Hello! We’re talking about Adani (again). We’ll also discuss RBI’s plans to remove red tape for foreign investors and then close with Gupshup, a round-up of the most important headlines from the week.

BTW: Manmohan Singh, the Indian Prime Minister who served before Narendra Modi, became PM despite not being the leader of the majority party in Parliament. In fact, he was not even an elected member of any party in the Lok Sabha. How did he become PM? (Answer at the bottom)

BTW x2: We’re on Twitter/X now. Follow us here.

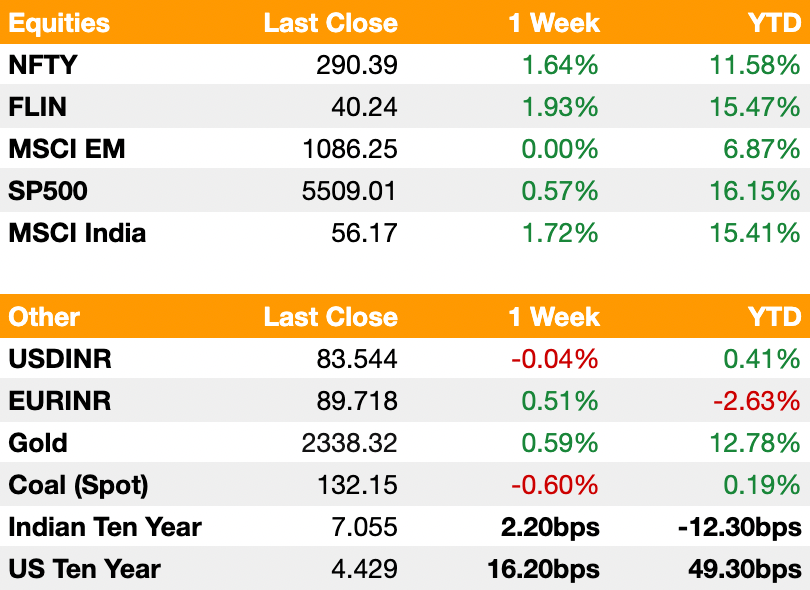

Markets

Quick Appendix: NFTY is a weighted average of the largest 50 companies listed in the National Stock Exchange of India by market capitalization. FLIN, or Franklin TSE India ETF, tracks large and mid-cap companies, weighted by market cap, to give international investors exposure to Indian markets. MSCI EM is an index that captures large and mid-cap companies across 24 emerging market countries and covers 85% of the free float-adjusted market capitalization in each country. SP500 is the index of the 500 largest companies listed in U.S. stock exchanges by market cap. MSCI India is an index that covers 85% of the Indian equity universe.

Forget Adani: Hindenburg Research Takes On The Whole Indian Government

Top: Nathan Anderson, founder of Hindenburg Research; Bottom: SEBI HQ in Mumbai

Hindenburg Research, the short-seller research firm that exposed business malpractice by the Adani Group last year, was served a 46-page show cause by the Securities and Exchange Board of India (SEBI) for what it alleged was a malicious report unfairly targeted Adani’s conglomeration. You can read the SEBI report here, which Hindenburg made available in full. Hindenburg’s response can be found here.

Here is the takeaways:

Order to show cause is when a regulatory body orders one to explain or justify actions deemed suspect or potentially illegal to a court

Hindenburg made only an unimpressive $4 million from its short position on Adani Group, which lost $150 billion in value after the short-seller released its original report. Most of this money went to its investment partner and client Kingdon Capital.

Indian regulations limit foreigners’ ability to short its companies

SEBI alleges that Hindenburg colluded with U.S.-based asset managers to short Adani Group, while its report “contained certain misrepresentations/inaccurate statements” that “mislead readers.”

SEBI alleges Hindenburg partnered with Kingdon Capital Management to indirectly short Indian equities, despite claiming to be objective

SEBI says Hindenburg shared a preliminary version of the Adani research report with Kingdon Capital Management, which it used to open short positions in the Indian markets via a broker called Kotak Mahindra Investment Limited (KMIL).

SEBI says Kingdon Capital agreed to a profit-sharing deal with Hindenburg, allowing the research company to indirectly financially benefit from its report

Hindenburg called the SEBI show-cause “nonsense,” adding that its sole purpose was “an attempt to silence and intimidate those who expose corruption and fraud perpetrated by the most powerful individuals in India”

Hindenburg denies SEBI’s implication that Hindenburg was secretly colluding with Kingdon — instead, it points to numerous public statements Hindenburg has made saying they are shorting Adani Group, and that partnering with a single asset manager has been their renowned and publicly documented approach to investing

“This wasn’t a mystery—virtually everyone on earth knew we were short Adani because we prominently and repeatedly disclosed it,” Hindenburg said in its response.

Hindenburg also denies that it ever claimed to be objective, pointing to the fact that in the first sentence of the report it makes clear, it has a short position in Adani Group and stands to benefit from a decline in the stock price, while also writing at the end of the report that it is published for informational purposes and readers should do their own research.

