Hello. Modi met with Putin last week, and inflation is higher than expected. We’ll dive into everything you need to know, and then close with Gupshup, a round-up of the most important headlines from the week.

BTW: Unless you live under a rock, you’ve probably heard of the highly opulent wedding hosted for India’s wealthiest man’s youngest son, Anant Ambani. The ceremony was attended by Indian and Western superstars, world leaders, and business tycoons. How much was the total cost of the wedding and pre-wedding ceremonies? (Answer at bottom)

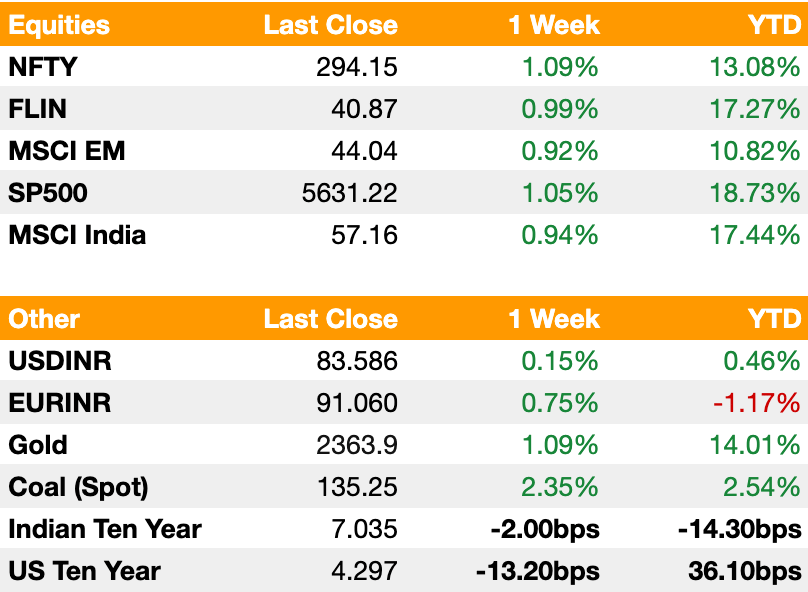

Markets

Quick Appendix: NFTY is a weighted average of the largest 50 companies listed in the National Stock Exchange of India by market capitalization. FLIN, or Franklin TSE India ETF, tracks large and mid-cap companies, weighted by market cap, to give international investors exposure to Indian markets. MSCI EM is an index that captures large and mid-cap companies across 24 emerging market countries and covers 85% of the free float-adjusted market capitalization in each country. SP500 is the index of the 500 largest companies listed in U.S. stock exchanges by market cap. MSCI India is an index that covers 85% of the Indian equity universe.

