Hello. Is India’s central bank, the RBI, independent from political interference? We’ll investigate and then go through Gupshup, the most important headlines you can’t miss.

BTW: India has one of the world’s best space agencies, recently becoming the first nation to land a rover on the far side of the moon. What 2014 achievement left even NASA in awe? (Answer at bottom)

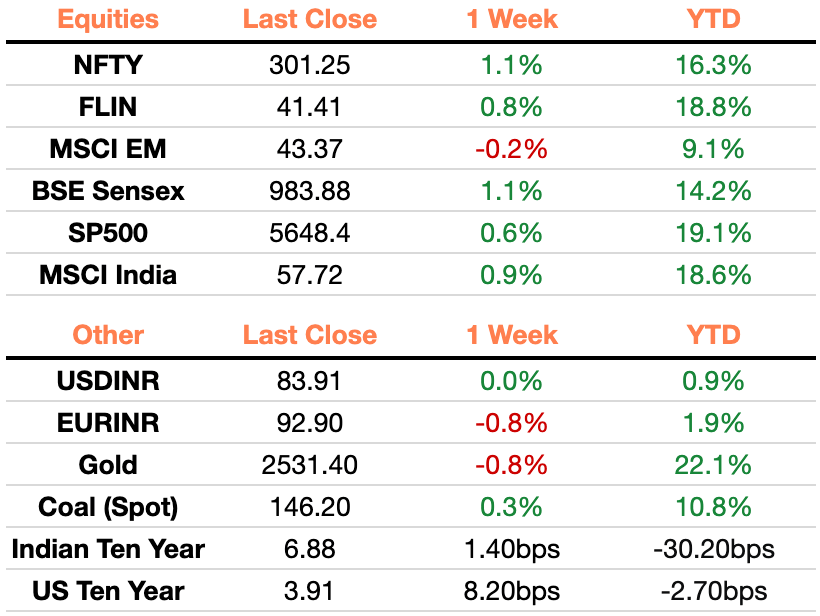

Markets

Read here for an appendix on the above.

Is the RBI Independent?

The RBI is not the chief monetary policymaker in India; that title belongs to the Monetary Policy Committee, established in 2016 through an amendment to the Reserve Bank of India Act of 1934.

The Monetary Policy Committee (MPC) is composed of six members, three from the RBI including the central bank’s governor and the deputy governor chiefly responsible for monetary policy, and three appointees directly from the government, called “external members.”. Worth noting that top RBI leaders are also appointed by the government, with the RBI Governor appointed directly by the Prime Minister and deputy governors determined by the Appointment Committee of the Cabinet, composed of the PM’s top advisors. Together, the six-member committee must set benchmark interest rates through a majority vote, with the RBI Governor serving as the tie-breaker.

RBI Governor Shaktikanta Das, who has served in the role since December 12, 2018

While the government intends to nominate apolitical experts to the committee, what happens in practice begs some questions. In a recent RBI meeting, the MPC decided to hold rates steady in a 4-2 vote. Notably, the two dissenters were both BJP government appointments to the “external member” roles, Dr. Ashima Goyal and Jayanth Varma. Dr. Goyal, a well-respected economist, is a member of Modi’s economic advisory council.

The existence of an MPC superseding the role of the central bank in setting rates does not automatically imply political interference in interest rate decision-making. The United Kingdom also has a monetary policy committee responsible for setting the country’s rates, composed of five Bank of England members and four external appointees from the government. Economists largely see the UK’s MPC free from political influence. Advocates for an MPC in India argued it served to introduce democratic accountability to an otherwise independent institution; “ In its law-making wisdom, Parliament has decided that since accountability rests with an elected government and not the expert official, so should power,” says Observer Research Foundation vice president Gautam Chikermane.

However, it does create more opportunities for RBI leaders to be exposed to political pressure.

Five months after the establishment of the MPC, Modi’s government took on demonetization as an attempt to remove shadow/black money from the economy which rendered 86 percent of cash in circulation useless overnight. Indians were asked to go to local banks to exchange their currency for new legal tender. In 2016, economists argued that the central bank was rushing to complete Modi’s demonetization plan was a sign that the bank was being coerced by political force to take a decision that otherwise should have been deliberated and decided on by the central bank without political influence. A former RBI governor, YV Reddy, said about the RBI’s role in implementing Modi’s policy, “The role of the central bank in our economy is under threat and it’s a national problem.”

