Hello. The Federal Reserve is expected to cut rates this week — how is this going to affect India? We’ll explore, and then close with Gupshup, a round-up of the most important headlines.

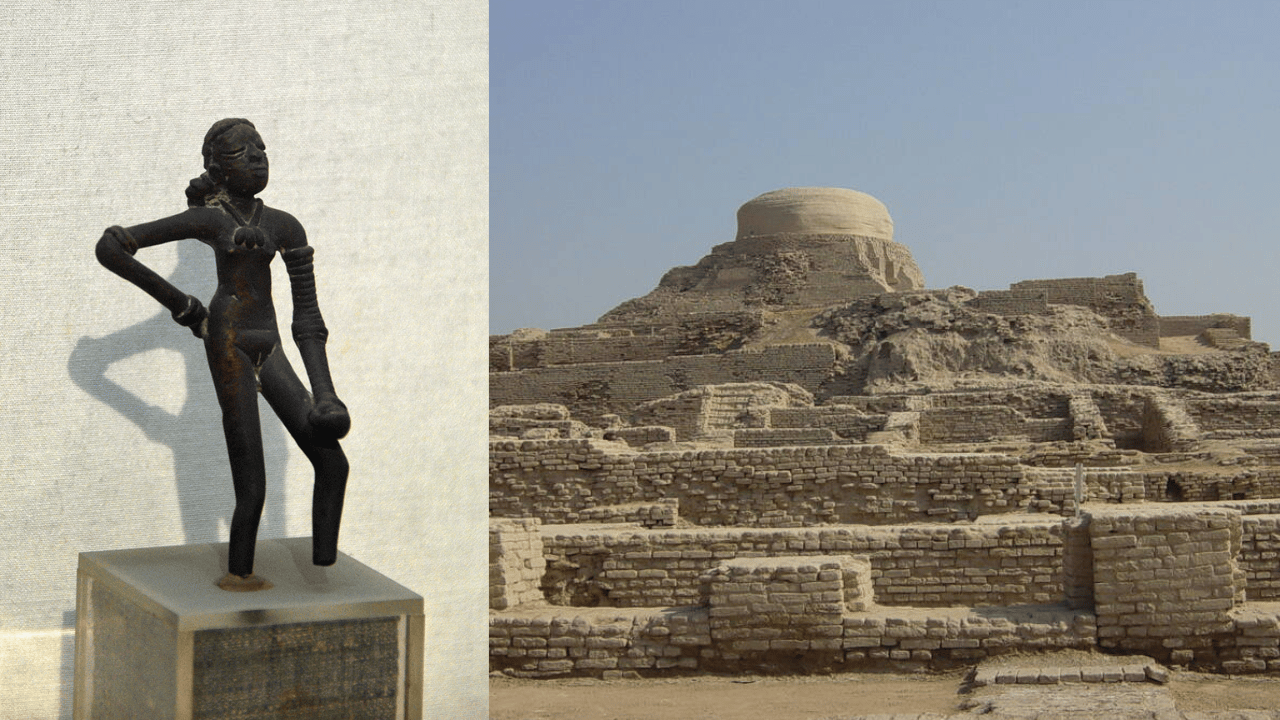

BTW: What famous artifact from the ancient Indus Valley civilization has puzzled archeologists to this day about the origins of human civilization? (Answer at bottom)

Markets

Read here for an appendix on the above.

Fed Cut

Both the BSE Sensex and Nifty50 rose about 1.8% this past Wednesday, a week before the September 18th FOMC meeting, with more inflation and jobs data being released. Since US inflation is closing in on the target of 2% (at 2.5% as of August), investors feel more reassured that cuts are imminent.

US rate decisions drive sentiments in all stock markets since any corporate borrowing is done at US rates plus a risk-adjusted spread. In addition, a weaker dollar would also drive more inflows into India while reducing inflationary pressures.

Not a Linear Path. While a risk-on market sentiment should make stocks rise, the rise will not be linear. Unless there is a recession in India (unlikely to happen at all), stocks should be higher in the next 12 months but rate cuts affect different companies in various ways.