Takeaways from Modi’s meeting with Putin

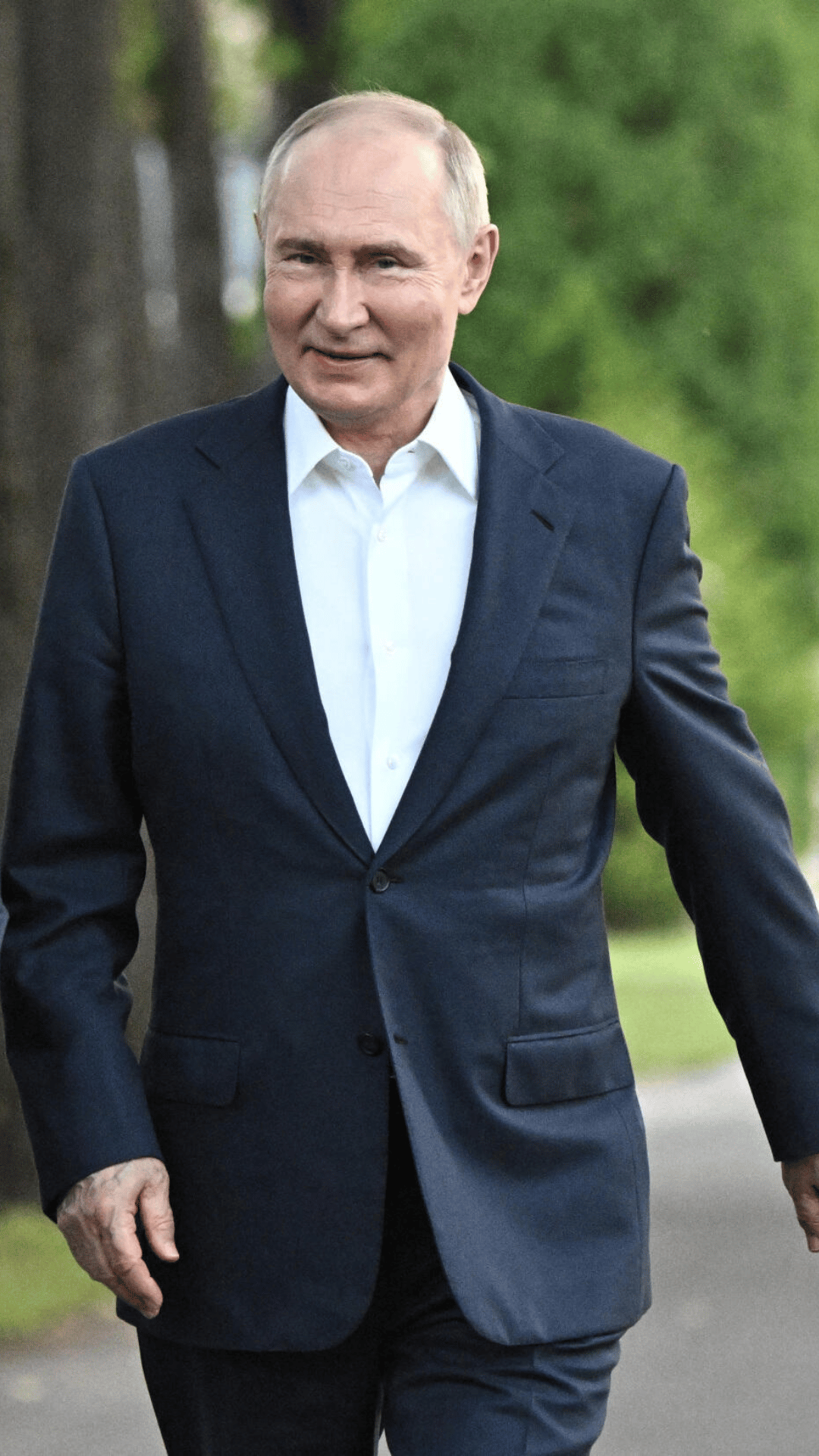

India’s foreign policy continues to serve as a spoiler for Western interests, as India’s PM Modi met with Russian President Putin last Monday, which coincided with the NATO summit in D.C. and Russia’s attack on a Ukrainian children's hospital. The timing of the meeting disturbed the White House, with some senior leaders calling it “deeply inappropriate.”

India’s leadership downplayed the timing of the meeting, saying it was not directed at any other party. “I would not want to read anything more in that in terms of its significance,” said Vinay Mohan Kwatra, who served as India’s foreign secretary until he retired yesterday.

However, India’s relationship with Russia is not a rebuke of the U.S. policy on Ukraine; historically, India led the non-alignment movement and maintained warm relations with the U.S. and the Soviet Union. India has consistently been among the largest buyers of Russian oil and military equipment. Even in 1960, the New York Times ran the headline “India May Step Up Russian Oil Deals ... Feud Flares with Western Concerns on Prices.” Leveraging its responsibility to get the lowest prices for some of the world’s poorest people that live amongst its borders, India has been able to get a pass from the West for its dealings with Russia.

India’s government also gave the U.S. a heads up of the meeting between Modi and Putin and promised it would be “light on substance,” as per Bloomberg reporting.

Here are the major takeaways from the Modi-Putin summit:

India currently imports fertilizers, arms, and oil while exporting agricultural and industrial products

India looks to Russia for long-term uranium supply for nuclear plants (BI)

Russian media announced Modi and Putin discussed Russia state-owned nuclear company building six new high-powered nuclear reactors in India (CNN)

Russian oil deliveries have been getting cheaper, particularly to India and China (BBG)

Actual freight costs have fallen to below $8 a barrel compared to $15 during the onset of the war

The value of sanctions on shipping a million barrels has fallen by $4M with dark fleets

Putin promises to discharge Indians ‘misled’ into joining active combat in Russian army

Russian army lured Indian nationals with “army support” jobs, but many were wrongly conscripted to active combat in Ukraine

Putin awarded Modi the Order of St. Andrew the Apostle, the highest civilian award in Russia, for his work expanding bilateral relations between the two countries

