Good afternoon,

As Iran and Israel enter military conflict, we discuss how insulated India is from entering an energy crisis.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

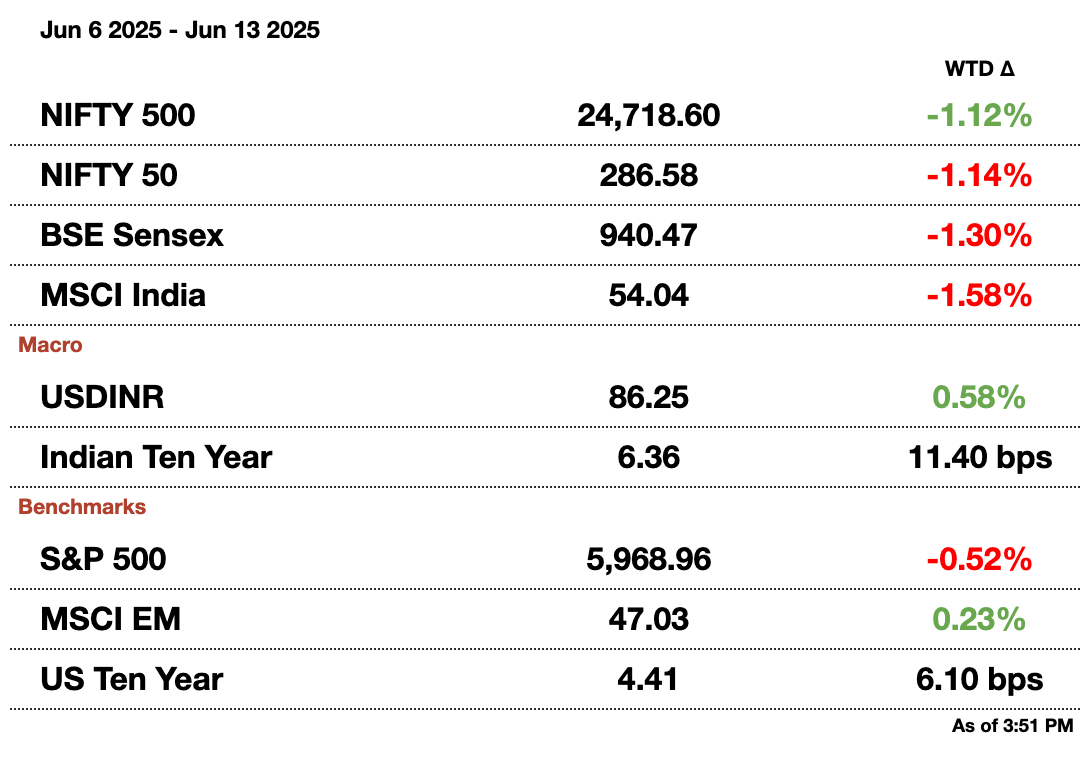

Market Update.

India’s Energy Supply Chains Remain Strong Amid Iran Tensions.

Iran and Israel (Wikipedia)

As tensions escalate in the Middle East following the recent exchange of hostilities between Israel and Iran, global energy markets are once again on edge. However, for India, traditionally one of the world’s largest crude importers, the immediate impact may be far less severe than in previous years. Thanks to a deliberate and evolving energy strategy, India has positioned itself with greater resilience than many observers might assume.

India currently imports almost no crude oil from Iran. Following the re-imposition of U.S. sanctions on Iran in 2018, India gradually phased out direct purchases from Tehran. As a result, Iranian crude has effectively disappeared from India's import basket for over five years now.

This is a sharp contrast to earlier decades, when Iran was among India’s top suppliers, often accounting for 16.5 percent of its crude needs in 2008-09. Today, India's top suppliers include Russia, Iraq, Saudi Arabia, the UAE, and the United States—creating a highly diversified and geopolitically balanced portfolio. Experts note that this diversity allows India to largely sidestep any direct supply chain disruptions tied to the Israel-Iran conflict.

India’s dependence on Russian oil—while peeving the United States—has proven to be a smart strategy. In the wake of Western sanctions following the Ukraine war, India seized the opportunity to buy deeply discounted Russian crude, significantly reshaping its import structure. Russian oil now accounts for as much as 40 percent of India’s total crude imports, according to recent trade data.

India remains exposed to the broader consequences of conflict in the Persian Gulf. The Strait of Hormuz—a narrow waterway through which roughly 20 percent of the world’s oil transits—remains a global chokepoint. Any disruption here would trigger supply chain bottlenecks and drive up shipping costs and insurance premiums, even for oil that originates elsewhere.

Strait of Hormuz, a tiny chokepoint

Indeed, oil prices spiked as much as 12–14 percent intraday following Israel-Iran hostilities; prices briefly topped $77 a barrel shortly after the attack began.

Historically, Indian consumers are somewhat insulated from oil price spikes because state-run oil marketing companies (OMCs) have been absorbing higher crude costs, resulting in significant margin compression. Retail prices for petrol and diesel can remain largely unchanged thanks to a combination of political considerations and prior tax adjustments.

