Hello. India promised to privatize some of its state-owned banks — now it might be backtracking, and that’s not a good thing. We’ll tell you everything you need to know, discuss reactions from prominent figures to last week’s budget, and then close with Gupshup, a round-up of the most important headlines from the week.

BTW: India’s literacy rate is 77% (steeply lower than China’s 99%, and Thailand’s 94%), but this can differ wildly between states. Which state has the highest literacy rate? (Answer at bottom)

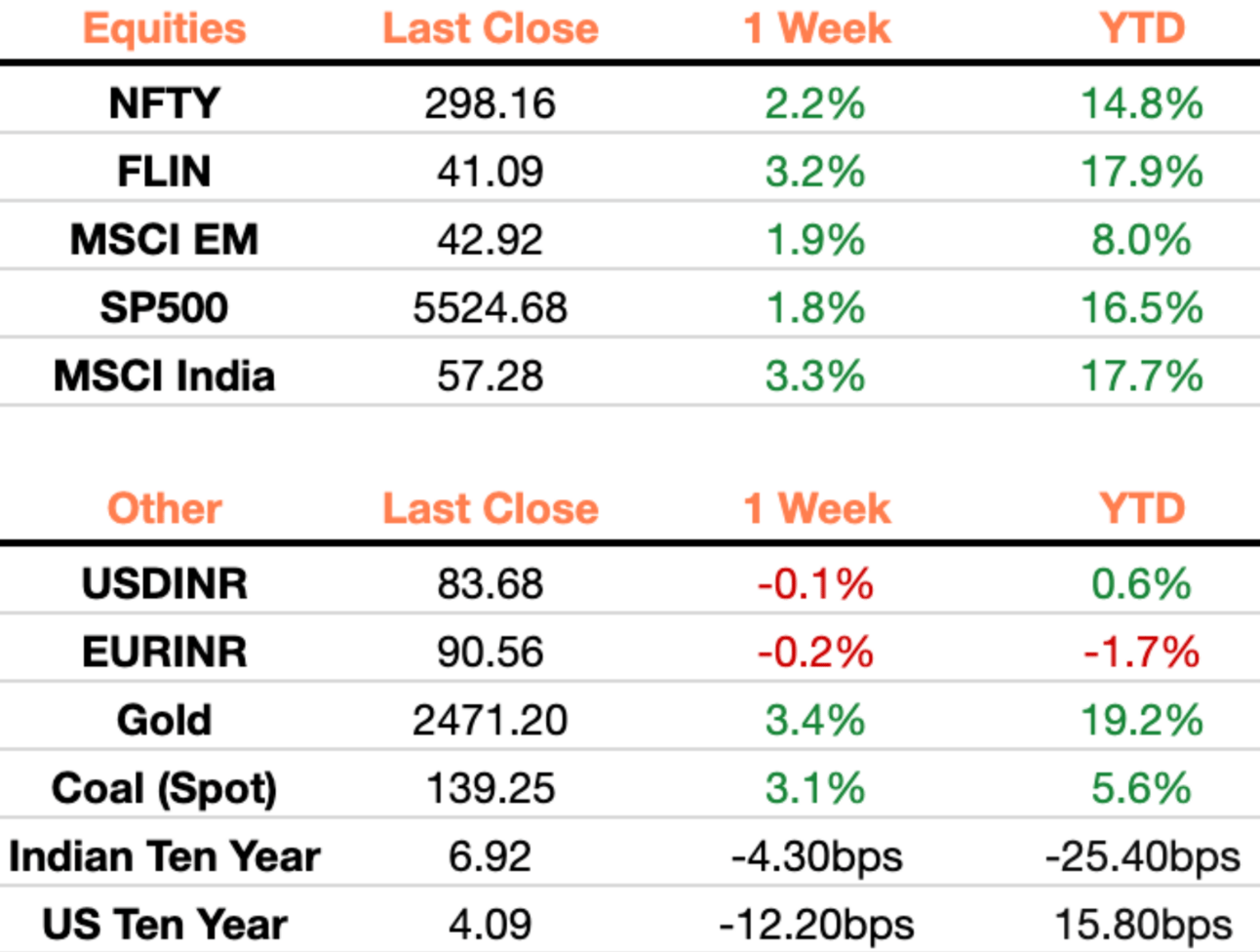

Markets

Quick Appendix: NFTY is a weighted average of the largest 50 companies listed in the National Stock Exchange of India by market capitalization. FLIN, or Franklin TSE India ETF, tracks large and mid-cap companies, weighted by market cap, to give international investors exposure to Indian markets. MSCI EM is an index that captures large and mid-cap companies across 24 emerging market countries and covers 85% of the free float-adjusted market capitalization in each country. SP500 is the index of the 500 largest companies listed in U.S. stock exchanges by market cap. MSCI India is an index that covers 85% of the Indian equity universe.

