There are days when weeks happen, and weeks when days happen. The last 24 hours have certainly been the former. We’ll explain the United States’ justification for 25 percent tariffs on India starting tomorrow, if there is truth to their claims, how the U.S. is pushing India closer to China, and how India plans to respond.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

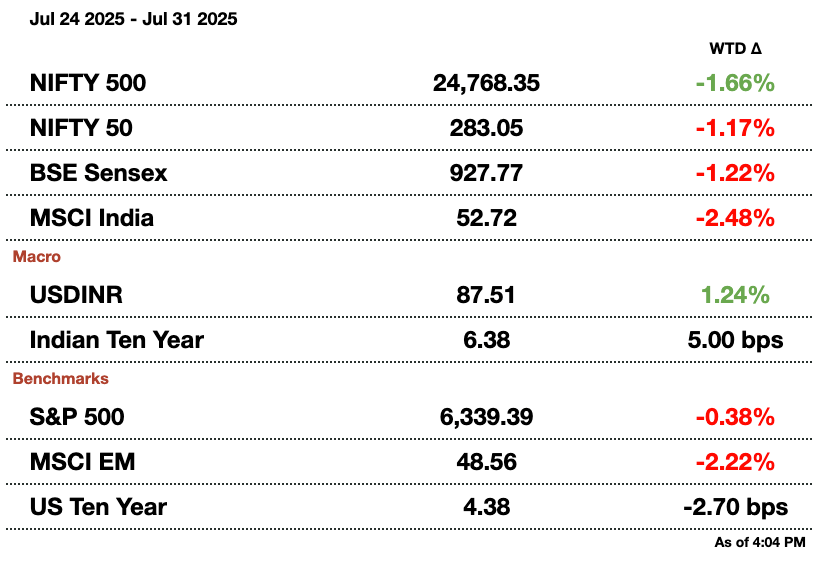

Macro

Trump’s surprise 25 percent tariff on Indian goods sent the rupee near a record low of 87.74 and dragged equity indices down 0.6 percent, with analysts warning it could shave up to 40 bps off India’s 2025–26 growth and delay investment decisions. While exports to the U.S. make up just 2–3 percent of India’s GDP, the move raises uncertainty over trade, currency stability, and manufacturing ambitions.

India’s state-run refiners, which control over 60 percent of the country’s 5.2 million bpd capacity, paused Russian oil purchases this week as discounts shrank and Trump threatened 100 percent tariffs on buyers of Russian crude.

Equities

Trump’s 25 percent tariff on Indian goods is unlikely to disrupt Apple’s iPhone production in India, which now supplies 71 percent of U.S. iPhones—up from 31 percent last year—as Apple shifts away from China. Despite higher costs, India remains key to Apple’s strategy due to lower wages, local incentives, and supply chain resilience.

Swiggy's quarterly loss nearly doubled to $137 million (₹11.97 billion) as marketing and expansion costs surged, despite a 54 percent revenue jump to $567 million (₹49.61 billion) and 108 percent growth in Instamart's order value. Total expenses rose 60 percent, driven by intensified competition and investments in quick commerce.

India’s PB Fintech reported a 40 percent jump in quarterly profit to $9.7 million (₹846 million) as rising demand for digital insurance, especially health policies, boosted revenue 33 percent to $154 million (₹13.48 billion).

India’s R R Kabel posted a 39.4 percent rise in Q1 profit to $10.25 million (₹898 million), driven by a 16 percent sales increase in its wires and cables segment, supported by strong domestic and export demand.

Coal India’s Q1 profit fell 20 percent to $998 million (₹87.43 billion) as weaker power demand led to lower shipments and prices, with revenue dropping 4.4 percent to $4.1 billion (₹358.42 billion) amid a nearly 3 percent decline in coal-fired power generation.

India’s TeamLease Services reported a 27.6 percent rise in Q1 profit to $3.03 million (₹265.4 million), driven by higher demand in general staffing (up 11 percent) and specialized staffing (up 22 percent), despite challenges from hiring freezes in banking and tech sectors.

India’s Mankind Pharma reported an 18 percent decline in Q1 profit to $50 million (₹4.38 billion rupees) as a 35 percent rise in expenses outpaced a 24.5 percent revenue increase, driven by strong domestic demand for chronic disease medications.

India’s Adani Enterprises reported a first-quarter net profit drop to $84 million (₹7.34 billion rupees) from ₹14.55 billion, driven by a 27 percent decline in coal trading revenue amid weaker coal-fired power demand and lower overall electricity output. Its clean energy segment also saw an 11 percent revenue fall, with pre-tax profits down 34 percent, contributing to a 4 percent fall in the company’s shares post-results.

Alts

Over 300 sacred gems linked to Buddha’s remains, dating back to 240–200 BCE, were returned to India after 127 years following government pressure that halted a planned Sotheby’s auction. The gems, repatriated through a sale to Godrej Industries, will now be publicly displayed.

India’s garment and jewellery exporters, heavily reliant on the U.S. market—which accounted for nearly $22 billion in exports in 2024—face a sharp decline in orders and potential job cuts after President Trump imposed a 25 percent tariff on Indian imports, raising concerns that buyers may shift to lower-tariff countries like Vietnam.

Policy

India vowed to shield its farmers as Trump’s 25 percent tariff threat sparked political backlash, market dips, and concerns over stalled trade talks and economic growth.