Global Inflation: KPMG economist Diane Swonk expects global inflation will rise to 4.1 percent (instead of 3.7 percent before attacks) this year if oil barrel prices peak at $85 and settle in the high $70s. This is bad news for the RBI, which has only just recently tamed India’s inflation and taken advantage of the opportunity to ease monetary conditions.

If global oil prices remain elevated for an extended period, OMCs may eventually require some combination of government intervention or upward price adjustments to remain solvent.

In October 2024, when suspicions of Israel-Iran tensions reached a new peak, Oil Minister Hardeep Singh Puri stressed that current oil supply levels remain adequate for the coming months despite market volatility at the time.

Want to reach our audience?

Email [email protected] to sponsor the next newsletter.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Gupshup.

Macro

India and the US are locked in tough trade negotiations ahead of a July tariff deadline, with both sides standing firm on key issues like data localization and tariffs on steel and pharmaceuticals. A phased trade deal is being targeted, with hopes for progress during the upcoming G-7 summit.

India’s inflation eased to 2.82 percent in May, supporting the Reserve Bank of India’s recent large rate cut and providing room to focus on boosting economic growth. Early monsoon rains are expected to keep food prices and overall inflation contained.

A Chinese-operated ship carrying US ethane is headed to India for the first time, marking a shift caused by US-China trade tensions disrupting usual ethane flows. The cargo resale highlights how buyers are adjusting to long-term contracts amid the trade war’s impact on the niche gas market.

India and China have agreed to speed up the resumption of direct flights and enhance communication as bilateral ties improve, following efforts to resolve border disputes and trade differences. This move aims to stabilize relations and boost cooperation in areas like aviation and regional peace.

Equities

A deadly Air India crash has cast doubt on the airline’s ambitious turnaround plans, threatening reputational damage and delays in key upgrades. Despite recent progress, the tragedy could hinder its path to profitability and erode customer trust.

Reliance Industries sold a 3.7 percent stake in Asian Paints for $900 million (₹77.5 billion) via a block trade, while retaining a small holding. SBI Mutual Fund bought the entire stake. The deal comes amid intensifying competition in India’s paint sector, which has pressured Asian Paints’ stock.

Between March and May, Foxconn shipped 97 percent of all iPhones exported from India to the U.S., reflecting Apple’s strategy to avoid high U.S. tariffs on China by focusing India-made iPhones primarily on the American market. This marks a significant shift from 2024, when exports were more widely distributed globally.

Sun Pharmaceutical has appointed Kirti Ganorkar as managing director effective September 1, with current MD Dilip Shanghvi continuing as executive director and board chair. The appointment awaits shareholder approval at the July 31 annual meeting.

UK-based Pearson plans to increase its India workforce by 43 percent to 2,000 employees, reflecting its focus on India as a top global priority market. The company aims to expand across its three key locations in the country.

India's IndiGo promoter, Interglobe Enterprises, is reportedly planning to sell about a 4 percent stake through block deals to raise around $1 billion (₹86.2 billion), according to CNBC-TV18 sources. Interglobe currently holds a 35.71 percent stake in IndiGo.

Alts

Indian developer Suruchi Properties secured $52.3 million (₹4.5 billion) in private credit from Tor Investment and Nomura to refinance costlier debt. The three-year non-convertible debentures carry a 10 percent coupon and highlight growing private credit activity in India’s real estate sector.

ICICI Prudential, managing $115 billion (₹9.9 trillion), is shifting focus to ultra-short-term Indian debt, securities with maturities under two years, amid expectations of faster economic growth and limited future rate cuts. CIO Manish Banthia sees this as a safer bet than longer-duration bonds, which could face yield spikes as the economy strengthens.

Bangalore International Airport is in advanced talks to raise about $1.1 billion (94.8 billion) through local currency bonds to refinance debt and fund expansion, with major Indian banks involved. This move aligns with India’s broader push to upgrade airport infrastructure amid rising passenger capacity and capital expenditure.

Policy

India is considering easing its 50 percent localization requirement for EV makers and suppliers as China’s rare earth export curbs disrupt key component supplies. Automakers may be allowed to import fully built motors or assemblies to qualify for incentives under the government’s PLI scheme.

After the deadly crash of an Air India Boeing 787, Donald Trump offered condolences and assistance to India, including “pointers” on possible causes. U.S. investigators will support the probe into what marks the first total loss of a 787 Dreamliner.

India has signaled that Prime Minister Narendra Modi is likely to attend the G-7 summit in Canada next week, calling it an “important opportunity” to repair strained ties with Ottawa. A potential meeting with Canadian Prime Minister Mark Carney could help reset relations amid past tensions over Sikh separatist issues.

India has asked its state-run miner IREL to halt rare earth exports to Japan and focus on conserving supplies for domestic use, aiming to reduce dependence on China amid escalating trade tensions. IREL plans to boost rare earth mining and processing capacity, targeting industries like automotive and pharmaceuticals.

See you Monday.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.