending.

India’s median age is 28.2, compared to 39 in China and 38.5 in the U.S.

India Growth Can Top 6.5% for Decade, Economic Adviser Says (BBG)

India’s economy can sustain growth of more than 6.5%-7% over the next decade, supported by investments in physical and digital infrastructure, the country’s Chief Economic Advisor V. Anantha Nageswaran has said.

Equities

Norway Blacklists Adani Ports From Government Pension Over Ethical Concerns (Indian Express)

Citing “unacceptable risk” from Adani Ports’ contributions to human rights violations, Norges Bank, the central bank of Norway, has excluded the company from its pension

The Norwegian Government Pension Fund Global GPFG owns 1.5 percent of all shares worldwide, one of the largest funds in the world.

State Bank of India Profit Tops Estimates on Lending Income (BBG)

The country’s largest lender said first-quarter net income rose 24% from a year earlier to 206.9 billion rupees ($2.5 billion), according to a statement Thursday. That tops the average estimate of 132.2 billion rupees in a Bloomberg survey.

SBI shares rose 1.1% Thursday after earlier hitting a record high, boosting its gain for the year to 28%.

Global Health, which operates Medanta Hospitals, Increases Net Profit by 25% to $15.25 million (Economic Times)

Net profit for the quarter ending March 2024 was 1.27 billion rupees, while total income was $100.38 million (8.36 billion rupees)

Global Health is the third largest healthcare company in the U.S. by market cap (Simply Wall)

Bharat Petroleum (BPCL) had a 35% drop in net income to $506 million. They also approved a 1:1 bonus issue. (Economic Times)

BPCL is state-run by the Ministry of Petroleum and Natural Gas but is publically traded under BPCL in NSE

The stock did not fall on the news and is up 62.01% in the last six months (as of May 18 COB)

Fixed Income

India’s Biggest Junk Bond Sweetens Offer in Return for More Time (BBG)

Goswami Infratech Pvt, an investment company within the Shapoorji Pallonji group owned by billionaire Shapoor Mistry, issued India’s largest junk bond last year for $1.7 billion (143 billion rupees).

However, upon troubles in making payments, the investment fund will offer an extra 4 billion rupees, bringing the total payment to 18 billion rupees ($216 million) to delay the payment to its investors

The payment must be made no later than September 30

Investors in the junk bond include Cerberus Capital Capital Management LP, Varde Partners LP and Davidson Kempner Capital Management LP. Others have included Canyon Capital, Edelweiss, Deutsche Bank and Standard Chartered Bank.

Investors Favor Indian Bonds After China Pushes Back on Rally (BBG)

Indian sovereign debt returned 3.9% in 2024, vs China’s 2.9%

Emerging market government bonds overall experienced a 0.6% loss

JPMorgan Inclusion of Indian Bonds to Aid Private Credit (BBG)

JP Morgan will add Indian bonds to its bond index on June 28

This will give increased exposure to Indian credit, described as a “watershed moment”

India private credit deals were up 47% in 2023 at $7.8 billion, from $5.3 billion in 2022

Asian Junk Bond Sales Are Hottest in Five Years on India Boom (BBG)

Asia ex-Japan junk dollar bond sales rise for the first time since 2019 (though barely and from a low bottom)

Indian junk bonds made the largest share of the growth

Politics

Phase 5 of Indian National Elections Took Place Today (Indian Express)

Elections took place at constituencies in Bihar, Jharkhand, Maharashtra (including Mumbai), Odisha, Uttar Pradesh, West Bengal, Jammu and Kashmir, and Ladakh

Average voter turnout was 58.96%

India is currently amidst its six-week election, where Prime Minister Modi is seeking another five-year term. The election began on April 19 and will end on June 1

PM Modi announced a $400 billion welfare promise ahead of elections (BBC)

The plan promises water, food, and housing for India’s lowest-income earners

The bold plan is the equivalent of how much Modi’s government has spent on direct cash benefits to 900 million people over the last decade: $400 billion (34 trillion rupees)

Indian Authorities Seize $1.1 Billion in Cash, Drugs In Election (BBG)

Indian authorities have so far seized $1.1 billion (88.9 billion rupees) worth of black money, drugs, and other goods in a crackdown on illegal vote buying

45% of seizures have been drugs

China Picks Xu Feihong as New Ambassador to India, PTI Says (BBG)

Relations between India and China have been frozen since June 2020 when clashes between soldiers along the disputed Himalayan border left at least 20 Indians and an unknown number of Chinese dead.

The two countries have made incremental progress in resolving the border crisis in 21 rounds of diplomatic-military talks since then.

We need your feedback to make this newsletter more useful to people like you. Please let us know what you think here.

And, consider sharing with three friends.

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.29 Indian Rupee