India’s central bank governor reaffirms growth projections to the country’s finance leaders. A “ghost trade” jolted the Indian stock market last week. Fitch ratings keeps Indian sovereign debt unchanged at BBB-.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

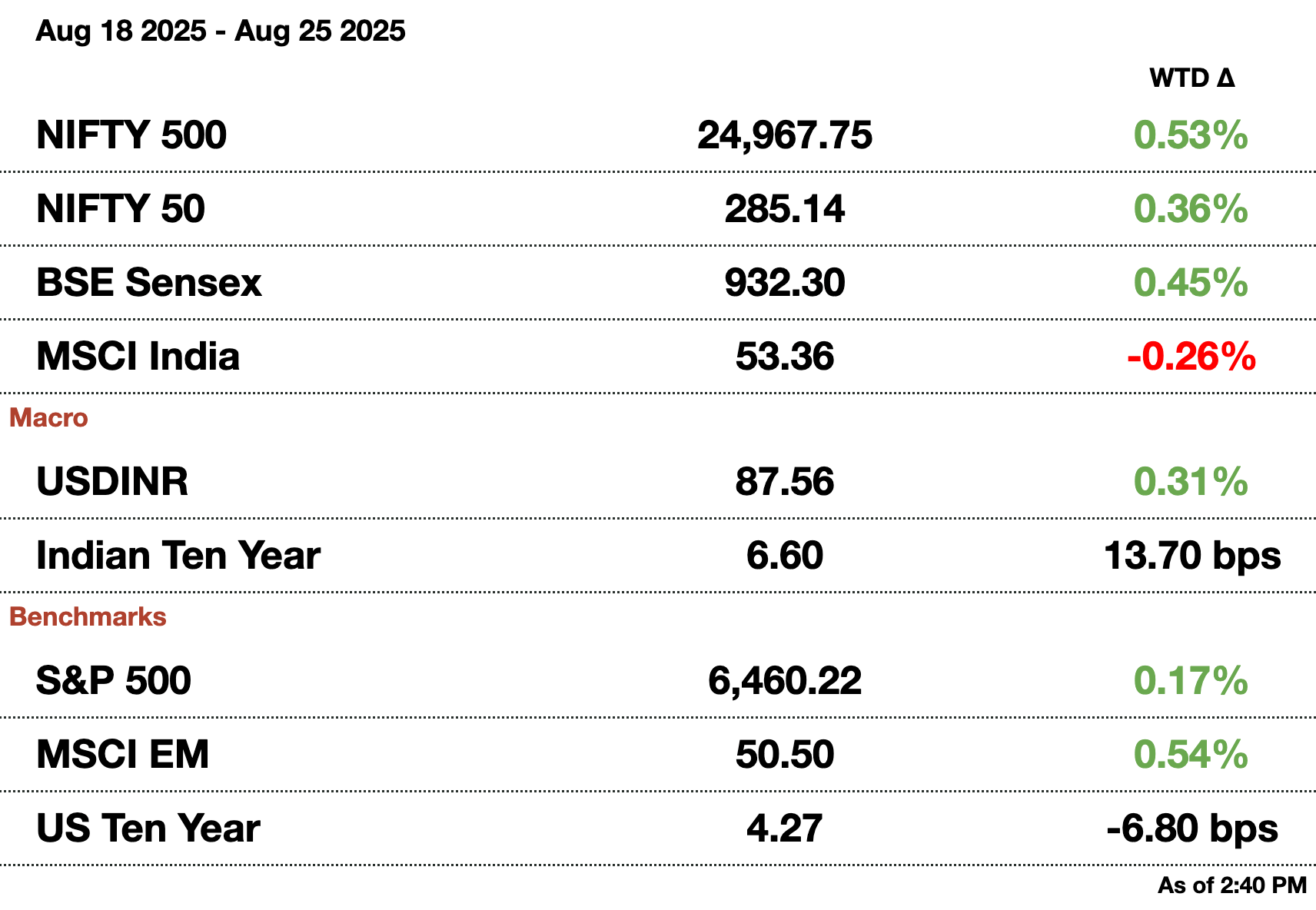

Macro

India’s bond rally has reversed as fiscal worries resurface, pushing benchmark yields sharply higher and leaving traders cautious after heavy losses. Concerns over deficit risks and potential additional borrowing have driven the selloff, despite earlier optimism from an S&P upgrade.

Emerging-market assets are expected to outperform developed peers, with analysts citing Fed easing, weaker dollar, and more conservative fiscal policies as key drivers. Fund managers from Fidelity, T. Rowe Price, and Ninety One highlight attractive valuations and faster equity inflows boosting EM prospects.

India will overhaul its consumer price index in 2026 by sourcing data directly from e-commerce platforms like Amazon and Flipkart to better capture digital-era consumption. The revamp will also reduce food’s weight, add digital services, and launch a Services Production Index.

Indian equities opened higher on Monday, with the Nifty 50 climbing 0.39 percent to 24,967.75 and the Sensex adding 0.4 percent to 81,635.91. Gains followed U.S. Fed Chair Jerome Powell’s Jackson Hole remarks hinting at a possible September rate cut.

The Indian rupee ended weaker for a fourth straight session on Monday, slipping 0.1 percent to 87.58 per U.S. dollar. Tariff concerns fueled steady dollar demand, while importer bids added pressure despite the rupee’s early intraday gains.

Equities

Adani Wind, part of Adani New Industries, secured 304 megawatts of wind turbine orders in India this month, with installations planned across Gujarat and Tamil Nadu. The company now aims to expand globally, exploring opportunities in Australia, Brazil, and Southeast Asia as clean energy demand accelerates.

IndiGo operator InterGlobe Aviation has been added to India’s Nifty index after its stock surged over 30 percent this year. However, Crisil warned sector profits could fall 14 percent by March despite rising passenger demand, reflecting fuel and cost pressures.

