Welcome to Samosa Capital’s evening briefing — the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

2024’s stock market winners and losers,

2024’s record-high corporate debt issuance,

And, India diversifies its oil supplies away from Russia.

Finally, we’ll close with Gupshup, a round-up of the most important headlines.

If you have feedback on our newsletter or just want to chat about India, always feel free to reach out to me. You can also share criticism about the newsletter anonymously here.

—Shreyas, [email protected]

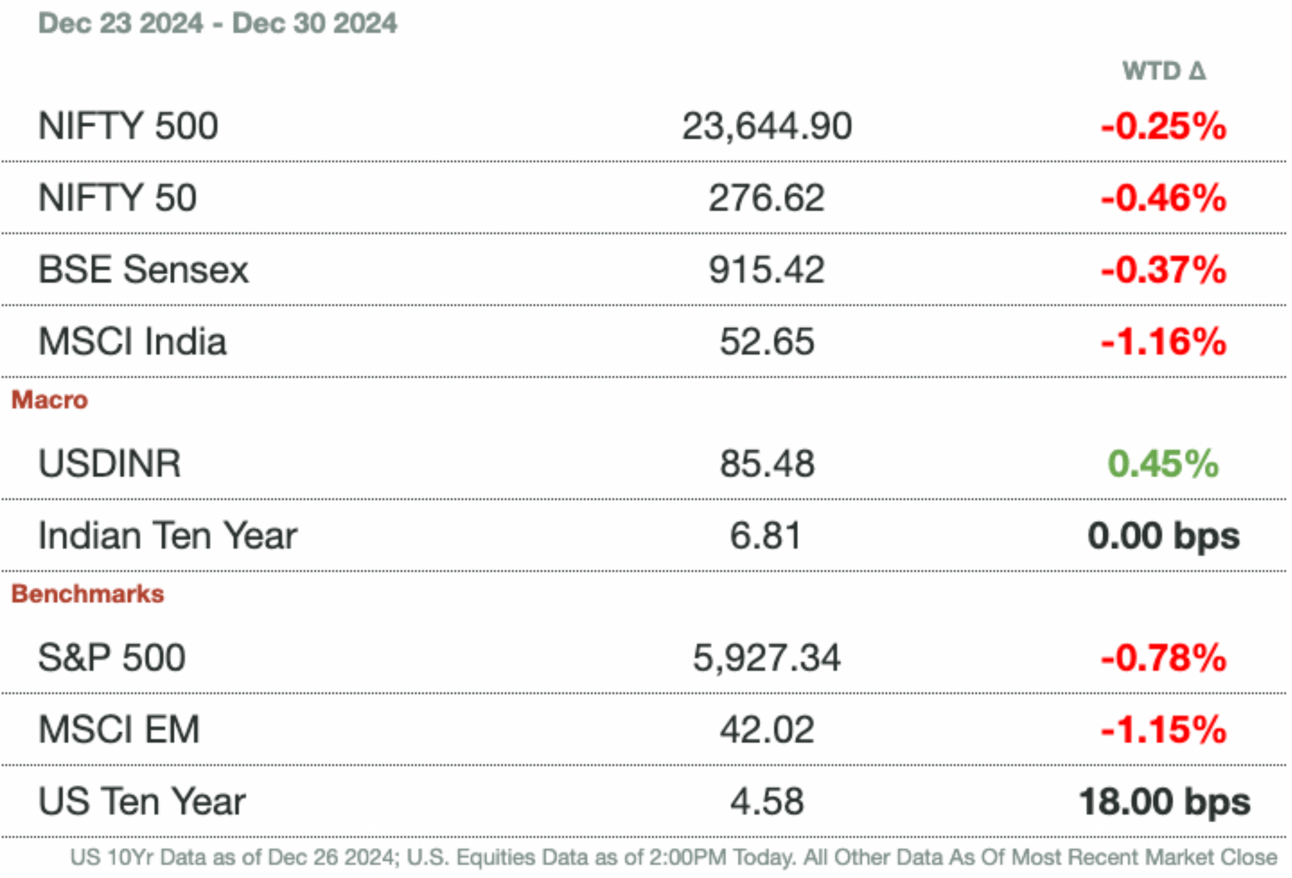

Market Update

Live Event

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

Looking back at 2024’s Stock Market

The Good News. Indian stock markets closed 2024 on a high note, with the Nifty50 Index up 10 percent for the year, marking its ninth consecutive yearly gain. A rally in new-age technology companies powered this unprecedented streak, strong performance in the pharmaceutical and real estate sectors, and vibrant primary markets that raised a record $20 billion (₹1.7 trillion) in IPOs.