India’s markets regulator SEBI has proposed revising IPO rules for large offerings by reducing retail investor allocation from 35 percent to 25 percent and raising institutional buyer allocation from 50 percent to 60 percent, while also expanding anchor investor categories to include insurance companies and pension funds; public feedback is open until August 21.

1. The Trade Update

The U.S. government has imposed a 25 percent tariff on Indian goods starting tomorrow (August 1), citing a range of "strenuous and obnoxious" non-tariff barriers that it says unfairly restrict American businesses’ access to India’s market. According to a March report from the U.S. Trade Representative, India limits imports of key products like pulses, laptops, and tablets through quantitative caps and licensing rules designed to protect domestic manufacturing. Additionally, India’s tightened quality-control standards across sectors such as chemicals, medical devices, and electronics are often misaligned with global norms, creating further hurdles for exporters. The U.S. also points to India’s restrictive certification requirements for dairy products, which clash with its religious customs but limit U.S. dairy exports. Furthermore, India’s data privacy laws and IT regulations impose strict compliance demands and grant the government broad control over cross-border data flows, creating challenges for American tech companies. Other complaints include burdensome customs valuation practices and limits on foreign investment in Indian banks and insurers, which constrain U.S. firms’ growth. These cumulative barriers have led the U.S. to enact tariffs as leverage in ongoing trade negotiations with India.

While a 25 percent tariff is quite a penalty, there is truth to the United States’ criticism of India’s anti-trade practices. India maintains some of the highest tariffs among major economies, especially on agricultural and dairy products, along with stringent import licensing rules that limit U.S. market access. Non-tariff barriers are widespread, including opaque and frequently changing standards in sectors such as electronics, medical devices, and pharmaceuticals, often misaligned with global norms. These regulations increase costs and uncertainty for foreign exporters.

India also enforces strict data localization and privacy rules, requiring sensitive data to be stored domestically and imposing compliance burdens on U.S. tech firms. Foreign investment in key sectors like banking and insurance faces caps and complex restrictions. Customs procedures are notorious for delays and inconsistent valuation practices, complicating imports further.

While India defends these measures as necessary to protect domestic industries, food security, and jobs, many of the barriers are indeed more stringent or complex than in comparable countries.

President Trump has threatened “secondary tariffs” on India for being a major importer of Russian oil; this week’s 25 percent tariff threat (along with threats of a 100 percent tariff for buying Russian crude) finally pushed India to pause Russian oil purchases.

2. Trump Pushes India to China

India’s National Security Advisor Ajit Doval (left) meets Chinese foreign minister, Wang Yi (right), in Beijing

As China positions itself as the global beacon of free trade and stability, India seems to be adjusting its regional strategy, marked by several recent high-level visits to Beijing by key officials like National Security Advisor Ajit Doval, Defence Minister Rajnath Singh, and External Affairs Minister Subrahmanyam Jaishankar. While Jaishankar once linked improved ties to restoring the pre-2020 border status, his latest comments suggest a more open stance toward engagement. Prime Minister Narendra Modi is also reportedly planning a trip to China in September, signaling a desire to ease tensions.

This diplomatic outreach comes despite China’s continued support for Pakistan, including sharing intelligence during the May 2025 India-Pakistan conflict. India, however, has directed its criticism solely at Pakistan, avoiding public rebuke of China.

India’s trust in China remains fragile despite recent diplomatic efforts, as major concerns persist: China’s massive $167 billion dam project on the Brahmaputra threatens India’s water security; China’s close military and strategic support to Pakistan, including during India-Pakistan clashes in 2025, fuels distrust; and China’s expanding naval presence in the Indian Ocean raises security alarms. While political dialogue has resumed, deep skepticism among the Indian public about China’s intentions endures, highlighting the challenge of building lasting trust.

3. How India is Responding to Trump

India Commerce Minister Piyush Goyal

Commerce Minister Piyush Goyal strongly defended India’s trade stance in response to Donald Trump’s latest 25 percent tariff announcement, telling Parliament that India “will not compromise” on core national interests—especially the livelihoods of its farmers.

Goyal rejected U.S. pressure to open India’s agriculture and dairy markets, citing the vulnerability of millions of subsistence farmers. “We have consistently protected farmers’ welfare and food security,” he said, noting that India has kept these sectors out of recent trade agreements, including the one with the UK.

While emphasizing India’s openness to trade, Goyal highlighted that India had already signed balanced deals with the UAE, UK, Australia, and EFTA nations despite rising global protectionism. Ongoing talks are underway with several other countries.

Goyal also hit back at Trump’s characterization of India and Russia as “dead economies,” pointing out that India is the fastest-growing major economy in the world. “We are contributing nearly 16 percent to global growth,” he said, citing Make in India, export incentives, and infrastructure as drivers of the country’s manufacturing resurgence.

Responding to concerns about Trump’s rhetoric and tariffs, Goyal reassured stakeholders that the government was conducting consultations and carefully examining implications for Indian exporters. He promised that the government would continue supporting MSMEs, workers, and entrepreneurs against any disruptive external shocks. “India is open for business, but on fair terms,” Goyal stated, underscoring that trade policy will remain rooted in national interest, not foreign pressure.

Specific policy proposals to shield the country from Trump’s tariffs—unless they are paused, as they have been for Mexico already—are still to be announced.

How would you rate today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.