Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we’re discussing brewing tensions between India and Pakistan.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

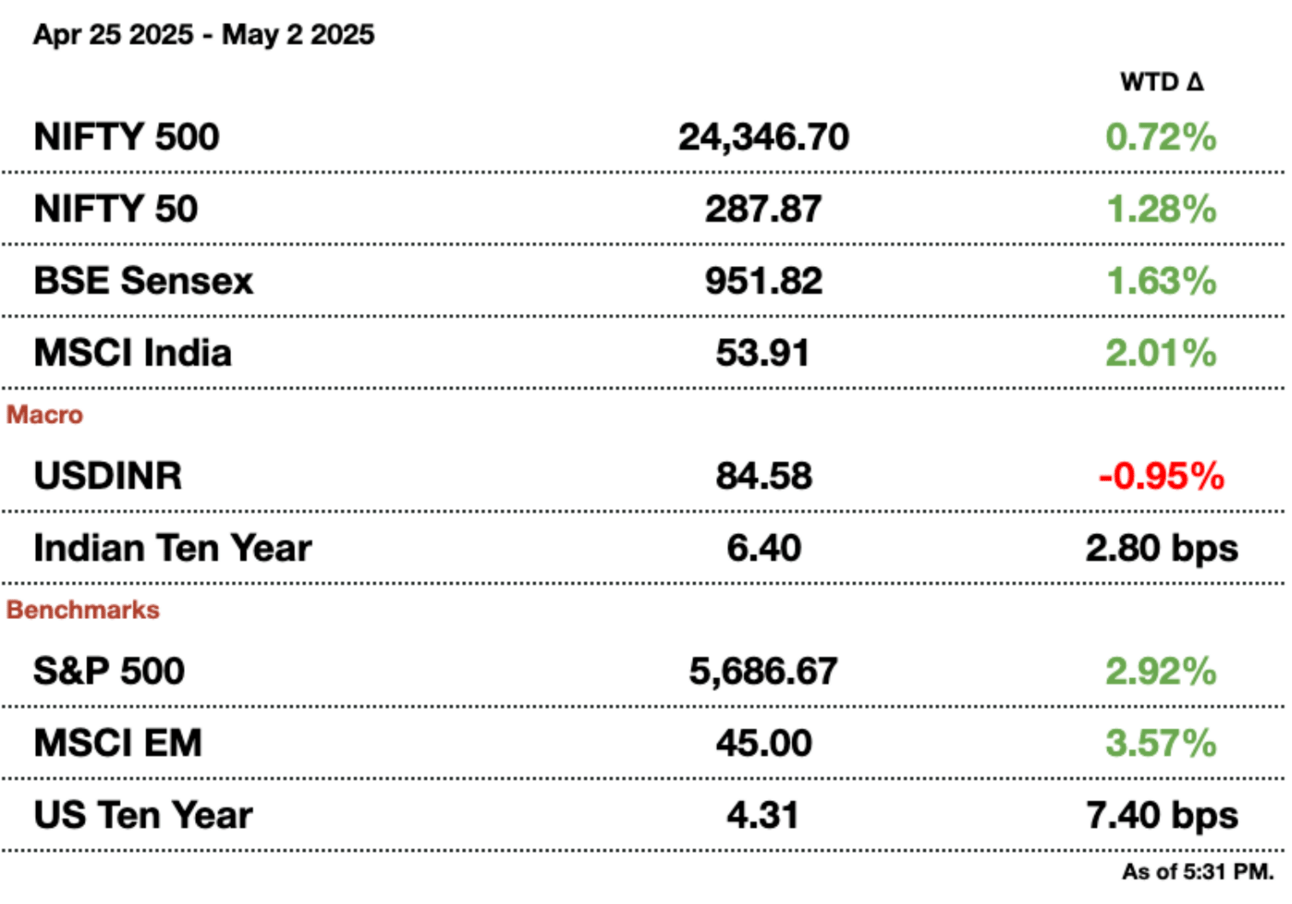

Market Update.

India and Pakistan.

Since the April 14 terrorist attacks in Kashmir, India and Pakistan have exchanged fire along the Line of Control, expelled diplomats, closed border crossings, and suspended bilateral trade. All of these steps will remind readers of 2019, when India commenced air strikes on Balakot. Of course, the conflict in 2019 ended there. Yet this time, the geopolitical stakes and domestic politics on both sides make de-escalation far from assured. Modi has staked his legacy on “normalizing” Kashmir after revoking its special status in 2019, investing $36 billion (₹3 trillion) in infrastructure and deploying an extra division of troops to suppress insurgency. His dramatic abrogation of the 1960 Indus Waters Treaty, a unilateral move without precedent in the bilateral water-sharing pact’s six-decade history, signals that Modi feels compelled to translate rhetoric into tangible costs for Pakistan.

