In partnership with

The EU and India have struck a landmark trade deal after nearly two decades of negotiations. Today, we explain more.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

Macro

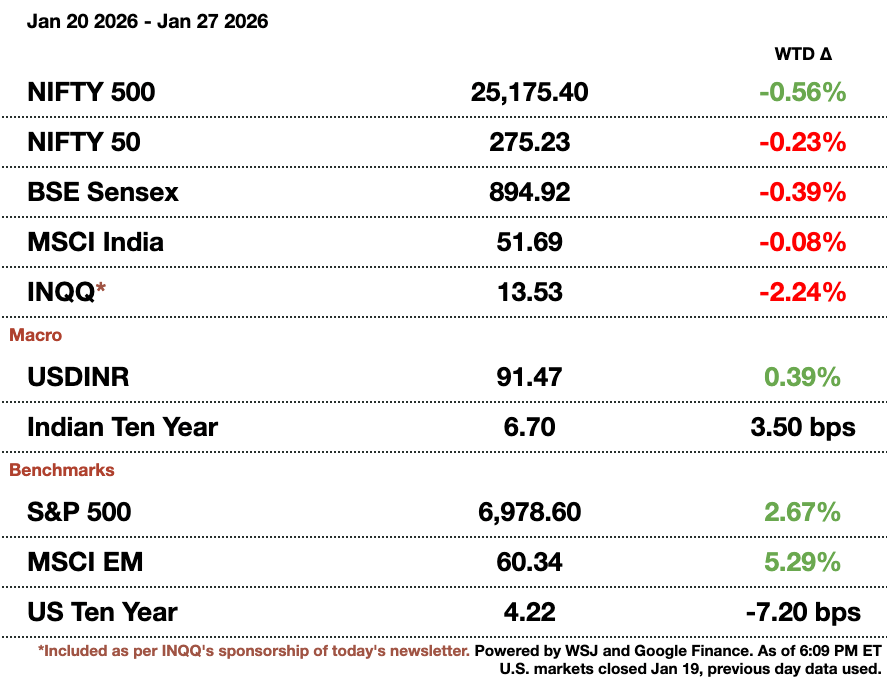

Most analysts see the rupee going past 92 towards 95. The RBI can likely only slow the currency’s continued decline. The bank has not picked a specific level to defend, rather only curbing bouts of volatility. Barclays and UBS see the rupee falling towards 94 by the end of this year.

Equities

Equities broke a 3-day losing streak with EU trade news and positive US FTA news. Trump announced that work is being done on an India FTA. As such, the index also finally broke past its 200 moving average which it had fallen under recently.

Margin based stock bets rose to over $13.2 million (₹1.2 billion). Brokers, rather than happy, are actually dismayed since most do not have the infrastructure to handle the inflow citing illiquid stocks. Outstanding loan amounts have more than doubled.

ICICI Asset Management is renewing its investment interest in small-cap stocks. The fund had shuttered its small-cap fund nearly 2 years ago due to weak returns and extremely high valuations. The bank is now accepting more money for its $920 million (₹83.9 billion) fund.

Eternal's Blinkit, a quick-delivery platform, broke even on an adjusted-EBITDA basis.This is the first large delivery platform to not majorly underperform. Analysts still flagged concerns with order value growth falling 9 percent q-o-q, a sign of intensifying rivalry and smaller wallet size.

Alts

India's holdings of US treasuries falls to $174 billion (₹15.9 trillion), a fresh 5-year low. This is 26 percent down from 2023’s peak and treasures now only account for 33 percent of the RBI’s total reserves. Gold and alternatives taking a larger share mimics other economies like China with dollar assets getting pounded by central banks globally. The move is likely to mitigate sanctions risk.

A former Citigroup private banker already drew in $2 billion (₹182.4 billion) for his new wealth management firm.The firm is less than a year old and has already hired 60 bankers. Nexedge will focus on wealthy individuals and family offices.

Policy

Canadian British Columbia Premier Eby says India wants to deepen relationships on metals and energy resources. Eby spoke with executives at Indian Oil and Hindustan Petroleum about direct investments in the region. Companies also mentioned envisioning their Canadian business to grow at 8 to 10 percent annually.

India’s Tech Boom Is Here. Now, You Can Invest in Minutes.

Samosa Capital is excited to partner with The India Internet ETF (NYSE: INQQ), a U.S.-listed ETF that lets you invest in the tech companies driving India’s future in minutes: from Swiggy and Lenskart to Eternal and Nykaa.

In a single trade, you'll get access to a basket of innovative companies contributing to the future of the world’s most populous country, and gain exposure to India's long-term investment potential.

INQQ is available through most major online brokerages, giving you direct access to rigorously researched Indian tech giants.

Reach out to [email protected] to reach our audience and see your advertisement here.

India-EU Trade Deal Announced

The EU and India have settled a landmark free trade agreement after nearly two decades of negotiations, marking a major shift in global economic alignments as countries respond to the Trump administration’s aggressive tariff policies. Both regions are also establishing free trade between two of the largest consuming blocks of 2 billion people.

EU President von der Leyen announced the deal Tuesday during a visit to New Delhi alongside European Council President Antonio Costa. Calling it “the mother of all deals,” von der Leyen said the agreement creates a free trade zone spanning two billion people and sends a clear signal that cooperation remains the best answer to global economic uncertainty.

Modi described the pact as India’s most significant trade agreement to date, saying it would strengthen the country’s manufacturing and services sectors while improving market access for farmers and small businesses. The deal comes as India looks to offset the impact of a 50 percent US tariff and shed its long-standing protectionist image.

Here are some of the specific details: India will eliminate or reduce tariffs on 96.6 percent of EU goods, according to the European Commission. In return, the EU will cut or scrap duties on 99.5 percent of Indian exports over seven years. India has also agreed to allow up to 250,000 European-made vehicles to enter the country at sharply reduced tariffs, a concession far larger than those offered in recent trade deals. In fact, the concession is 6 times larger than any one previously made.

The pact is expected to give Indian exporters a competitive edge in labor-intensive sectors such as textiles, gems, jewelry and footwear, which have been hit hard by US trade barriers. The EU has also made binding commitments on student mobility, post-study visas and access across more than 140 services sectors, while India has kept its politically sensitive dairy industry outside the agreement.

Some other important trade details are India cutting tariffs on alcohols, chocolate, and manufacturing equipment. The tariffs are being cut from, on average, nearly 100 percent to anywhere ranging at 0 to 30 percent. Beyond trade, the two sides also unveiled a new security partnership aimed at deepening defense cooperation and coordinating more closely in the Indian Ocean region, where China’s presence has expanded in recent years.

Bilateral trade between the EU and India stood at $136.5 billion (₹12.5 trillion) in the fiscal year through March 2025, making the bloc India’s ninth-largest trading partner. Both sides expect the agreement to double this trade amount by 2032. The agreement still requires legal vetting and ratification by the European Parliament, a process expected to take about six months.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.