Hello. India’s central bank, the RBI, has a bit of an obsession with the number 84. And no one knows why. We’ll explain, and then go through Gupshup, a round-up of the most important headlines.

BTW: What famous board game originated in India? (Answer at bottom)

Markets

Read here for an appendix on the above.

Eighty-four

Throughout the summer of 2024, the Indian rupee (INR) has danced precariously close to the ₹84-per-dollar exchange rate, but it hasn’t fallen below this level. Analysts believe this isn’t a coincidence. While the Reserve Bank of India (RBI) has not officially confirmed its interventions, market observers suggest the central bank is quietly taking steps to stabilize the rupee and prevent it from slipping past this psychological barrier. But how exactly is the RBI managing this, and why does it matter?

Google Finance

When it comes to defending the rupee, the RBI has several strategies at its disposal. One of the most common methods involves the use of Non-Deliverable Forwards (NDF) markets. In these markets, the RBI can sell dollars and buy rupees without actually taking delivery of the rupees. Instead, the transactions are settled in dollars, allowing the RBI to influence offshore demand for the rupee without significantly impacting the domestic money supply.

This method allows the central bank to strengthen the rupee subtly and avoid drawing too much attention to its actions. While the RBI rarely confirms these interventions, traders have noticed that whenever the rupee flirts with ₹84 per dollar, the currency finds support, suggesting central bank involvement.

Why ₹84? The RBI hasn't explained why 84 is the magic number, but the logic is similar to why the Federal Reserve consistently targets a 2% inflation rate. Deviating from this established norm could unsettle speculators, signaling that the central bank may not uphold its usual policies, which could erode confidence in its commitment to maintaining stable benchmarks. The RBI’s interventions seem designed to prevent the rupee from crossing the ₹84 mark because doing so could trigger a chain reaction of speculative pressure. If the rupee were to fall below ₹84, traders and investors might bet on further depreciation, creating a self-fulfilling prophecy of a sharp and uncontrolled decline.