Troops along the India-Pakistan border

Military Action

On Pakistan’s side, its military chief’s recent warning that Indian retaliation could materialize within the week underscores Islamabad’s belief that conventional deterrence thresholds have shifted. Since 2019, Pakistan’s defense budget has climbed 35 percent in real terms — surpassing $14 billion (₹1.2 trillion) this fiscal year — as it deepens strategic dependence on Chinese platforms: the JF-17 Block III fighters, Type-054A/P frigates, and HQ-16 air-defense batteries now form the backbone of its three services. Yet Beijing’s own frustration over repeated militant attacks on CPEC infrastructure and its broader calculus in the Indo-Pacific may limit China’s willingness to absorb instability on its western flank.

India’s broader security focus has likewise pivoted toward China since the 2020 Galwan clash: defense outlays have risen to 2.4 percent of GDP, and last year’s draconian “tactical disengagement” agreements along the LAC have yet to fully demilitarize high-altitude standoffs. Against this backdrop, a calibrated strike on Pakistani military installations in Azad Kashmir could serve a dual purpose. India could punish Islamabad for perceived state sponsorship of terrorism and demonstrate to Beijing India’s capacity for a two-front deterrent. Data from the Stockholm International Peace Research Institute shows India’s army modernization index improving by 20 percent since 2019, driven largely by the induction of S-400 air-defense systems, Apache helicopters, and upgraded T-90 tanks—platforms that would feature prominently in any cross-border raid.

With direct military and diplomatic backchannels almost nonexistent due to Pakistan’s withdrawal from the Corps Commander talks in 2021 and New Delhi’s freezing of the NSA dialogue, the risk of miscalculation has never been higher. In 2019, both sides were able to step back after India’s Mirage-2000 strike on Balakot and Pakistan’s retaliatory F-16 flight, in part because pre-established crisis-management protocols were still partially intact. Today, Pakistan’s pivot toward China and its cooling ties with the United States leave fewer moderating voices close to Pakistani General Asim Munir, while India’s deepening security partnership with Washington emboldens a hardline posture.

Washington’s role will be pivotal. Despite Trump’s overtures to mediate and Vance’s public expressions of support for India’s counterterrorism imperatives, the US may calculate that a limited Indian volley rather than war better serves its Indo-Pacific strategy of containing Beijing. Covertly sharing real-time ISR feeds and enforcing no-spillover assurances via diplomatic channels could help New Delhi calibrate strike options for minimal escalation. Simultaneously, conditional offers of a fast-track US-India trade and investment pact, which could be suspended until hostilities cool, would reinforce to Modi that economic gains hinge on strategic restraint.

Islamabad’s role: The goal should be discreet military‐to‐military lines via the US Central Command or Shanghai Cooperation Organization to restore dialogue on de-escalatory measures. Islamabad’s request for US mediation on mineral investments offers a diplomatic lever: linking prospective $10 billion (₹845 billion) agreements to Pakistan’s commitment to avoid cross-border infiltration could realign incentives. Likewise, China’s envoys could pressure Pakistan on the same basis, emphasizing that regional stability is essential for Belt and Road corridors.

Water Treaties

The IWT itself governs water usage in the Indus River Basin, slicing across the border drawn in 1947. The six tributaries built out by the British to irrigate Punjab and Sindh now flow from their Himalayan headwaters in India through contested Jammu and Kashmir into Pakistan. The World Bank mediated the treaty to avert just such a water war, allotting control of the three Eastern rivers (Ravi, Beas, Sutlej) to India and the three Western rivers (Indus main stem, Jhelum, Chenab) to Pakistan. Despite its cooperative veneer, the IWT functions more as a divorce settlement than a shared-use pact, granting India only 3.6 million acre-feet of storage on the Western rivers strictly for “run-of-the-river” hydropower, and requiring unfettered downstream flows of roughly 182 km³ per year.

Over three-quarters of Pakistan’s renewable water comes from upstream, nearly all from the Indus system, while agriculture employs two-thirds of rural households, contributes 22.9 percent of GDP, and 24.4 percent of exports. Its nine major hydroelectric plants on the Indus generate one-fifth of the national electricity. Yet combined reservoir capacity across the basin holds less than 10 percent of annual flows, leaving Pakistan with a scant buffer against either flood pulses or foregone monsoon replenishment. Any curtailment of Indian data sharing already hampers downstream water management, heightening Pakistan’s exposure to both water stress and disaster.

Can India cut off the flow? In the near term, no. The IWT’s technical annexes deliberately limit Indian infrastructure on the Western rivers to small diversion weirs and powerhouses without large reservoirs. Even the hydropower projects under construction will at best marginally boost India’s ability to modulate flows, and not before 2032. Building new large-scale dams or diversion canals outside the treaty’s strictures would take many years, involve enormous sunk capital and environmental trade-offs, and still require water releases through turbines to generate power. Proposals to flush sediments or manipulate gate operations risk damaging both Indian and Pakistani water users alike and could backfire politically and hydrologically.