Blue Star expects higher air conditioner sales this year, driven by Modi’s newly announced consumption tax cuts on everyday goods and appliances. The company sees this boost as India’s biggest tax overhaul since 2017, aimed at lifting demand.

Alts

The New Development Bank, created by BRICS nations, has appointed RBI executive director Rajiv Ranjan as its vice president for a five-year term. He will also serve as the bank’s chief risk officer, according to its website.

At least eight people, including two women and a child, were killed and 43 others injured when a container truck collided with a tractor carrying devotees in Uttar Pradesh early Monday. Police said three victims remain in critical condition on ventilators.

Policy

India’s parliament has advanced a bill to ban online money gaming apps, citing rising addiction, financial fraud, and links to money laundering. The move threatens India’s $3.8 billion (₹332.7 billion) gaming industry, despite industry groups urging regulation over prohibition to avoid fueling illegal operators.

India’s embassy in Washington has hired Mercury Public Affairs for $75,000 a month to handle lobbying and media relations just days before Trump’s 50 percent tariffs on Indian goods take effect. The move highlights New Delhi’s urgent push to manage worsening ties with Washington over Russian oil purchases, while still emphasizing the importance of U.S.-India relations.

State Bank of India, the country’s largest lender, has urged regulators to let banks finance acquisitions, arguing it would boost transparency and growth opportunities. Chairperson Challa Sreenivasulu Setty suggested starting with listed firms where shareholder approval ensures oversight.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Reach out to [email protected] to reach our audience and see your advertisement here.

1. RBI Chief Reaffirms Growth Focus as Tariff Risks Loom

RBI Governor Sanjay Malhotra

India’s central bank is keeping growth firmly in its sights while balancing the need for price and financial stability, RBI Governor Sanjay Malhotra said on Monday. Speaking at the annual FIBAC banking conference in Mumbai, Malhotra emphasized that stability is “an enabler, not an obstacle” to expansion and pledged continued support for the economy through ample liquidity.

The annual FIBAC conference is hosted by the Federation of Indian Chambers of Commerce and Industry (FICCI) and Indian Banks’ Association (IBA).

The governor’s comments come at a delicate time. The RBI has already cut its benchmark repo rate by 100 basis points this year, helping to soften borrowing costs, while inflation eased to an eight-year low in July. The sharp drop in consumer prices has given policymakers space to respond to external shocks, including Trump’s 50 percent tariff threat on Indian exports.

Malhotra acknowledged the risks but struck a measured tone. “We are hopeful negotiations will play out and the impact will be minimal,” he said, pointing out that nearly half of India’s export sectors remain outside the tariff regime. He also highlighted the government’s ongoing push to secure free trade agreements as a buffer against global uncertainty.

Looking ahead, the RBI is working on expanding the rupee’s international role, with local-currency trade flagged as a key strategic area. On domestic finance, Malhotra noted steps to improve funding for non-bank lenders but ruled out granting them the same standing liquidity facilities available to banks.

The message was clear: despite geopolitical headwinds, the RBI remains positioned to safeguard growth while keeping inflation and financial risks in check.

2. “Ghost Trades”

India’s stock market was jolted last week after one of its biggest trading blunders in years exposed cracks in the framework governing block trades. A unit of Avendus Capital accidentally executed two simultaneous sales of Clean Science & Technology shares, amounting to nearly 24 percent of the company, or about $300 million (₹26.3 billion), after traders mistakenly thought the first order had failed.

Such duplicate “ghost orders” are exactly the kind of mishap that block trade windows, short 15-minute sessions before and during market hours, are designed to prevent. Yet many large deals bypass these windows because of the restrictive rule that caps discounts at just 1 percent to prevailing prices. In this case, Clean Science shares were offered at a steep 13 percent markdown, forcing execution in the live market, and heightening the risk of slippage.

SEBI has since moved to tighten safeguards, proposing to triple the discount limit to 3 percent for some stocks and raise the minimum trade size to $2.9 million (₹250 million) from $1.14 million (₹100 million). Settlement of block trades would also be mandated through share delivery.

The episode underscores the surging importance of block deals in India, which have overtaken IPOs as a preferred route for private equity exits and promoter stake sales. While market veterans argue India’s system is generally efficient, regulators face pressure to adapt rules as trade sizes grow and liquidity strains increase.

3. India Doesn’t Earn Fitch Upgrade

The Secretariat Building in New Delhi, housing the Finance Ministry

Fitch Ratings has kept India’s sovereign rating unchanged at BBB-, the lowest investment-grade level, highlighting concerns over high public debt and looming tariff risks from the United States.

The decision comes just weeks after S&P Global Ratings upgraded India to BBB, its first lift in 18 years, raising expectations that other agencies might follow. Moody’s still maintains a Baa3 rating.

Fitch said India’s government debt stood at 80.9 percent of GDP in fiscal 2025, far higher than the 59.6 percent median for countries with the same grade. It forecast debt to edge higher to 81.5 percent in fiscal 2026, warning that if nominal growth slips below 10 percent, debt reduction will be challenging.

The agency expects the economy to expand 6.5 percent in FY26, matching last year’s pace. However, Fitch flagged US President Donald Trump’s planned 50 percent tariffs on Indian goods, set to take effect this week, as a “moderate downside risk.” The steep levy, largely tied to India’s Russian oil purchases, could dampen investment sentiment and blunt India’s ability to benefit from supply chain shifts out of China.

Fitch noted that domestic demand will likely cushion growth, supported by the government’s infrastructure push and steady private consumption. Prime Minister Narendra Modi’s proposed goods and services tax reforms could also offset some of the risks, Fitch said, by boosting household spending.

How would you rate today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.