However, the outlook for 2025 remains uncertain as corporate earnings weaken, global funds turn cautious, and the economy faces slower growth. On the other hand, expectations of interest rate cuts and increased government spending offer hope for another strong year.

2024 Winners

New-Age Tech Soars: Digitization fueled a rally in shares of tech firms. Food delivery giant Zomato Ltd. more than doubled its share price, while fintech players like PB Fintech Ltd. (Policybazaar) and One 97 Communications Ltd. (Paytm) jumped 160 percent and 60 percent, respectively. The sector also benefited from investor enthusiasm in IPOs, making tech one of the year’s standout performers.

Pharma’s Resurgence: Pharmaceutical stocks surged, driven by stabilizing US generic drug prices and robust domestic demand. Companies like Glenmark Pharmaceuticals Ltd., Natco Pharma Ltd., and Lupin Ltd. each climbed more than 60 percent, while Max Healthcare Institute Ltd. benefited from expanding capacity and revenue growth.

2024 Losers

Consumer Giants Falter: Blue-chip consumer goods companies such as Nestle India Ltd., Tata Consumer Products Ltd., Hindustan Unilever Ltd., and Britannia Industries Ltd. delivered negative returns amid weak urban demand. Smaller startups quickly launching competitive products have further pressured these companies.

Unsecured Lenders Under Stress: Banks and microfinance lenders, including IndusInd Bank Ltd., suffered as defaults in unsecured credit rose. IndusInd fell 40 percent, making it the worst performer on the Nifty 50 Index. Aggressive lending practices and regulatory tightening added to the sector's woes, with analysts expecting continued pressure in 2025.

2024 Saw Record-High Corporate Debt Issuance

Indian companies raised a record $124.8 billion (₹10.7 trillion) through corporate bonds in 2024, a 9 percent increase over the previous year. Declining yields and rising demand for long-term debt-fueled this growth, with experts predicting robust issuance in 2025.

Why: Corporate fundraising surged as companies sought to diversify funding amid slowing bank credit growth. Including Indian government bonds in global indexes freed up opportunities for domestic investors, particularly insurers and pension funds, who prefer long-term assets. Issuances of bonds with maturities over five years rose by 19 percent, while short-term bond sales declined by 2 percent.

Falling yields, driven by a 25-50 basis point drop in corporate bond rates, added momentum. Expectations of rate cuts by the Reserve Bank of India (RBI), starting with a potential 50 basis point reduction in February 2025, are likely to push yields lower and sustain investor demand.

Keep in mind that banks scaled back lending due to challenges in deposit growth and a widening credit-deposit gap, prompting firms to rely more on bond markets. A bearish signal in terms of issuance will be better for credit demand. Assuming nominal GDP growth is expected to remain at 10-12 percent, bank credit demand will increase plus the cash reserve ratio cut makes loans and private credit cheaper.

India Diversifies Its Oil Supplies

Bharat Petroleum Corp (BPCL), India’s state-run oil refiner, is increasing its reliance on Middle Eastern crude to compensate for a reduced supply of discounted Russian oil. BPCL’s diversification strategy also includes its first-ever purchase of Argentinian crude. It plans to expand sourcing from West Texas Intermediate (WTI) or other affordable options if Russian supplies continue to dwindle.

Changing Dynamics. Russian oil, which accounts for 35-37 percent of BPCL’s refining inputs, has declined availability due to rising domestic demand in Russia and production quotas under OPEC agreements. Furthermore, a long-term deal between Russian oil giant Rosneft and India’s Reliance Industries for 500,000 barrels per day starting in 2025 is expected to limit BPCL’s access further.

BPCL has turned to the Middle East to mitigate this, purchasing Omani crude and securing a deal to lift 10,000 barrels per day from Qatar for fiscal 2025/26. The company now sources 53 percent of its crude through term deals, ensuring supply stability amidst market volatility.