Hindenburg cited instances where it alleges the Indian government has attacked those critical of Adani:

4 journalists were called in by Gujarat police after writing critical articles of Adani but were cleared from arrest by the nation’s Supreme Court.

Members of Parliament were expelled on allegedly false corruption charges after being critical of Adani

SEBI’s chief met with Gautam Adani, the billionaire CEO of Adani Group, twice in 2022. It is the first time the finance regulator chief has met with a “high-profile businessman.”

RBI Removes Red Tape, But It’s No Red Carpet

RBI is partnering with SEBI to reduce red tape around foreign investors buying Indian sovereign debt, which comes on the heels of the bonds’ inclusion in the JP Morgan EM debt index. Namely, the measures will reduce registration and paperwork.

Foreigners investing in Indian markets can still expect regulatory difficulty compared to the open U.S. markets.

Regulatory Challenges Investing in Indian Government Bonds (G-Secs)

Access Routes:

Foreign Portfolio Investors (FPIs): Limits on Investment: The RBI sets caps on the total amount of G-Secs that FPIs can hold. These limits are periodically reviewed and updated.

Compliance with FEMA: Investments must adhere to the Foreign Exchange Management Act (FEMA), which regulates foreign exchange transactions.

Reporting and Monitoring:

Frequent Reporting: FPIs must report their holdings and transactions regularly to ensure compliance with investment limits and other regulatory requirements.

RBI Monitoring: The RBI closely monitors FPI investments in G-Secs to manage market stability and ensure adherence to caps.

Repatriation: The process for repatriating interest income and principal payments is governed by FEMA, adding layers of regulatory compliance.

Key Differences

Market Access: The U.S. Treasury market is far more accessible to foreign investors with minimal regulatory hurdles, whereas India requires foreign investors to register as FPIs with SEBI to invest in Indian government securities. This registration process includes compliance with KYC norms and regulatory due diligence.

Investment Limits: India imposes caps on foreign holdings in G-Secs to manage market stability, while the U.S. does not impose such limits.

RBI often changes limits on a monthly or quarterly basis

Approval and Compliance: Foreign investors in India must navigate a complex approval and compliance framework involving SEBI and RBI, unlike the straightforward process in the U.S.

Reporting Requirements: The U.S. has minimal and straightforward reporting requirements, whereas India requires frequent and detailed reporting to regulatory authorities.

Taxation: The U.S. offers tax advantages like no withholding tax on Treasury interest, which is more favorable compared to the potential tax complexities in India.

Currency Risk: Indian sovereign debt investments involve managing INR currency risk and FEMA regulations for repatriation, whereas U.S. Treasuries, denominated in USD, involve less currency risk and simpler repatriation processes.

RBI and SEBI regulations are continuously evolving. A decade ago the RBI did not let companies enter into foreign exchange hedging programs. This was first rolled back for companies with more than $30M in exposure; starting in 2017, smaller companies doing less than $30M also were able to enter FX hedges.

Additionally, regulation against domiciles is being reduced; many investment vehicles are domiciled in the Caribbean to avoid capital gains taxes. In the past, investors have been using derivatives and swaps to gain exposure to Indian returns without increasing FDIs in the country.

Macro

India leads EM ETF Inflows in June (BBG)

FLIN recorded its highest monthly inflow ever: $324.59 million

Indian bond yields near flat on third day after inclusion in JP Morgan index (Money Control)

Coal is becoming a much more resilient investment, akin to gold in the past (The Economist)

Coal, a heavily used fossil fuel in India, has stabilized as a prominent investment due to prices remaining solid amidst challenges in Europe and China due to Indian strength

India generally consumes coal as soon as it is produced and the fuel is heavily used in all factories

Service exports are growing rapidly with India supplying 5% of all global services (The Economist)

Virtual cashiers, call centers, and even camera checkers have caused supply ‘exports’ to rise 60% or $7.9T (7.5% of global GDP) in the past 10 years

India’s IT firms and global capability centers (technology and research) have led to growth there

India passes the Paris-based Financial Action Task Force’s anti-money laundering test (BBG)

FATF reported that India prevents laundering, financial terrorism, and international cooperation

India is a member of the FATF alongside major countries like the US, China, Japan, and EU

India’s strong fundamentals draw high inflows with potential Fed pivot driving more (BBG)

The spread-yield advantage for India continues growing with Western rates falling while the RBI historically has a lower amplitude of rate cuts

Fast economic growth will likely make the RBI keep yields at 7% compared to 4.3% on US bonds

Several trading firms, like Goldman Sachs, predict the INR to be the most stable Asian FX (BBG)

Goldman in particular shorts Western currencies like the euro against the rupee to benefit from higher Indian rates coupled with high dollar reserves allowing the RBI to intervene in markets

Equities

Hyundai India expected to raise $3.5 bn in IPO (BBG)