India and Russia agree to allow militaries to share facilities for training

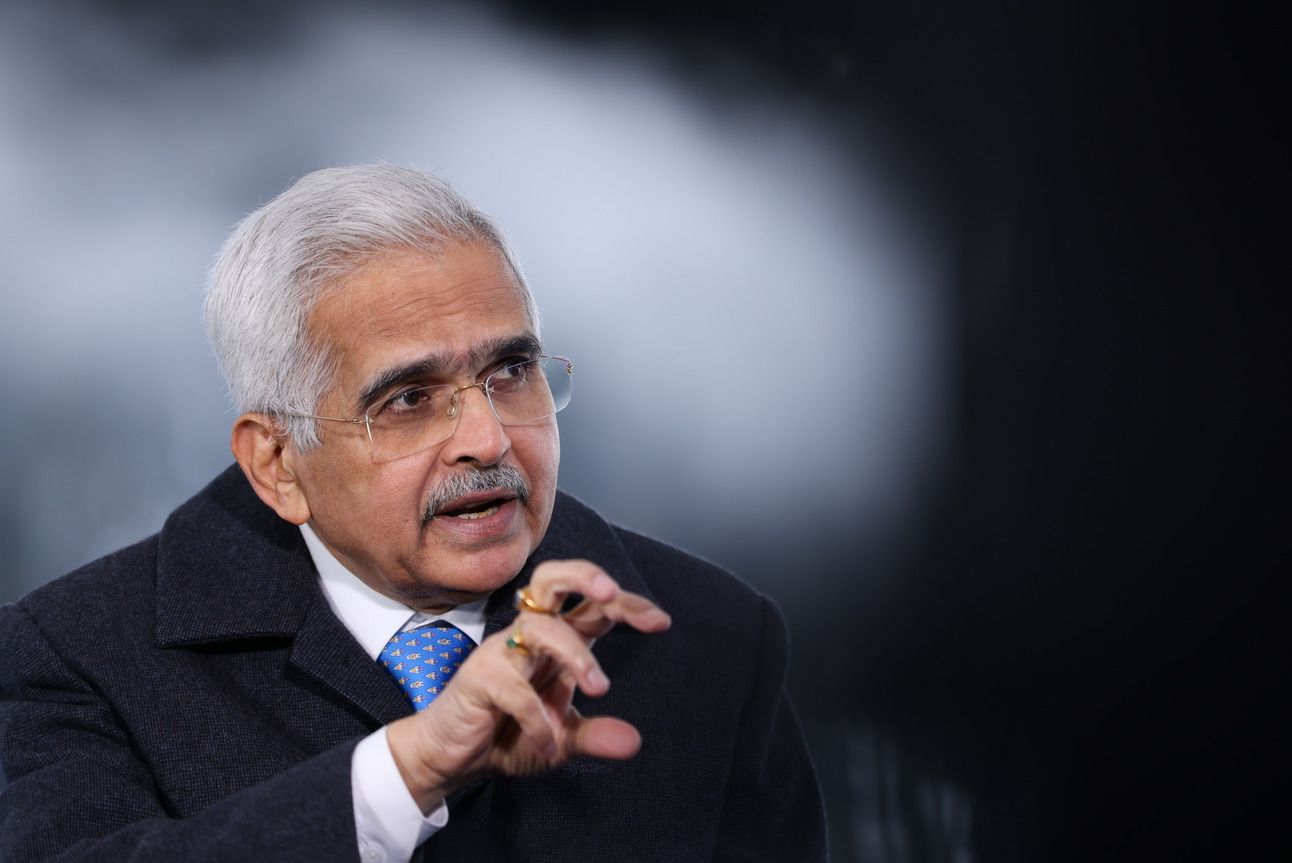

No Cuts Coming Soon

India's inflation surged to a four-month high in June, reinforcing the central bank's decision to maintain higher interest rates.

Key Points:

Inflation Rate: Consumer price index increased by 5.08% YoY in June, up from 4.75% in May.

Exceeded the 4.80% forecast by economists in a Bloomberg survey.

RBI’s Stance: Governor Shaktikanta Das emphasized it’s too early for interest rate cuts.

Policy rate remains unchanged at 6.5% for over a year.

Food Prices: Jumped 9.36% YoY in June, from 8.69% in May.

Core Inflation: Rose to 3.15% in June, up from 3.12% in May.

Growth Projections: Q1 fiscal growth strong; full-year growth projection at 7.2%.

Urban demand stable, rural demand picking up.

Capital inflows over $11 billion since inclusion in JPMorgan Chase & Co. emerging market index.

