Hello. Happy Friday, and Happy Diwali! We’ll examine how Diwali impacted Indian markets and look at new regulations put forth by India’s securities regulator. Then, we’ll close with Gupshup, a round-up of the most important headlines.

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends. Scroll to the bottom for your personal referral link.

BTW: How many fireworks are used globally for Diwali celebrations? (Answer at bottom)

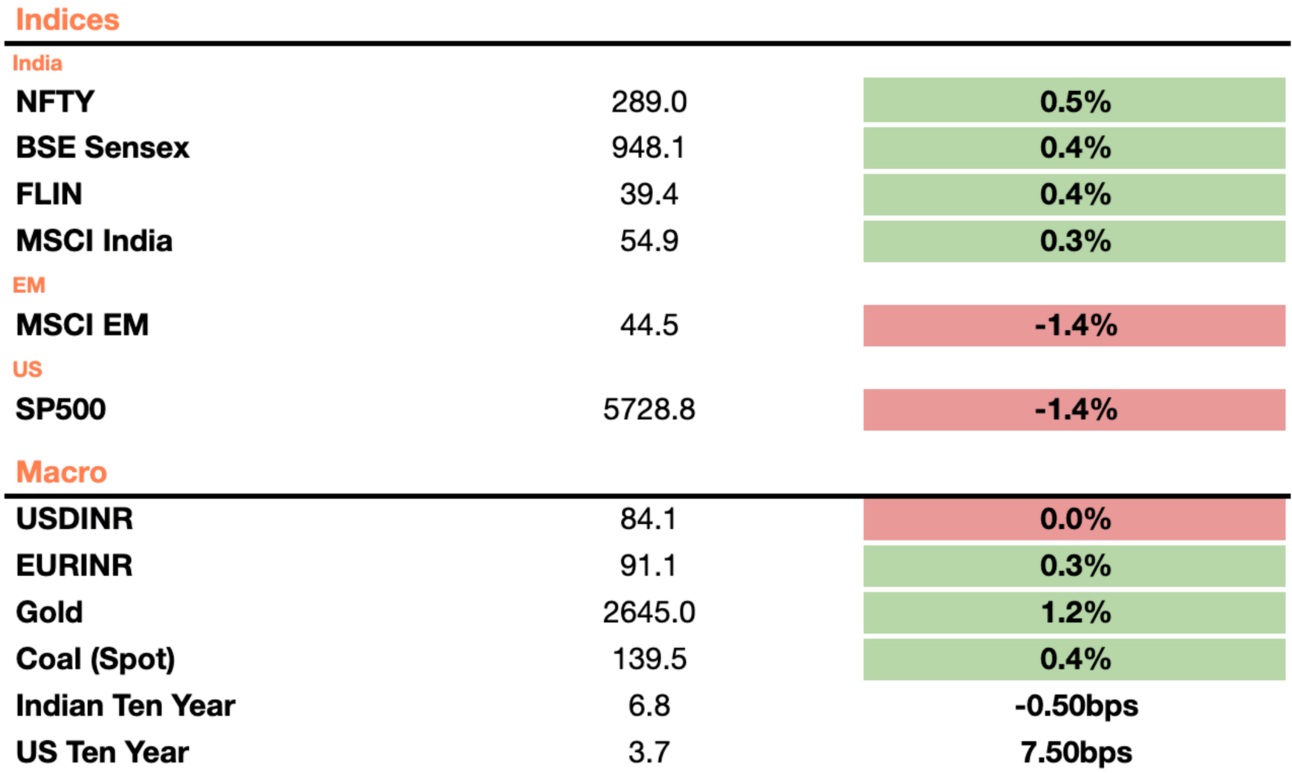

Markets

Read here for an appendix on the above.

Analysis

Markets Rally During Diwali Trading

Indian markets saw an uplift in a special Diwali trading session, known as Muhurat trading, with the NSE Nifty 50 rising by 0.4 percent. Muhurat Trading is a special one-hour trading event that took place on Friday, November 1, at 6:00 PM Indian time.

Key players like Mahindra & Mahindra, Reliance Industries, and Axis Bank led the charge, fueled by a rally in U.S. stocks, which had climbed on the back of strong October job numbers and rising hopes for more rate cuts. This annual ceremonial session, timed with the Hindu festival of lights, is seen as an auspicious moment for new investments and typically draws in both institutional and retail investors eager to set the tone for the coming year.