Broader fallout: New Delhi’s suspension of the IWT shatters a cornerstone of bilateral confidence and invites Islamabad to consider asymmetric retaliation by targeting Indian power grids fed by shared rivers, or amplifying militant incursions to ensure international attention. Furthermore, Bangladesh and Nepal, which also rely heavily on transboundary rivers controlled by India, will watch with alarm. If Delhi is abandoning historic treaties with Pakistan, what does that mean for other countries?

Finally, India itself is downstream from China on the Sutlej and Indus main stem, as well as the Brahmaputra, where Beijing has built massive dams and no treaty constrains its upstream projects. By weaponizing water against Pakistan, India may be setting a precedent that Beijing could reciprocate against Indian water users, thereby turning a diplomatic lever into a potential liability.

Endgame: Even if both capitals tentatively agree to limit retaliation to surgical strikes in Pakistan-administered Kashmir, the underlying rivalries over water, Kashmir, and power remain unresolved. While there is a lot of similarity between 2019 and now, the risk of unintended escalation is far higher given Washington and Beijing’s great influence. Add in military modernization, fractured communication channels, and the most gruesome terrorist attack since 2019, and the odds of escalation rise dramatically.

—

Next Friday, we’ll break down which specific stocks in the pharma industry are catching our attention.

Want to reach our audience?

Email [email protected] to sponsor the next newsletter.

Gupshup.

Macro

The RBI favors extended hours for foreign bond traders. Since India is joining global bond indices, it makes more sense for market hours to expand beyond the 4 pm local closing time. The deals can happen up to 11 pm (if new legislation passes,) and trades would have to be reported to clearing houses before market hours the next day. Such trades would be settled on a T+2 basis.

Traders are looking for the rupee, pharma, automobiles, and textiles with trade. All of those asset classes will see massive reverberations due to tariff and trade deal negotiations. The rupee is fairly obvious, but others depend on industry. Automakers, generic drugs, and textile producers could also see increased or reduced demand based on how tariff negotiations unfold.

Indian bonds have their worst outflow since the JPM index inclusion back in June. Aggregate holdings of bonds by foreigners dropped by $1.3 billion (₹111 billion), which is likely due to profit booking from a huge rally in the rupee and domestic debt. Flows into local bonds will likely stay steady due to overperformance from Indian assets.

Equities

JSW Steel's acquisition of Bhushan Power has been overturned. Bhushan was debt-laden and undergoing bankruptcy processes 4 years ago, when JSW offered to buy it. A debt resolution process did not conform to ongoing bankruptcy law and is ordering JSW to liquidate it. Bizarrely, even though the acquisition did not close, JSW counted Bhushan as a subsidiary and gained 65 percent more steel capacity from the company.

Oyo Hotels is postponing its third IPO attempt after Softbank balked at the deal. Softbank is demanding stronger earnings before an IPO; the large investor’s refusal to go ahead would cause major investors to balk if the CEO went for it anyway. The company is looking for a $7 billion (₹591.5 billion) valuation. The issue for CEO Agarwal is that an IPO is tied to a restructured $2.2 billion (₹185.9 billion) loan he took out, which would have extended terms given an IPO.

Vedanta could IPO its Zambian copper subsidiary to fund a $1 billion (₹84.5 billion) investment. The investment is to buy the Zambian assets back up since the country forced Vedanta to take it back after it sold that Zambian unit. The reason is that Vedanta underpaid taxes and lied about expansion plans.

Alts

India's ghost roads and airports mimic China with city planning issues. Big-ticket infrastructure projects keep stalling or fizzling out with little to no demand. China has experienced a similar issue with overleveraged house developers who have built ghost cities due to too much infrastructure too quickly. Aviation development in particular has been disastrous; elected officials like building airports due to the grandeur rather than the actual use case.

Adani Ports is pushing globally with South African ports. Adani’s big goal is for 15 percent of revenue to be from global sources, which would require a doubling from current levels. The planned South African investment coincides with the country’s efforts to fix its dilapidated rail and port network.

Policy

Vance is working to ensure that India-Pakistan tensions thaw. He and other US officials have been in contact with Pakistani and Indian leadership to ensure that India responds in such a way that does not start a global conflict. At the same time, the US wants Pakistan to work with India to apprehend the terrorists or surveil potential perpetrators.

Adani is blessed by Modi to continue expanding its mega Indian port in Kerala. The Viszhinjam terminal will have 5 million TEUs of capacity by 2028. The endorsement from the PM comes at a time when Adani is still in indictment worries with US authorities. The terminal is likely to get another $1.1 billion (₹95 billion) in funding, with investment across all phases to be $2.1 billion (₹180 billion).

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.