Monetary Policy Outlook:

MPC Meeting: Scheduled for June 5-7.

Expected to hold the benchmark repo rate at 6.50%.

Economists’ Predictions:

33 of 71 economists in a May 17-30 Reuters survey predict the first repo rate cut in Q4 2024, with a median forecast of 6.25%.

By end-2024, predictions vary:

33 economists see rates at 6.25%.

15 expect 6.00%.

5 anticipate 5.75% or lower.

18 forecast no rate change.

Despite these predictions, inflation is expected to remain above the RBI's 4% target this year and next.

Macro

Indian forex reserves at all-time highs, growing $5.2 billion to $657.2 billion in the week of July 5 (BBG)

$550 million in foreign investment flowed into Indian bonds in same week, likely attributable to India’s inclusion in J.P. Morgan’s EM bond index

Foreign banks have been the largest buyer, buying $6 billion in Indian debt since June 1 (BBG)

The government refuted a Citigroup report stating that the country would struggle even at 7% growth (BBG)

India’s Ministry of Labor and Employment said the report did not consider 80M new jobs in the last 5 years

India needs 1 million highly-skilled engineers within 2-3 Years to support economic growth, industry trade group estimates (BBG)

Will require massive government investment in upskilling and expanding education

India stifling growth potential with lack of labor-intensive manufacturing jobs, IMF says (BBG)

Moving workers to factory jobs can increase economic growth by 0.5 percentage points yearly

Indian government is debating to ease rice export limits (BBG)

The government is considering allowing white rice exports with a flat tax

Such a move would help cool the Asian benchmark for food inflation and staple crop prices

India’s trade gap decreases in June due to declining imports (BBG)

Equities

Adani Group seeks to double investment in Vizhinjam international transshipment terminal by 2028

Karan Adani, the billionaire founder’s elder son and CEO of Adani Ports & Special Zone, announced a $2.4 billion (200 billion rupees) investment

Vizhinjam is a port on the southern tip of India, and accelerating capacity would make it more competitive in maritime trade against China

Indian midcap stocks set to break $1 trillion market cap (BBG)

NSE has total market cap of approximately $5 trillion

Indian mutual funds hit record high in June (Reuters)

Inflows into Indian equity funds rose 17% YoY to $5B (Rs. 406B) for the month

Bulk of the inflows are going to small and mid caps, with more speculation happening

Anthem Biosciences is considering a $400 Million IPO in India in late 2024 or early 2025 (BBG)

The company researches and produces drugs for pharmaceutical companies

IPOs this year average 57 percent gain from debut (BBG)

2024 Indian IPOs outperform global averages

Credit

Overseas investments into India slowed for a second week as sovereigns joined the EM index (BBG)

Flows went down to $430M (Rs. 36B) from Rs. 47B the previous week according to the Clearing Corp. in India

Inflows are still nearly double the average of Rs. 21B and onshore demand is expected to stay high

Bain Capital-backed wealth manager announces $200 million fund with Ruchir Sharma’s Breakout Capital (BBG)

Karan Bhagat’s 360 One wealth management to take advantage of new RBI regulation allowing domestic investors to open foreign currency accounts

Politics

Modi’s second largest ally in Lok Sabha demands $3.6 billion (300 billion rupees) for Bihar (BBG)

Bihar is India’s poorest, and the state’s debt is nearly 40 percent of its GDP

The requested amount is half of the government’s food subsidy budget, a major federal program

The BJP government is prepared to be judged based on its first new budget (BBG)

The new Indian government's first budget will be a crucial test of its ability to balance populist demands with fiscal responsibility

Naidu demands $12B to build a new capital in Andhra Pradesh (BBG)

Political analysts expect this to continue with Modi failing to win an outright majority

India takes shot at Hindenburg over short seller’s report on Adani (BBG)

Sebi issued a show-cause notice saying that Hindenburg failed to abide by rules governing research analysts

Sebi and the government view shorting profits as “unfair” due to “collusion”

SEBI begins investigation into Uday Kotak’s bank for aiding Hindenburg’s short positions (BBG)

In particular, only Kotak’s Mauritius subsidiary is being dragged - not the Indian banking arm

We need your feedback to make this newsletter more useful to people like you. Please let us know what you think here.

And, consider sharing with three friends.

Oh, the billionaire heir’s wedding is estimated to cost $600 million, or 0.5 percent of Ambani’s $120 billion net worth.

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.12 Indian Rupee