Continued Investment Plans: BPCL plans to invest $20 billion (₹1.7 trillion) by 2028/29, with half of this funded through debt. Current projects include the expansion of its Bina refinery in central India, backed by $3.7 billion (₹320 billion) in loans from Indian banks. Over the next five years, future investments include $2.9 billion (₹250 billion) for oil and gas projects in Mozambique and Brazil. The company also aims to refinance $467-584 million (₹40-50 billion) in loans next year and explore external borrowing by 2026/27, contingent on favorable interest rates.

Gupshup

Macro

Volatility for the rupee hits a 1 year high amid speculation that RBI intervention could slow. Volatility hit 4.09 percent (implying that a one standard deviation annual move for the rupee would be 4 percent) which is the highest since August 2023. Speculation is that the RBI will allow for more volatility since low volatility leads to complacency in domestic corporate FX hedging.

The rupee's overvaluation, on a REER basis, displays nominal strength which rose from a lack of RBI rate cuts. REER is a measure of the real effective exchange rate based on economic factors which just eclipsed 108. The currency has appreciated in nominal terms against peers due to widening interest rate differentials. The overvaluation also displays that depreciation against the dollar is likely to continue.

Indian household spending on non-food items rises with the urban-rural gap narrowing. Household spending on entertainment, transport, and clothing rose in both areas while spending on food items decreased for FY23/24. The shift in spending patterns is expected to lead to a decrease in the weighting of food items for CPI. This helps the RBI since food inflation has been the main accelerant through the last 2 years.

Indian banks' bad loan ratios are likely to worsen going into 2026.The RBI foresees bad loans to increase due to stretched asset valuations, high public debt, and growing geopolitical risks. In particular, the central bank is focusing on non-performing assets to book value which currently is at 2.6 percent and likely to climb to 3 percent through 2026.

Equities

A weak rupee has led to foreign investors fearful of dollar conversion losses when buying stocks. The rupee’s fall in value makes it so dollar investors have fewer returns when calculating back into their base currency. The other issue has been company underperformance as well at the same time that the rupee has weakened. The Nifty50 on a dollar basis has returned 8 percent this year compared to the rupee-weighted 10 percent.

Automobile and IT stocks have dragged indices down due to US hawkishness and sales volume. Due to US rate cuts being pushed back, IT companies that export services to the US primarily shed over a percent this week. While not seeming like a large amount, the holiday week normally has weak trading volumes making it significant. Automobile stocks fell 0.5 percent in fear of weak sales numbers being reported.

Adani Green CEO Amit Singh is stepping down after US bribery accusations. Singh led the company from May 2023 including the Hindenburg reports first released. While Singh led the company through energy storage innovation, the recent US bribery charges have led to a management restructuring.

India is on track for its highest retail inflow into equities ever at $18 billion (₹1.5 trillion). Global funds have only brought in a net $14 million (₹1.2 billion) on the other hand due to sluggish earnings and growth concerns. Retail investors have seen the stock price weakness as an opportunity to invest while also shifting personal investments from money markets to equities more like the US.

Alts

Gold — India's largest import — is likely to trade sideways due to demand and rate movement. While EM countries like India have been in an importing frenzy, rate cuts being pushed back balances out the price effect. Rate cuts can amplify the demand for gold and other investment vehicles. Continued appreciation of the metal which has gone up 27 percent this year would lead to increased inflation in India due to $45 billion (₹3.7 trillion) of gold imports.

UltraTech buys a stake in Star Cement as Adani's rivalry continues. UltraTech is buying an 8.69 percent stake for $100 million (₹8.5 billion) amid competition across the cement industry. UltraTech now gains more access to the northeast while blocking Adani Group from acquiring in Star or growing in northeastern states.

Adani is planning a $2 billion (₹170 billion) exit from their Wilmar JV. Adani is entirely exiting its 44 percent stake in the consumer goods JV. Adani cites wanting to focus on core infrastructure businesses. Another reason, though not cited, could be the need to raise internal financing after US charges led to ratings downgrades.

Policy

Former PM Manmohan Singh was cremated with state honors. Many in India have taken his saying, “History will be kinder to me than the contemporary media,” to heart by reminiscing on the long-term positive impact of his economic policies.

See you Wednesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.