Race to build a SuperApp Accelerates as Adani Group Aims to Have 1 of 3 Indians on its all-in-one WeChat-inspired app by 2030 (BBG)

The app, Adani One, has only 30 million active users

Competitors MyJio, by Ambani, and Neu, by Tata, have also seen little traction

India Brokers Fall as Watchdog Bars Tiered Transaction Fees (BBG)

Currently, stock exchanges will charge brokers a small fee for a larger volume of transactions

SEBI has ruled that stock exchanges must charge a flat fee, alleging that the status quo unfairly hurts smaller brokers — the ruling will kick in on October 1

Experts believe this will hurt profitability of larger brokers, causing stock decline

Adani’s push in cement has led to smaller players growing valuations (BBG)

The conglomerate, Adani, bought four smaller cement makers with Modi’s reelection

Other players like Ultratech and Shree Cement have seen shares rise 9% this year and have higher capital for mergers

Kumar Birla’s Ultratech Cement purchases a 23% stake in India Cements for $226M (Rs. 19B) (BBG)

Ultratech is attempting to combat Adani’s efforts at consolidating the market

Though Ultratech has the highest production capability, India Cements is a gate to South India

Vedanta Resources set to control the Konkola copper mine in Zambia once again (BBG)

Anil Agarwal plans to pay a $250M fee (after being forced to leave in 2019) to settle debts in order to ramp up output as global demand is expected to surge

Vedanta will sign prepayment agreements with commodity houses like Mercuria for financing

Indian regulators found Byju negligent but cleared the company of fraud (BBG)

A yearlong probe by the Ministry of Corporate Affairs found no evidence of siphoning funds or manipulation of financial accounts after 3 board members (Prosus, Peak XV, and Sequoia) left

A weak governance board plus terrible funding environments led to company underperformance

Tata Steel threatens to shut down British furnaces early over strikes (FT)

Tata operates Britain’s last two blast furnaces at Port Talbot and is planning on closing both by the end of this year

Unite, a large labor union, is exacerbating costs and Tata now threatens to close both months early

Billionaire Aditya Birla is investing $50M to build a chemical plant in Texas (BBG)

India raises $1.3B (Rs. 108B) from a weaker-than-usual airwaves auction (BBG)

Airwaves in 8 bands were put on auction with Bharti Airtel buying the majority for $820M

Airwaves auctions in 2021 and 2022 brought in a combined $30B with this one being disappointing

Bharti Airtel, Vodafone, and Reliance all start raising mobile prices (BBG)

Indian cell services make an average of $2 a user per month — Niket Shah, CIO at Motilal Oswal, predicts that carriers need at least $3 a user for financial health

Indian phone carriers are still recovering from a brutal price war when Mukesh Ambani’s Reliance entered the field back in 2016

Alts

Indian credit sees large benefits from index-related flows (BBG)

There has been a consistent $3B (Rs. 250B) of monthly inflows into government bonds

Traders expect inflows to lower company costs of borrowing as bond demand drives down rates

JSW Steel, India’s largest steelmaker, is investing $110M (Rs. 9.13B) in US offshore wind (FT)

The investment comes at an uncertain time with high rates and uncertainty in offshore wind given policy updates come November elections

Parth Jindal, managing director of JSW, dismissed the election risk

Surging returns are causing private equity giants to come back to India (BBG)

Blackstone and other private equity firms first entered India in 2005 but promptly left; in the last 5 years, foreign investors have represented ~60% of all investment

The liquid market has let investors easily buy and sell minority and majority stakes in a variety of companies from tech to industrial

Politics

Deputy Secretary of State Kurt Campbell continues pressing India about overseas assassination plots (BBG)

Campbell visited India last week and continues asking officials for criminal prosecution or institutional reform

Earlier this month, the Czech Republic extradited an Indian suspect who pleaded not guilty

Chinese engineers and technicians are struggling to obtain visas posing a bottleneck in India’s push to become a manufacturing nation (FT)

The flow of skills critical for the development of India’s manufacturing push has halted as Chinese workers bring their technical expertise to set up plants

German companies say bureaucratic hurdles in India growing this year compared to 2023 (BBG)

64% of German businesses operating in India cited protectionist measures and procurement rules

Chancellor Olaf Scholz is visiting in October to discuss trade

We need your feedback to make this newsletter more useful to people like you. Please let us know what you think here.

And, consider sharing with three friends.

Oh, and after the 2004 Indian national elections, Sonia Gandhi, leading the majority United Progressive Alliance coalition in Parliament and serving as the president of the Indian National Congress, was widely anticipated to assume the role of Prime Minister. Instead, she appointed Manmohan Singh, a distinguished economist and member of the Rajya Sabha (the upper house of the Indian Parliament), to the position. While the PM is typically a member of the Lok Sabha, there is no constitutional law prohibiting non-members from serving in the position as long as they have the majority’s support.

Left: Manmohan Singh; Right: Sonia Gandhi

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.56 Indian Rupee