The session continued a familiar trend, with Diwali day trades reflecting gains in eight of the last ten years and a cumulative 24 percent rise since last year’s celebration. Small and mid-cap stocks outperformed large-caps, with the Nifty Smallcap 250 index posting a notable 1.1 percent gain, underscoring continued investor confidence in India’s broader market despite recent setbacks.

While the festivities brought a positive note to Indian equities, the overall market faced headwinds in October. Heavy selling by foreign portfolio investors, who withdrew $10 billion on concerns over slowing economic growth and a tilt towards Chinese markets.

Explainer

SEBI (Finally) Bans Insider Trading For Mutual Funds

Starting today, India’s market regulator, the Securities and Exchange Board of India (SEBI), is enforcing a landmark update to insider trading laws that, for the first time, explicitly bans mutual funds from engaging in insider trading. Despite explosive growth in the mutual fund sector—up sevenfold from $114 billion in 2014 to $799 billion now—such restrictions had not previously applied to these investment vehicles. The updated regulation reflects a heightened focus on market integrity as mutual funds increasingly influence price movements.

Separately, SEBI also rolled out new guideline proposals to streamline deployment times for new funds launched by asset management companies, aiming to enhance transparency and operational efficiency in fund launches. Currently, there is no prescribed timeline for asset managers to deploy new money raised through a new fund. This absence of a structured framework means asset managers can hold on to an investor’s money for prolonged periods of time, creating uncertainty for investors. SEBI is accepting discourse and disagreements from the private sector by November 20th on this proposed guideline and is fast-tracking its implementation.

Both regulations aim to bring more trust and transparency into the burgeoning asset class, further promoting it as a safe place for Indian retail and institutional investors to store their money.

Insider trading guidelines:

Asset management companies have to disclose key persons, families, trustees, holdings, and more, every quarter. Senior personnel at such companies will now be prohibited from selling their holdings if they are believed to have insider information.

SEBI has expanded the meaning of “connected persons” while explicitly prohibiting profiting from insider information.

Implementing timelines for new funds (proposed):

Asset managers must deploy capital raised in new funds within 30 days, with a 30-day extension potentially allowed for special circumstances

Income raised from temporarily putting money in money market funds, government securities, or tri-party repos, must be passed along to the investor

Macro

Emerging markets cap off a turbulent month heading into the US election. The MSCI closed 4 percent down for the month and all major EM currencies are down against the dollar as well. EM markets have been shaken with losses due to the underperformance of individual companies, increased volatility, and investors debating on different outcomes of the election. Higher US yields have also led to investors being scared off. (Mint)

Several large corporations have started to flag softer demand growth, particularly among urban middle-class spenders. Seven of the largest Indian companies (all in consumer retail) flagged softer consumption demand than last year, pointing to post-pandemic savings running out, interest rates remaining high, and job prospects remaining low. While rural consumers are showing increased spending due to good monsoon seasons, it hardly compensates for revenue losses from decreased spending from the 500 million Indians living in urban areas. (BBG)

Equities

Stocks rise during the Diwali trading session, following the pattern of the last 8 Diwali trading days. Diwali day sessions, known as Muhurat, have climbed in 8 out of the last 10 years. Part of this comes from large caps advancing such as Reliance, Mahindra, and Axis Bank but October NFPs boosted chances of a US rate cut which was also bullish. (Reuters)

Alts

Ghana bets that Ambani-backed 5G firms will cut broadband costs. NextGen Infra is going to roll out its first 5G network today, according to the Ghana’s Minister of Communications. This comes after Ambani’s Jio began expanding telecom services across India in 2016. Meanwhile, Ghana, emerging from a debt crisis, is increasingly dependent on private investment for economic recovery. (BBG)

Fabricio Bloisi, the investor who made 3,700 percent on Tencent, sets his eyes on India. Bloisi believes that India will generate the next huge AI opportunity for the firm. (BBG)

Policy

After the Canadian government accused top Indian minister Amit Shah of masterminding a violent attack on Canadian soil, immigration between the two countries is expected to decrease. Canadian intelligence believes India will increase cyber warfare against Canada. As of now, though diplomatic relations between the countries are frozen, trade relations remain strong. (Reuters)

Oh, and around 50,000 tons of fireworks are set off around the world in celebration of Diwali.

See you Monday.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 84.09 Indian Rupee