Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India will allow private companies to design and build advanced fighter jets for the first time,

The NSE has reached a $58 billion (₹4.95 trillion) valuation in private markets,

HDB Financial Services awaits SEBI approval for IPO.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

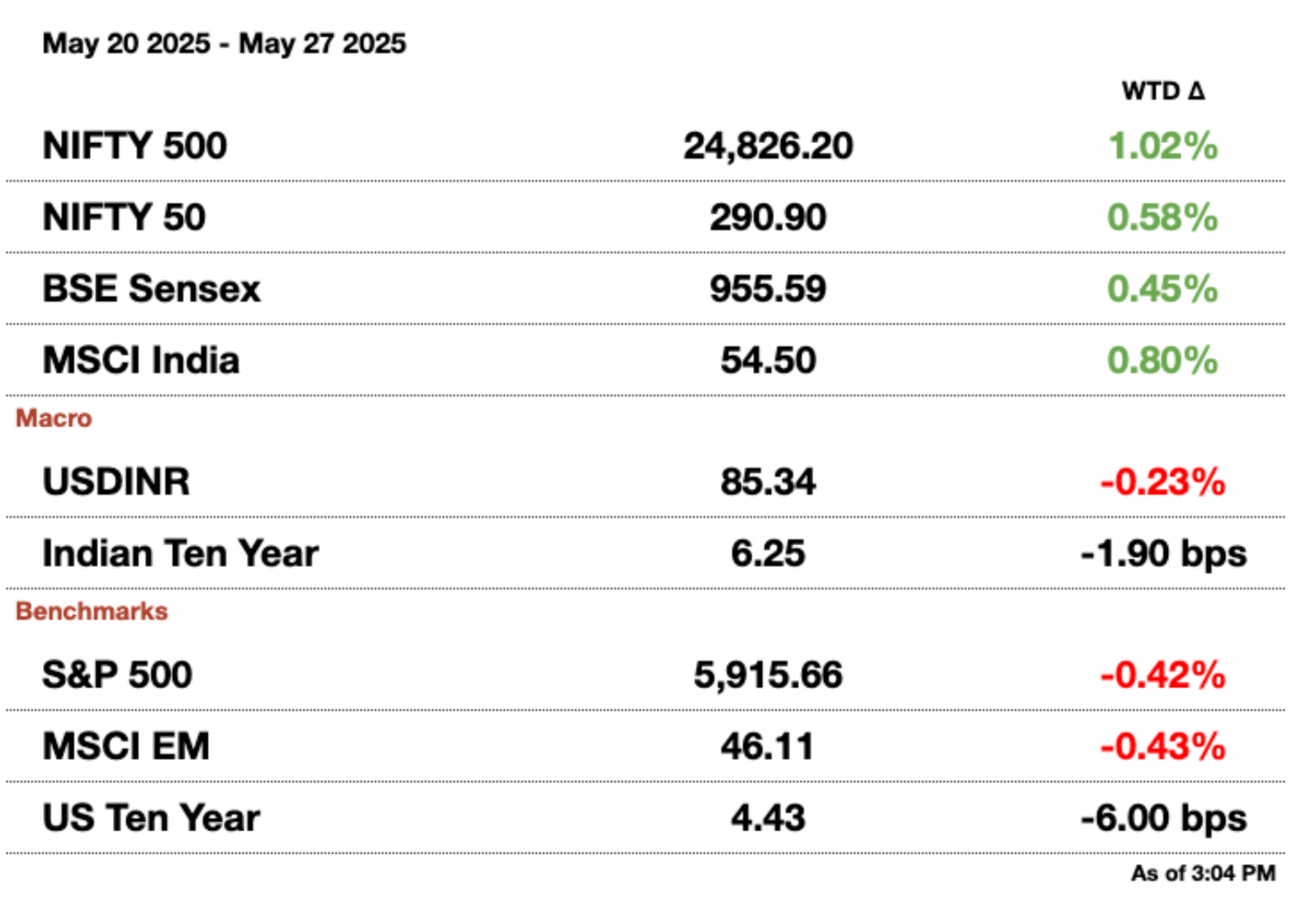

Market Update.

India Boosts Defense Manufacturing with Privatized Fighter Jets.

India will allow private companies to design and build advanced fighter jets for the first time, a major shift aimed at reducing the country’s reliance on foreign defense imports and expanding its domestic military-industrial base.

