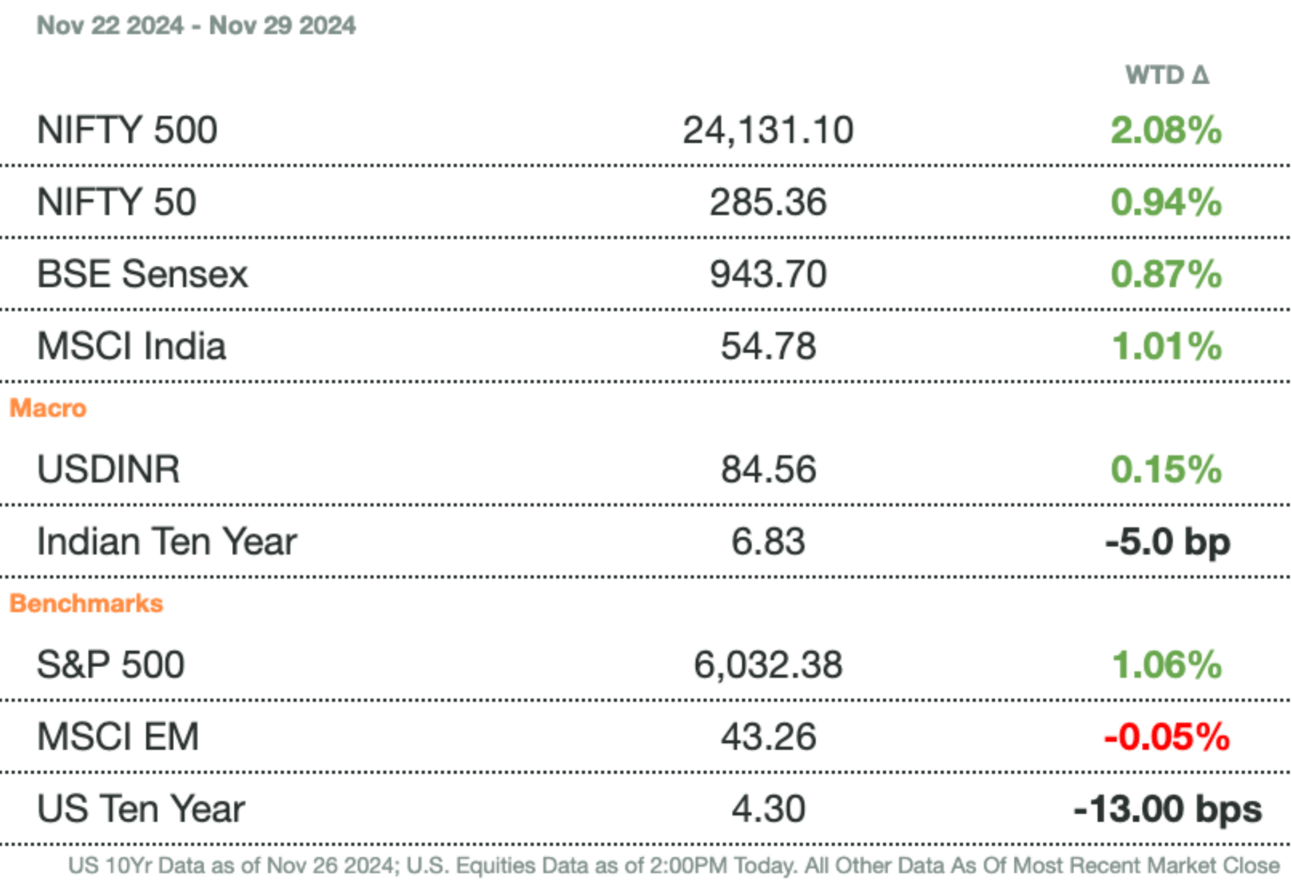

Market Update

Markets performed up 1 percent today after a larger selloff on Thursday. As a whole, this will be the first time Indian equities see back-to-back monthly losses since early 2023. Analysts see that foreign and domestic investors have wisened up to high market valuations which has broadly caused outflows, but are still investing in some sectors. Industrials, healthcare, and telecommunication have all gotten inflows due to expectations that high earnings multiples will continue to be met going into 2025.

Live Event

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

Explainer

How the RBI Manages Currency Fluctuations

After China’s stimulus package caused a roar in its markets, and the U.S. dollar appreciated further, the Reserve Bank of India has been under immense pressure to intervene in the country’s currency to prohibit it from depreciating too much. Often, the RBI maintains a soft limit of ₹84/$1, though this has been surpassed numerous times; the Indian rupee has hit new lows this fall, now at an exchange rate of ₹84.57 per dollar, the lowest since March. Now, more than ever, investors should understand the RBI’s methodology of currency controls; it is not as simple as tracking the exchange rate and automatically triggering the buying and selling of central bank reserves.

When the RBI chooses to intervene in foreign exchange markets, it usually is to fulfill two goals: limit the volatility of how much the rupee’s value is changing but also to align the exchange rate with the calculated equilibrium value. India’s economic narrative is undergoing a seismic shift, with the RBI embracing cutting-edge methodologies to align the exchange rate of the Indian Rupee with its equilibrium value.

