Today, trade negotiators from India and the EU quietly conceded that a long-promised free trade agreement will not be wrapped up by the end of the year. Here’s what this means for India’s economy.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

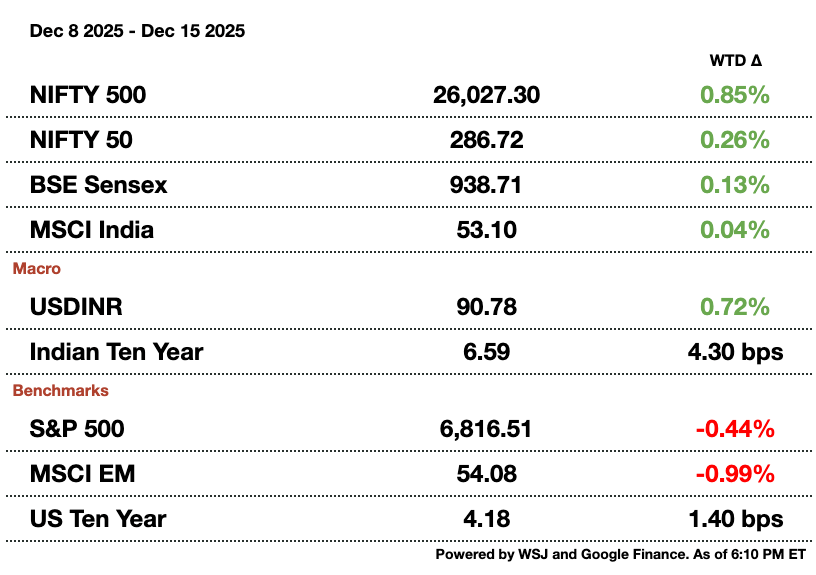

Macro

The RBI is buying $5.5 billion (₹500 billion) in the first bond auction since May. Maturities were from 2029 to 2050 and yields on the bonds were lower than expected. The move is part of the RBI plan to inject banking liquidity with this and a currency swap of $5 billion (₹453.5 billion).

The MSCI metals index is up 60 percent y-t-d due to supply cuts and demand boosts.This is the sector’s best performance since 2009 and China just announced further steel shipment cuts.

Equities

Stock pickers see Indian equities as a hedge against AI concentration risk. India has low correlation with other markets that are centered around AI companies. While Amazon and Microsoft just pledged $52 billion (₹4.7 trillion) last week for AI, there is a lack of pure-play AI companies based in India. Dominant industries here are pharma, construction, and commerce.

India gets another consecutive year of $20+ billion (₹1.8+ trillion) in IPOs thanks to mutual funds and retail investors. Next year’s juggernauts include Reliance’s Jio (expected to be India’s largest ever IPO) and more international subsidiaries.

Premium alcohol spirit manufacturers are expected to rise in 2026 due to more drinkers in India each year. There are 23 million more young adults each year eligible to drink and locally-made single malt consumption is growing at 25 percent y-o-y. Goa’s climate also allows for whiskey to be brewed 3x faster than in Scotland.

Mutual funds allowing investors to invest across different caps have pulled $5 billion (₹453.5 billion) in 2025.Flexi-cap funds make up 25 percent of all inflows into fund structures. They hold up better in times of large volatility while having flexibility to invest in small caps for higher returns.

Alts

Messi's tour in India starts with fans rushing the pitch in anger. Messi is visiting India for 3 days, but fans, citing they could only see him for a few minutes, started ripping up stadiums and were arrested for disorderly conduct.

JP Morgan is continuing its foray into India by opening a 4th commercial banking branch in Pune. The bank will focus on foreign currency transactions, trade finance, and liquidity management; next steps include building out a dedicated network of commercial banks while increasing its investment banking presence as well.

Axis is going to hire 50 private bankers to expand to 52 cities.Axis is focusing on growing wealth management needs in tier 2 cities and beyond. The wealth management industry is going to double its assets to $2.3 trillion (₹208.6 trillion) by 2030 with the growth of millionaires.

Policy

The government continues to curb pollution in Delhi with construction and mining halts, plus advising schools to move classes online. Old diesel and petrol cars have been banned from multiple roads in the old municipality and neighboring cities are being asked to follow suit with these changes. Recent AQI was measured at 550.

SEBI is working on 5 and 10 year cybersecurity roadmaps for major financial institutions.Recent cases of outages at brokers have brightened the spotlight on security risks, causing SEBI to create a panel of experts to mitigate risks in the short and medium term.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

Reach out to [email protected] to reach our audience and see your advertisement here.

The EU, India FTA is Being Quietly Delayed

Trade negotiators from India and the EU quietly conceded that a long-promised free trade agreement will not be wrapped up by the end of the year. Talks are bogged down on a few sensitive issues, particularly automobiles, steel and climate-linked trade rules.

Negotiations are now expected to spill into January, with both sides hoping to announce at least a partial deal when EU President Ursula von der Leyen travels to New Delhi early next year. That would miss the deadline set in February by Modi and von der Leyen to conclude the agreement in 2025, underscoring how difficult the final stretch has become after nearly two decades of on-and-off talks. The renewed urgency behind the deal was driven less by bilateral enthusiasm than by global disruption. Trump, of course, has imposed tariffs on both sides of the globe but particularly India. The EU is racing to diversify trade ties as relations with both the US and China are more strained.

Yet ambition has collided with domestic desires. The EU wants India to expand the quota of roughly 80,000 cars it can export under reduced tariffs, a demand that runs straight into India’s protection of its domestic auto industry. New Delhi is pushing for lower EU duties on certain steel products and greater flexibility around the bloc’s carbon border taxes, which Indian officials argue would penalize developing economies.

Even if a deal emerges, it is likely to be thinner than recent EU trade agreements, reflecting compromises on both scope and timelines. Indian officials insist progress has been made, while EU representatives say technical negotiations remain intense, but neither side is pretending the finish line is close.

The delay also highlights growing nationalism when it comes to deals. The US’s tariff threats have made global trade tighten with each side having more specific demands that are hard to close. America’s own insistence on protecting domestic interests has made other large economies cite the same needs. For India and Europe, the question is no longer whether a deal is desirable, but how much each side is willing to concede to get one done at all.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.