Since then, criticisms of RBI’s independence have grown. In 2018, the Modi government tried to pressure then-RBI Governor Urjit Patel to hand reserve surpluses to the government to fund its expenditures and finance its debt; Patel refused amidst immense political pressure arguing that the RBI needed to maintain its right to regulate reserves to preserve trust in the rupee, and resigned later that year in December 2018 for “personal reasons.” The Modi government subsequently opened the Bimal Jalan committee that was responsible for investigating the adequate amount of reserves the RBI needs, and starting in 2019 the RBI transferred a record surplus of 1.76 trillion rupees to the government.

Fmr. RBI Governor Urjit Patel

In 2018, then Deputy Governor Viral Acharya gave a grueling criticism: “Governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire, and come to rue the day they undermined an important regulatory institution.”

Many argue India’s RBI is heading in the wrong trajectory, as the government slowly picks away at central bank independence to achieve short-term political gains. However, a potential solution for the government would be rather than trying to influence the RBI’s expansive regulatory controls, to remove those regulatory capabilities altogether. For example, the RBI has the right to stop high-level promotions at private banks while controlling their executives’ salaries, can maintain strict controls on how families move their money in and out of the country and can force private banks to take unfavorable business decisions when it feels their performance is deteriorating. Maybe, rather than trying to gain access to the central bank’s controls by interfering in its independence, it should review if any governmental authority should have the right to intervene in the economy in this way.

Macro

Falling Chinese steel output could be a boon for Indian manufacturers (Moneycontrol)

Since earlier in 2024, Chinese output has depressed prices leading to price slumps with low demand

Output falls in June and July give hope that Indian steel manufacturers will raise profits in 4Q24

The Nifty50 faces a weak September after a record summer (BBG)

Typical seasonality patterns such as lower consumption result in stocks following early fall

Market participants still have faith that a September Fed cut should rotate capital into India

Indian manufacturers see slowing pace (Mint)

HSBC’s Indian Manufacturing PMI has fallen to 57.5 from 58

While still expansionary (above 50) there is expected to be a slowdown into 2025

Equities

Larsen and Toubro shares dropped as company spins off renewables into new segment (Moneycontrol)

L&T sees climate sustainability as the next major push in India and plans to work primarily in decarbonized electricity with wind and solar

Raymond Group plans 2 Indian listings by the end of 2025 (BBG)

The 100-year-old Indian conglomerate is looking to list its apparel and real estate businesses

Management is looking to increase shareholder value and increase valuations

Alts

TotalEnergies is investing $444M in a JV with Adani (BBG)

TTE, a French company, is looking to increase ties to India while growing its sustainability portfolio with solar projects; Adani Green can accelerate project timelines across the country with the JV

Vedanta pays a $932M dividend to reduce parent company debt (BBG)

This is the third tranche approved so far to improve the London-based mining companies solvency

Investors to begin pivoting from Indian sovereign debt to corporate debt (BBG)

As corporates continue to deleverage, spreads have fallen for corporates making investment easier

Investment grade, 1-3 year bonds are seeing greater inflows with reduced credit risk

Politics

Zee believes that SEBI chief Buch was biased in ending Zee-Sony merger (Economic Times)

Zee owner Chandra accused SEBI of corruption and bias and is now exploring legal action

Turkey bids to join BRICS alliance (BBG)

The Bloc is set to discuss expansion in October in Russia, with Turkey dismayed at difficulty in joining EU

The group includes Brazil, Russia, India, China, South Africa, plus various ME countries

Over 500M court cases await Indian courts (Moneycontrol)

While the Supreme Court continues clearing cases, other high and local courts have been slow

Critics suggest an overhaul of the legal system and expansion of courts is required to solve it

Oh, and in 2014, the Indian Space Agency became the fourth to send an object into Mars orbit, but the first to accomplish it on its first try, a testament to the incredible talent of engineers at the agency.

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.90 Indian Rupee