India Should Privatize Its Banks, Say Fmr. RBI Leaders

In last week’s budget, Finance Minister Nirmala Sitharaman notably did not provide guidance on the privatization of two state-owned banks (called public sector banks, or PSBs) and a general insurance company, a plan that she had once promised to follow through on in the 2021-2022 Union Budget announcement. Such ideas gained popularity following the $32 billion bailout India conducted of its PSBs in October 2017. For years, PSBs have been a drain on the Indian budget and crowded out the private sector banking industry. Research also finds private sector banking to be far more efficient, far less likely to have stressed assets while providing far more capitalization, far less susceptible to fraud as a percent of total assets, have a steeper and faster-growing return on equity, can more quickly grow bank branches, far less likely to accumulate defaulted loans, and have faster-annualized growth rates through any historical period, all while relying far less on government bailouts and backstops (NCAER).

Following the 2024-2025 Union Budget, fmr. RBI Deputy Governor Viral Acharya argued it was time for India to privatize its PSBs. Fmr. RBI Governor Raghuram Rajan has also argued for the same in the past.

Fmr. RBI Deputy Governor Viral Acharya

Currently, the government of India has a majority stake in 12 banks (% owned by the government, as of March 2023): State Bank of India (57.59%), Canara Bank (62.93%), Bank of Baroda (63.97%), Punjab National Bank (73.15%), Indian Bank (79.86%), Bank of India (81.41%). Union Bank of India (76.99%), Bank of Maharashtra (90.90%), Central Bank of India (93.08%), UCO Bank (95.39%), Indian Overseas Bank (96.38%), and Punjab and Sind Bank (98.25%).

PSBs represent 58.31% of India’s total banking assets (including public, private, and foreign banks) (IBEF), and operate 75% of bank branches in the country (excluding foreign banks). Historically, PSBs have been up to 90% of the banking sector. India’s government entered the banking space in 1955 by acquiring a 60% stake in Imperial Bank of India, which was then renamed State Bank of India and remains the country’s largest PSB and third-largest bank overall. In 1969, Indira Gandhi’s government nationalized 14 major banks.

By 2020, the Indian government operated 27 national banks. Under pressure to liberalize and increase efficiency in its financial markets and privatize many of the banks, FM Sitharaman consolidated the banks into the 12 PSBs operated today.

PSBs weaken the economy by allowing major parts of the banking system — the lifeblood of India’s financial markets — to operate under immense moral hazard. With the taxpayer providing a constant backstop to any defaults, the Indian banking system is plagued with poor investment decisions and loan defaults that reduce liquidity, limit the country’s ability to develop efficient capital markets that can be used to finance new businesses and projects, and dissuade investors from putting money in India where the return on equity is reduced. Research overwhelmingly finds that PSBs accumulate large amounts of non-performing assets (loans in default) that constantly require taxpayers to bail them out to avoid financial crises. Without an efficient financial sector, India’s growth will be dampened.

FM Sitharaman’s decision to not announce further privatization plans is likely a result of the news that PSB profits surged 40% in 2023, meaning they currently are not the anchors on the budget as they have been historically. However, PSBs can only seriously be privatized when losses have been cut and profits are up so that willing buyers can be found.

Privatizing banks is also unpopular among many. Last July, the All India Bank Officers Confederation (a national financial sector labor union) expressed their concern that PSBs play an important role in addressing wealth inequality and providing banking to low-income households that may be overlooked by private sector banks. These concerns do not reflect the data of faster growth in loans and services provided by privatized banks; providing low-income households with debt they cannot pay back is also a hamper on growth, not a booster. However, PSBs indeed played an important role historically in providing loans to low-income households that have helped immensely in providing food or shelter in times of need, in turn reducing extreme poverty in the country.

India’s government is moving forward with the privatization of IBDI Bank, which is not technically one of India’s PSBs as the majority stake is owned by the Life Insurance Corporation of India. However, the Life Insurance Corporation of India is over 90% owned by the Government of India. RBI is currently vetting potential buyers for the commercial bank.