A Fed cut will likely lead to a December RBI cut which could hurt the Nifty50. 33% of the index is made up of financial companies that have cyclical earnings that can benefit heavily from high rates. Just from that factor alone, the Nifty50 could trade sideways for longer than expected.

Rate Cut Expectations. Expectations for a rate cut have to also be priced in. With stocks having rallied 2% in a week (and 3% this past month) there is little room for stocks to rise. A 25 basis point cut is expected and if that is the outcome, stocks will likely trade sideways. Even though a 50 bps cut seems rosy, that can also signal deteriorating American economic conditions that would impact India too. Five fund managers/economists also agree with such a sentiment regarding US rates and Indian assets.

India VIX also fell 17% this last week which is a bullish sign since it was coupled with rising equities which also shows how baked into the market this cut already is.

What About Other Asset Prices? Bonds are expected to and already are increasing in price. As US rates taper, Indian rates fall and due to the price-yield relationship Indian debt will start to rally. Government-secured will do so in a stronger fashion than corporate since corporate debt is more reliant on the intrinsic company.

Oil prices are likely to rise in the short term due to the storage/opportunity cost factor that makes up the price. That being said, faltering US demand has led to prices falling precipitously and it’s hard to predict how prices and demand will change in the short term. Gold (a heavily demanded commodity in India) will benefit from the same storage cost factor.

Macro

Canadian pipelines routing crude to Asia (BBG)

Trans Mountain expansion helps boost exports off of West Coast to India and Asia

There have been deeper price cuts due to more Canadian crude flowing, but increased price vol

Consumer demand has fallen in India ahead of the festive season (BBG)

Consumers are starting to cut back on spending, seen by how growth has fallen this year, worrying economists as the holiday season grows closer

Economists believe that savings over the post-pandemic era have been fully eroded

Equities

Bajaj Housing surges 136% for best Indian debut over $500M (BBG)

Bajaj surged more than double reflecting local enthusiasm for IPOs with bids for over $40B considering an initial raise of $780M

There is still increased concern about liquidity propping up valuations

Tata’s airline merger continues to struggle (BBG)

Vistara and Air India, scheduled to fly on Nov. 12, face pilot shortages plus flier ire

The union of the two companies is part of a 5-year plan to reinvigorate Air India

Alts

Aluminum prices jump after an alumina refinery collapsed (BBG)

Alumina is the intermediate product before aluminum, which has been volatile due to macro risk

In Vedanta, severe weather conditions led to pressure and caused contamination in some fields

Adani’s Kenya Transmissions still being debated (BBG)

The President has confirmed a $1.3B deal, with more power lines worth $760M being negotiated

Adani Wilmar to start stake sale in JV next month (BBG)

Founders need to sell a 13% stake to comply with Indian securities law

They plan on meeting with investors in Southeast Asia, the US, and India

Policy

India gets $386B financing pledge for green energy push (BBG)

The ministry had asked project developers and investors for secure commitments last week

Minister Joshi announced the value at the RE-Invest Conference in Gujarat

Central government’s capex expenditure is rising after a slow Q1 (Mint)

Finance Minister Sitharaman is well on target for growing capex and limiting the fiscal deficit to 4.5%

Indian subsidies for chips, while growing, need to be more targeted (BBG)

Officials are paying up to three-quarters of CapEx for the production of various semiconductor facilities

India is too focused on becoming an end-to-end manufacturer, something which seems unattainable; India should use strategic dependence on imports from neighbors

Oh, and Dancing Girl of Mohenjo-Daro is one of the most famous unexplained artifacts from human history. Historians and archeologists know little about the residents of the ancient civilization of Mohenjo-Daro, in modern-day Sindh, Pakistan. Not their ethnicity, their religion, their language, or why they mysteriously disappeared with no evidence of war, disease, or famine as a cause.

Dancing Girl of Mohenjo-Daro, left; Mohenjo-Daro ruins, right

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.88 Indian Rupee