In a statement on Tuesday, the Ministry of Defence said both state-run and private sector firms will be granted “equal opportunities” on a competitive basis to develop a next-generation twin-engine fighter aircraft. Companies can bid independently, as joint ventures, or in consortia.

The move marks a significant departure from India’s decades-old model that favored Hindustan Aeronautics (HAL). This state-owned aerospace giant has long held a virtual monopoly on domestic aircraft production. Private firms until now have largely been confined to supplying components.

Hindustan Aeronautics fighter jet

Regional tensions drive change: The decision aligns with Modi’s push for self-reliance in defense production; a campaign intensified by ongoing border tensions with China and Pakistan, as well as the lessons learned from global supply chain disruptions during the Russia-Ukraine war.

India’s current fighter fleet is heavily dependent on aging Soviet-era platforms, and efforts to replace them with domestically developed aircraft have progressed slowly. Its single-engine Tejas fighter, developed over decades, only recently entered service in significant numbers. Developing twin-engine jets will present an even more complex engineering and production challenge, one that the government now hopes to accelerate by opening the door to private innovation and investment.

Supply concerns: A key uncertainty remains around the sourcing of jet engines for future aircraft. India is currently in negotiations with the US to co-produce engines, though progress has been slow. Last year, the government penalized General Electric over delays in engine deliveries for the Tejas program.

Opening the fighter program to private industry is expected to catalyze investment, create aerospace jobs, and potentially attract foreign technology partnerships, all while bolstering India’s strategic autonomy in defense.

India’s Top Exchange Jumps in Value Ahead of Long-Awaited IPO.

The NSE has reached a $58 billion (₹4.95 trillion) valuation in private markets as investors ramp up bets on a long-delayed initial public offering that could materialize later this year. Demand for the unlisted shares has soared in recent weeks, with wealthy individuals and institutions paying as much as $23 (₹2,000) per share, according to people familiar with the transactions. The surge has dramatically outpaced supply, pushing the exchange’s valuation up 60 percent from September levels and nearly doubling since earlier this year.

If realized, the IPO would place NSE above the Nasdaq in market value and narrow the gap with Deutsche Boerse, currently worth around $62 billion (₹5.29 trillion).

Investor frenzy: Private transactions suggest NSE now has nearly 2.5 billion outstanding shares, 64 percent of which are held by public investors, including domestic and foreign institutions, and high-net-worth individuals. In some recent deals, intermediaries were forced to return funds to buyers after sellers pulled out amid soaring prices, two people said, requesting anonymity as details are private.

NSE’s stock has become one of the most sought-after assets in India’s pre-IPO market, fueled by optimism that the exchange is nearing resolution of a regulatory dispute that has stalled its listing plans for nearly a decade.

Regulatory overhang: NSE is working to settle a long-standing investigation by SEBI into alleged preferential access given to certain high-frequency traders. NSE has reportedly offered $118 million (₹10 billion) to resolve the case, which is expected to clear the path for its long-awaited IPO.

The exchange, backed by major investors including Life Insurance Corporation of India and Canada Pension Plan, first filed for a public listing in 2016. The SEBI probe led to a six-month ban from capital markets and effectively froze progress for years.

Market share: Alongside IPO preparations, NSE is looking to regain dominance in equity derivatives trading. After losing ground to rival BSE, the exchange is applying to shift its weekly and monthly contract expiries to Tuesdays, a direct challenge to BSE's position, following a regulatory cap on expiry days.

CEO Ashish Kumar Chauhan recently told investors that the firm’s market share decline had “run its course,” and the exchange is positioning itself for a comeback as it approaches what could be one of India’s most anticipated public offerings in years.

HDFC Arm Nears Regulatory Nod for an IPO.

HDB Financial Services is close to receiving approval from India’s market regulator for an initial public offering that could raise up to $1.5 billion (₹128.1 billion), potentially making it the country’s largest-ever IPO for a shadow bank.

SEBI is expected to issue its final approval in the coming weeks, paving the way for the HDFC shadow unit to launch one of the most anticipated listings this year. The company is preparing to engage with institutional investors as soon as next month, one of the people said, asking not to be named as the information is private.

Biggest shadow bank IPO yet: The offering would mark the biggest IPO in India’s non-banking financial company (NBFC) sector and one of the largest across all industries since Hyundai’s $3.3 billion (₹281.7 billion) debut in 2024. The listing will also test the resilience of India’s capital markets, which have remained active despite global volatility and recent trade tensions with the US.