Reactions to Modi’s 3.0 Budget

Last week, Samosa Capital provided a summary of the 2024-2025 Union Budget announced by FM Sitharaman. Here are reactions from prominent figures of how the budget will shape the Indian economy.

Private Sector: Most are bullish, as the budget boosts infrastructure spending while reducing the fiscal deficit.

Shirpal Shah (CEO of Kotak Securities): Shah believes the increasing capital gains tax and tax on futures and options contracts is positive. He argues this will drive more sustainable market gains, which will encourage foreign direct investment (Reuters).

Radhika Rao (senior economist at DBS Bank): The budget brings in positives of financial consolidation while not derailing growth and demand drivers. The tweaks to taxation (particularly capital markets) could take time to settle in, but they help balance slight boosts to employment. (Reuters)

Santosh Iyer (CEO of Mercedes-Benz India): The Union Budget positively includes 3.4% GDP allocation to infrastructure projects. Iyer was looking for reduced taxes on EVs, but still saw lithium mining and a developing climate finance taxonomy as a positive for the automobile industry and Indian growth. (Livemint)

Sajjid Chinoy (JP Morgan Chief India Economist): Chinoy argues that rather than raising taxes, India should sell assets to allow for decentralization and privatization, while also using it to raise funds to finance its infrastructure projects. (BBG)

Priyanka Duggal (Partner at Grant Thornton Bharat): Duggal sees the removal of the Angel Tax as growing domestic and foreign investment from PE and VC funds since secondary transactions are easier to facilitate now. The tax previously was on all investors but now 21 countries plus Indians have been exempted. (PE International)

Amarendu Prakash (Chairman of Steel Authority of India): Argues the budget’s infra spending will lead to a growth multiplier for the country and steel industry. (Reuters)

Academia:

Raghuram Rajan (fmr. RBI Governor): Rajan criticized the budget for lacking adequate investment in jobs and an upskilling workforce. “When you look at the aggregate sort of allocations to education, skilling, and agriculture, they haven't budged,” he said, adding, “The sums of money devoted to some of these programs are very, very limited, so will they incentivize businesses to hire?” (CNBC)

Mukesh Butani (CSIS Senior Associate, Chair in U.S.-India Policy Studies): India should prioritize simplifying its tax code, arguing it would promote savings and investment. Currently, India’s goods and services tax (GST) system splits consumption into four separate buckets, which often can be hard to differentiate, and taxes them at different rates. (CSIS)

Jayant Krishna (CSIS Senior Fellow, Chair in U.S.-India Policy Studies): As only three of India’s universities rank among the top 100 globally, Krishna argues the budget misses an opportunity to upscale its higher education system to attract and retain young talent. (CSIS)

Public Sector: Most BJP allies applauded the budget as being fiscally responsible by reducing the federal budget, a necessity as the country aims to earn higher credit ratings. Most critics derided the crowding out of the budget through major appeasements made to Modi’s allies.

Rahul Gandhi (Opposition Leader): Gandhi derided the BJP, calling it a “kursi bachao” (save your seat) budget, calling out the billions going especially to the home states of Modi’s biggest political allies: Bihar, Andhra Pradesh, and Gujarat. Gandhi, who ran against Modi on more expansive welfare programs, also called the allocations to the underserved weak. (Indian Express)

P. Chidambaram (Senior Congress Leader and fmr. FM): He argues that inflation is not being taken seriously and that the budget allocations undermine the government as federal by picking and choosing states to give aid to based on them aiding the Prime Minister’s political goals. (Indian Express)

Sitharaman has pushed back on claims that the government is not adequately addressing inflation, arguing further subsidies or stimulus to help people during high prices will only exacerbate the issue (Economic Times)

Macro

Indian Bond Funds See Structural Decline in Long Term Rates, Driven By Strong Economic Forecast (BBG)

Bandhan, Kotak Mahindra, and DSP Investment Managers all see improving fiscal and economic conditions leading to a structural decline to r*

Economists see r* as being the neutral rate of interest to keep the economy stable between growth and receding

Expectations of a neutral fiscal deficit, low current account deficits, and contained inflation lead to economist recommendations of buying longer-duration bonds

Insurance, pensions, and foreign funds have also piled into what is a crowded trade

India Closes in on China as Largest Emerging Market (FT)