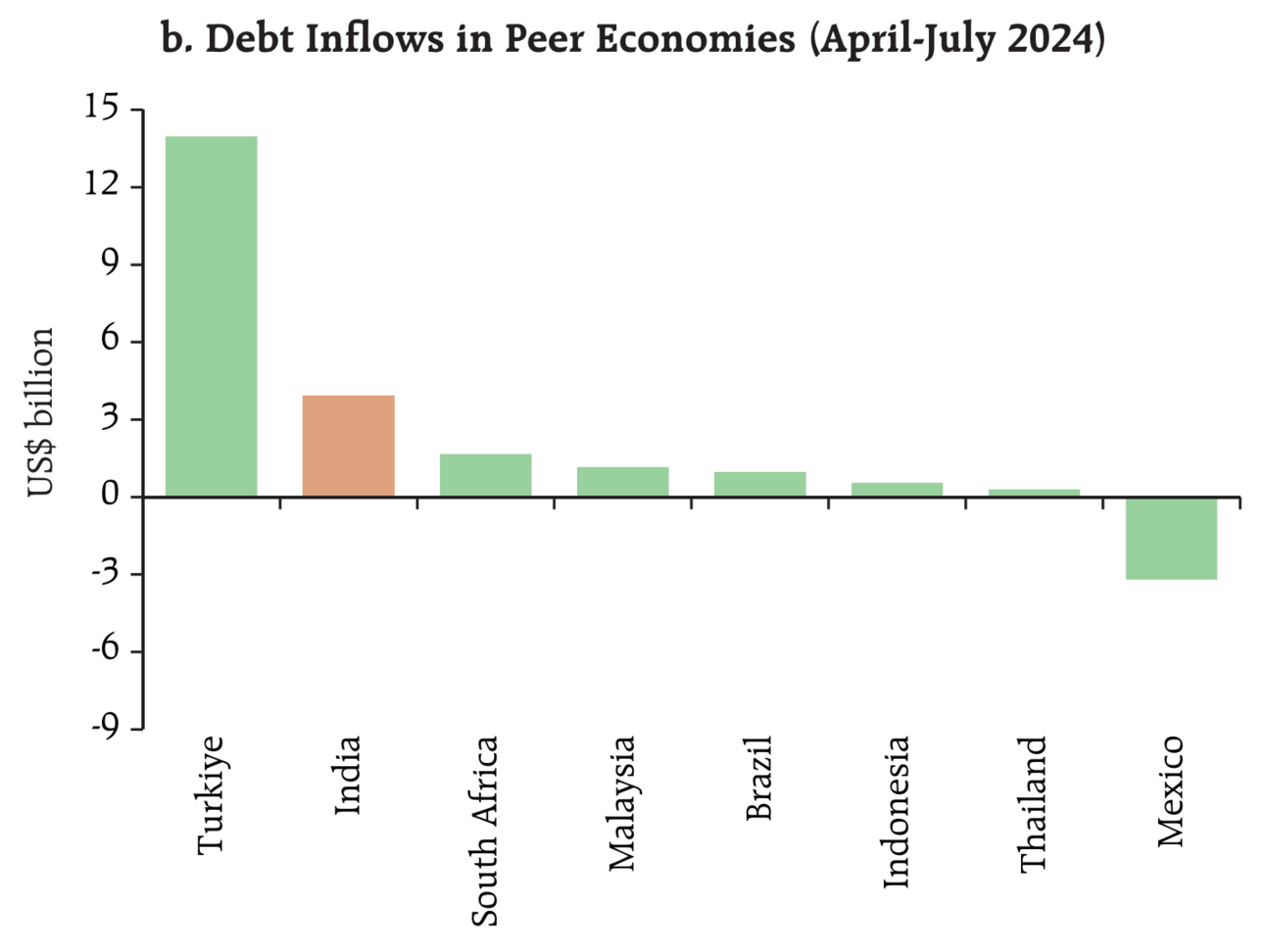

An 84 target also gives investors forward-looking confidence. This is especially important for foreign direct investment (FDI). A stable exchange rate reduces the currency risk for foreign investors, making Indian assets more attractive. This has been crucial in maintaining healthy FDI inflows, which rose to $6.9 billion in the first quarter of 2024-25, up from $4.7 billion a year earlier. In contrast, emerging market countries like Indonesia and Colombia, where currency volatility is higher, struggle to attract consistent long-term investment.

from RBI Bulletin, August 19

from RBI Bulletin, August 19

RBI’s intervention has been successful, making it the most stable currency of its competitors compared to the U.S. dollar.

However, the RBI isn’t trying to halt the rupee’s depreciation entirely. The central bank is focused on allowing the rupee to weaken in a controlled, “orderly manner,” ensuring that it doesn’t lose too much value too quickly. According to VRC Reddy, deputy general manager at Karur Vysya Bank, the RBI’s goal is to allow gradual depreciation while maintaining India’s export competitiveness.

A weaker rupee benefits exporters, particularly in sectors like software and pharmaceuticals, by making Indian goods and services cheaper in global markets. But if the rupee were to depreciate too quickly, it could lead to inflation and erode the purchasing power of Indian consumers, especially when it comes to essential imports like oil.

There’s plenty of demand in the market to push the rupee below ₹84. Foreign exchange traders have commented that there is "sufficient and more" dollar demand to force the rupee lower, yet the RBI remains firm in its defense of this level. This suggests that the central bank is prioritizing stability over market forces, a move that helps shield the Indian economy from the volatility that often plagues other emerging markets.

If the rupee were allowed to fall further, it would not only lead to inflation but could also create panic in the markets. Currency volatility is one of the key factors that deter foreign investors from placing capital in emerging markets, especially those like Indonesia and various parts of Africa, where sharp currency fluctuations are common.

Macro

Ford to use India’s plant for exports even after 2021 exit (BBG)

The US carmaker has sent a Letter of Intent to Tamil Nadu to use the factory for the overseas market

Earlier in 2024, India announced lower import taxes if car manufacturers pledged $500M of investment

RBI signals no policy change despite inflation dip (BBG)

Governor Das is in no hurry to cut rates as inflation being below 4% was more due to base effect

Base effect is the statistical factor of comparing absolute inflation to last year’s to get percent changes

India continues to remove export conditions as inflation eases (Economic Times)

The government has removed a minimum export condition on onions at $550 per MT

Indian forex reserves continue to rise even with interventions (Livemint)

RBI data shows that FX reserves stand at nearly $700B, including pounds, euros, and yen

This does factor in appreciation of various currencies so the effect of adding dollars versus seeing currency appreciation is more difficult to break down

Equities

Hindenburg fires a Swiss shot at Adani (BBG)

The short seller says prosecutors in Switzerland are looking at money laundering, with Adani Group responding to say the allegations are baseless

Nifty surges with global purchases (BBG)

There was a random, one-way surge with global funds entering with $1B of purchases

Indian mutual funds moved into select infra, removed telecom holdings last month (Economic Times)

Alts

India to give Maldives aid as default threat looms (BBG)

The RBI is opening up $400M in a currency swap program to offer the Maldives

This comes as India and China are vying for dominance in that region

US to consider more funding for clean energy sector (BBG)

International Development Finance Corp. considers more deals, with the lender having offered nearly $4B in financing thus far

Ride hailing apps expected to keep growing in popularity (BBG)

Chief Growth Officer Kanv Garg at BluSmart is seeing heavy growth in ride-sharing

Each marginal 2.5M trips takes about 3 months or less for most ride-sharing service providers

Politics

Biden to host Quad Summit in Delaware, September 21st (BBG)

The Quad is the US’s deterrent to China (Australia, India, and Japan)

This will be President Biden and Japanese Prime Minister Kishida’s last Quad Summit

SEBI chair Buch rebukes impropriety allegations (BBG)

Buch termed the allegations against her and her husband as “false, malicious, and motivated”

The couple also said that Buch has not dealt with any financial holding file since taking her post

SEBI drops case against NSE in the co-location case citing insufficient evidence (Economic Times)

3 whistleblowers complained to SEBI that some brokers got early preference on NSE servers

The People’s Democratic Party in Kashmir and Jammu is not open to working with the BJP (BBG)

The PDP was once a Modi ally but is now looking to block the BJP from building a local coalition

The PDP hopes to emerge as a “king-maker” in what is expected to be a fractured election

Modi’s rival freed on bail 6 months post-arrest (BBG)

India’s top court granted bail to Delhi’s Chief Minister Arvind Kejriwal after he was arrested for alleged kickbacks received in a now-scrapped liquor policy

Oh, and chess is the most famous board game to have been invented in India during the 6th century Gupta dynasty.

See you next week.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 83.88 Indian Rupee