HDB Financial’s parent, HDFC Bank, is India’s largest private lender and has long signaled plans to unlock value through a listing of its consumer finance arm. The move comes as investors show a growing appetite for financial sector plays, particularly those linked to established banking franchises.

HDFC’s IPO catalyst: HDB’s IPO may be followed by even bigger deals. Tata Capital recently filed preliminary documents with SEBI to raise as much as $2 billion (₹170.7 billion), while South Korea’s LG Electronics has paused its planned Indian unit listing amid macroeconomic headwinds.

India’s IPO market was among the world’s busiest last year, with strong participation from retail and institutional investors alike. HDB Financial’s debut would be a key gauge of whether that momentum can continue through 2025.

Message from our sponsor.

Unlock the Ultimate ChatGPT Toolkit

Struggling to leverage AI for real productivity gains? Mindstream has created a comprehensive ChatGPT bundle specifically for busy professionals.

Inside you'll find 5 battle-tested resources: decision frameworks, advanced prompt templates, and our exclusive 2025 AI implementation guide. These are the exact tools our 180,000+ subscribers use to automate tasks and streamline workflows.

Subscribe to our free daily AI newsletter and get immediate access to this high-value bundle.

Email [email protected] to sponsor our next newsletter!

Gupshup.

Macro

India's steel ministry supports extending import restrictions on low-ash met coke, citing ample domestic supply. This move challenges steelmakers who want fewer limits on imports. The country had set quotas in December, capping imports at 1.4 million metric tons for the first half of the year.

The Indian rupee weakened 0.3 percent on Tuesday to close at 85.33 per U.S. dollar, in line with declines across Asian currencies as the dollar regained strength. Traders cited month-end dollar demand from importers as an additional factor pressuring the rupee. After briefly rising to a two-week high of 84.78 on Monday, the currency gave up those gains amid broader risk-off sentiment and weaker Asian equities.

Equities

India’s stock market is expected to reach new highs by the end of 2025 and continue rising next year. Despite concerns over high valuations and a potential short-term correction, foreign investors returned as net buyers in April, helping the Nifty 50 index climb nearly 15 percent from its April low.

Coal India will sell up to 10 percent of its stake in its consultancy arm, CMPDI, via an IPO, the first such listing among its units. The offering includes 71.4 million shares, with Coal India keeping 90 percent ownership. IDBI Capital and SBI Capital will manage the sale.

The Nifty India Defense Index hit a record high, with analysts expecting continued outperformance driven by strong order visibility and growing global demand. Despite high valuations, investor sentiment remains positive for the sector.

IndiGo co-founder Rakesh Gangwal has sold a 5.7 percent stake in the Indian low-cost airline through a block deal valued at approximately $1.36 billion (₹116.1 billion). The sale is part of Gangwal’s ongoing efforts to gradually reduce his stake in the airline.

India's Life Insurance Corporation (LIC) reported a 38 percent rise in Q4 profit, boosted by a significant drop in employee-related costs, which fell from $1.61 billion to $690 million (₹137.50 billion to ₹59.28 billion) y-o-y.

India’s kitchenware maker TTK Prestige reported a 39 percent drop in Q4 profit, mainly due to weak rural sales affected by reduced microfinance lending. The company also took a one-time impairment charge of $8.4 million (₹714 million) on its UK subsidiary amid economic stress and potential U.S. tariffs.

Alts

India and Pakistan are ramping up investments in drones following recent clashes, marking a new phase in their long-standing military rivalry. While India partners with domestic manufacturers, Pakistan relies on China and Turkey for its UAVs, which both sides use to apply pressure without escalating into full-scale conflict.

Indian authorities are working to contain an oil spill off Kerala's coast after the Liberia-flagged vessel MSC ELSA3 sank on Saturday, leaking fuel and releasing 100 cargo containers into the Arabian Sea. The ship was en route from Vizhinjam to Kochi. All 24 crew members were safely rescued.

Policy

India will reinstate tax refund benefits for exporters starting June 1 to enhance their global competitiveness, the trade ministry announced. The Remission of Duties and Taxes on Exported Products scheme, which reimburses exporters for embedded duties not covered by other refunds, had ended in February but will now cover sectors like textiles, chemicals, pharmaceuticals, cars, agriculture, and food processing.

India's market regulator SEBI has mandated board approval for more senior roles at exchanges, aiming to enhance governance and potentially clear hurdles for the NSE's IPO. The move also includes using external agencies for hiring and setting cooling-off periods for hires from rivals.

See you Wednesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.