India now makes up a fifth of global EM stock benchmarks; this has become an issue for investors debating picking hotter, overvalued Indian equities vs struggling but cheap Chinese stocks

Indian stocks trade at 24x expected ‘25 earnings, China is at 10x

Investors have started exiting the consensus long India short China trade for better safety

RBI Proposes Increasing Liquidity Requirement For Banks, Which Will Hurt Credit and Loan Growth But Improve Banking Stability (Economic Times)

The new regulation, proposed last Thursday, would go into effect next April

The proposal requires all money held in relatively safe government bonds to be valued at no more than their current market rate

These bonds lose value during rate hikes, meaning banks likely have less liquidity than they claim

Equities

HSBC, Standard Chartered, and ICICI Plan to Report Earnings Amid Weaker Loan Growth (BBG)

More Asian-based banks like HSBC and Standard Chartered see falling Hibor rates with stalling loan growth as leading to weaker expected earnings

Banks are still expected to make the higher end of expected interest income and announce fresh equity buybacks

RBI Moves Forward In Privatization of IBDI Bank (BBG)

IBDI is a publicly traded and state-owned commercial bank

RBI is on track to complete due diligence of potential buyers of the bank

India’s government plans to raise $6 billion (500 billion rupees) in the sale

Adani and Birla Both Continue Acquiring Capacity and Assets (BBG)

Adani and Birla’s Ultratech have made a combined 7 deals in 2 years to benefit from an uptick in concrete demand as infrastructure spending continues to rise

A major advantage for Adani is the M&A warchest they possess plus the HoldCo is the largest private sector port operator in the country, letting Adani battle Chinese producers

Adani Airport Holdings Sends Offer to Invest in Kenya’s Largest Airport (BBG)

Kenya is seeking $1.835 billion total to conduct upgrades and fixes

IndiGo Drops Earnings as Rising Fuel Costs and Demand Slowdown Reduce Profits (BBG)

Passenger load fell to 86.7% from 88.6% last year; IndiGo benefitted from Go Airlines India being grounded last year which bolstered IndiGo’s load factor

Costs rose 24% due to rising fuel and engine-related repair and acquisition expenses

Adani Energy Beginning Process for a $600M Share Sale (BBG)

The energy group has chosen investment banks to start advising including ICICI, Jefferies, and SBI Capital Markets to conclude the share sale in mid-August

Adani Energy is India’s largest private sector power utility unit operating 21,000 km of transmission lines

Bajaj Automobiles Ventures Into Natural-Gas Powered Motorbike (BBG)

India’s #1 manufacturer of auto rickshaws — a very common mode of transport in the country — has received 6,000 orders for its new product

Bajaj is the fourth-largest scooter/motorbike provider

The new motorbike aims to be a cost-efficient and greener alternative to products available today

SoftBank and Tiger Global backed start-up seeks $734 million IPO (61.46 billion rupees) (BBG)

Ola Electric Mobility is India’s largest e-scooter maker

Alts

India Starts Developing an Alts Market, Starting with Shoes (BBG)

The growing affluent class has led to sneaker resale stores and collectors getting private equity and venture capital firms to invest millions in startups

VC fund Silverneedle Ventures is investing $2M into such companies

While this alt market is much smaller than the ones in the US, UK, and China, investors expect exponential growth on the back of a strong economy and increasing purchased powers

Politics

The Government Sees Asset Sales as a Way to Manage the Fiscal Deficit (BBG)

State-run firms are trading above historic valuations so the government has started sales in IDBI Bank and Hindustan Zinc

Larsen and Toubro Advocates for the Indian Government to Use Private Defense Suppliers More (FT)

Currently, L&T’s production capabilities far exceed the government’s ability to produce in a time requiring a defense infrastructure overhaul

Modi’s government has become more open to allowing other companies to win contracts but still highly relies on foreign goods like Russia

India and China Agree to “Urgently” Solve Border Dispute (BBG)

A 2020 dispute left 20 Indian and 4 Chinese soldiers dead — both countries amped military presence at the border as a response

India banned Chinese apps and strict import and investment restrictions on Chinese businesses

Reversing these restrictions is key to ensuring India can join the global manufacturing supply chains

We need your feedback to make this newsletter more useful to people like you. Please let us know what you think here.

And, consider sharing with three friends.

Oh, and the southern coastal state of Kerala has India’s highest literacy rate of 96.2% (NSO)

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.12 Indian Rupee