To do so, they have defined the fundamental equilibrium exchange rate (FEER), desired equilibrium exchange rate (DEER), behavioral equilibrium exchange rate (BEER), permanent equilibrium exchange rate (PEER), and nominal effective exchange rate (NEER). FEER is derived from internal and external balances such as maintaining inflation, current account balance, and saving/investment. DEER is more of a perceived measure that policymakers would want to see happen. BEER considers long-term fundamentals and short-term cyclical influences while PEER is purely long-term fundamentals. NEER on the other hand is the actual change in the rupee relative to a basket of nearly 40 currencies. Together, these frameworks allow for a nuanced assessment of the rupee's alignment with economic realities.

From RBI Bulleting, November 2024

The graph above compares various metrics to the actual currency fluctuation (REER). Since each metric involves complex valuations and datasets to project currency movements, the graph provides insight into how these metrics align with the actual currency and highlights the months where they diverge. BEER is generally a good indicator, while FEER provides important nuance but is not a singularly reliable metric: FEER is inherently backward-looking and is not calculated using projected growth rates.

Since 2000, the rupee, on a trade-weighted basis, has appreciated by 1 percent each year but NEER has depreciated at 2 percent per year led by inflation differentials between India and its trading partners. REER also shows how labor productivity and technology have grown dramatically leading to fundamental rupee appreciation, but there is also volatility since commodity price shocks have been more risky for India, especially with crude oil.

There are numerous other insights such as BEER and PEER suggesting that the INR has held its ground, hovering close to equilibrium over the long term. FEER, however, paints a different picture, flagging occasional misalignments driven by trade volatility and fiscal pressures. These insights aren’t academic musings—they’re the backbone of policy formulation. Armed with these models, the RBI doesn’t just intervene in forex markets; it does so with surgical precision, smoothing volatility without pegging the rupee to a specific band.

The creation of these indicators has been very data-driven with various factors being exposed to large amounts of Indian data to discern key takeaways. The process of using these models gives tangible results such as regression equations detailing how much of BEER and PEER are decomposed in long and short-term factors plus the standard error expectations for both. For BEER, the RBI can see that relative GDP per capita and Net Foreign Assets are statistically significant in the long and short run.

That being said, the RBI does acknowledge how some factors could be dislocated in long-term rupee valuation. FEER has interest rates as input but does not know what path rate policy will follow, just a vague understanding of the destination. BEER also uses past relationships to predict the future, but large structural changes distort that outcome as well.

Gupshup

Macro

India's economic growth decelerated to 5.4% in the July-September quarter, the slowest in seven quarters and well below forecasts, as weaker manufacturing and consumption weighed on output. The slowdown is likely to increase pressure on the central bank to consider rate cuts.

The Indian rupee saw its steepest monthly drop since March, slipping nearly 0.5% in November as Donald Trump's U.S. election victory strengthened the dollar and triggered persistent foreign outflows. Rising U.S. bond yields and a $1.7 billion selloff in Indian assets further pressured the currency.

India's infrastructure output grew 3.1% year-on-year in October, driven by gains in coal and refinery products, marking an improvement from September's 2.4% growth. However, crude oil and natural gas production continued to decline, weighing on overall performance.

Indian banks saw loan growth slow to 12.8% year-on-year in October, down from 15.4% a year ago, as the Reserve Bank of India's tightened norms curbed unsecured lending. Growth in personal loans and credit card debt also eased sharply, reflecting rising defaults and regulatory action.

India's fiscal deficit for April to October reached $88.8 billion (₹7.5 trillion), or 46.5% of the full-year target, with net tax receipts at 51% of the annual estimate. Government spending was slightly higher than the previous year, though capital expenditure lagged at 42% of its target.

Equities

Adani Group's CFO denied U.S. allegations of a $265 million bribery scheme involving its executives, including Chairman Gautam Adani, while the Indian government stated it has not received any official request on the matter.

India is set to broaden EV manufacturing incentives to include automakers using existing plants, shifting focus after Tesla declined to set up local production. The revised policy aims to attract broader EV investment and is expected to be finalized by March 2025.

Alts

Blackstone continues investment into India with a new $5 billion (₹422.5 billion) hospital deal to create one of India’s largest hospital chains. There will be more than 10,000 beds from the onset and Blackstone will be a 31% owner of the conglomerate.

India continues to use currency derivatives to intervene against the dollar now and into the future. The non-deliverable forwards market allows India to intervene overseas as well against the dollar at spot rates and future rates as well. Traders found that India’s positioning is short USDINR NDFs at $60 billion (₹5.04 trillion) which is triple the size it has ever been.

German auto parts manufacturer Mahle GmbH is exploring an IPO for its Indian unit, potentially aiming for a $1 billion valuation, according to insiders. Early discussions with advisers suggest the offering could raise up to $400 million, though plans are still in preliminary stages.

Adani Green Energy Ltd. plans to revisit its shelved $600 million dollar bond between April and June 2025, according to CFO Jugeshinder Singh. The company also aims to raise up to $500 million offshore by February through banks or private placements, despite recent turbulence surrounding the Adani Group.

Policy

India’s central bank devolved 70% of a new 10-year green bond on primary dealers, as market participants sought yields beyond the Reserve Bank of India's acceptable range. The bonds, sold at a 6.79% coupon, marked the first development since February 2023.

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 84.56 Indian Rupee