Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we’re discussing

Demand for cars shows signs of slowing,

Air India asks the Indian government for a subsidy after Pakistan shuts down air space,

and, Adani presses pause on $10 billion (₹845 billion) semiconductor partnership.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

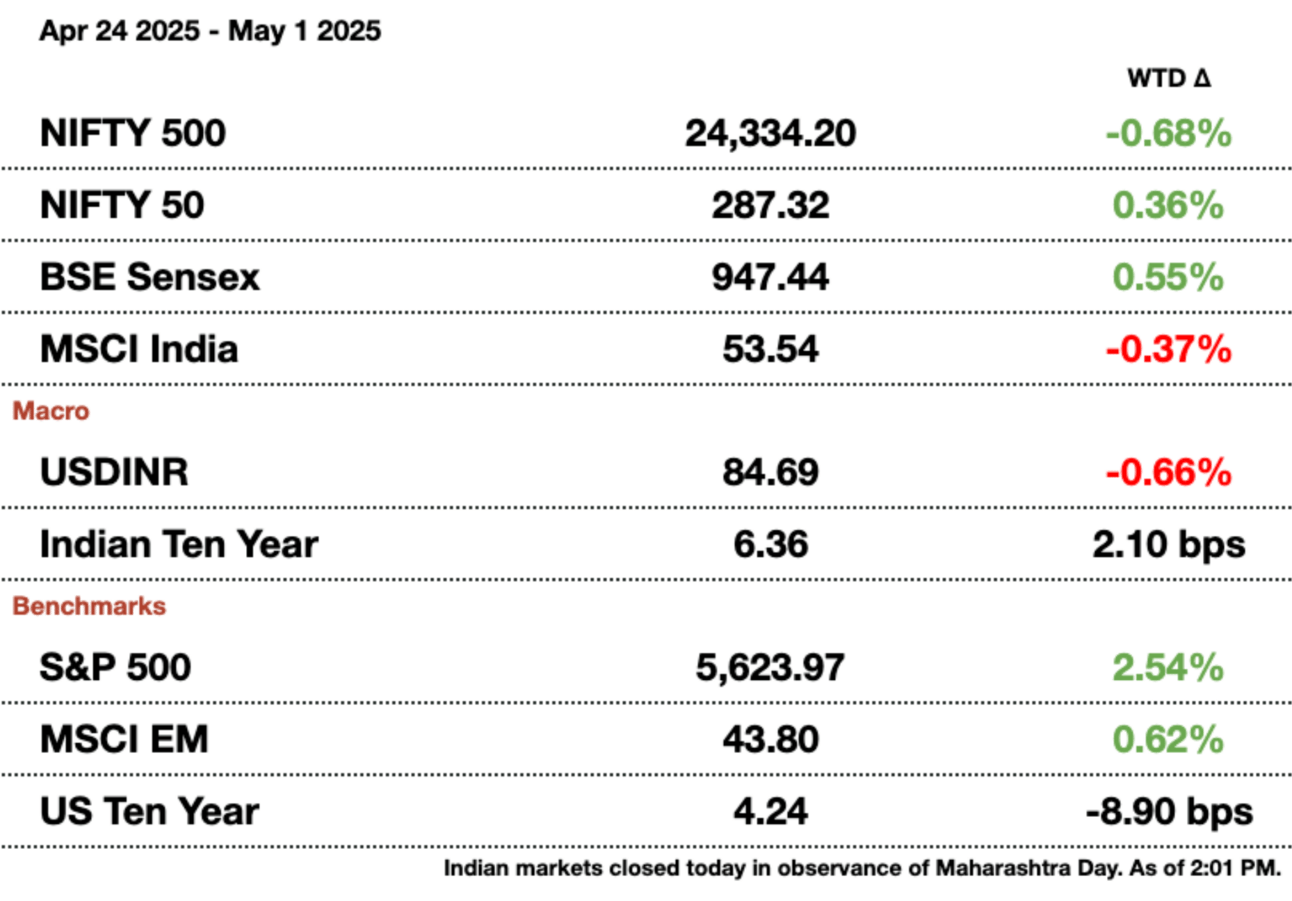

Market Update.

Demand for Cars Slumps.

Despite a record 4.3 million passenger vehicles sold in FY24, April’s plateau of 1.4 percent aggregated growth across the top four OEMs (original equipment manufacturers) illustrates the fade of post-pandemic pent-up demand. Industry forecasters now project a modest 1–2 percent volume uptick in FY25, contingent on rate cuts penciled in for June or September and potential personal-income-tax relief in the July budget. For the next four months, automakers and dealers are braced for continued buyer deferment while they recalibrate financing deals, channel incentives, and fresh launches to reignite consumer interest.

Specific OEMs: Maruti Suzuki’s marginal 0.6 percent dealer‐level sales growth in April underscores its resilience amid a broader market slowdown, driven by sustained demand for its midsize SUVs and steady fleet bookings that account for roughly 30 percent of its dispatches. Maruti’s extensive network and competitive financing schemes have also insulated it, even as financing costs edge higher: retail vehicle loans now command an average increase of 5–8 percent y-o-y as rates rose by 50 basis points since 2024.

Hyundai Motor India’s 11.6 percent decline reflects not only the absence of fresh model introductions but also supply constraints on in-demand variants amid a global semiconductor crunch. Two-thirds of Hyundai’s sales derive from SUVs and crossovers; without new facelifts or electrified powertrains to lure buyers, its showroom footfalls have shrunk 8 percent m-o-m. Hyundai’s planned EV launches in Q3 may help arrest the slide, but electrification incentives under the FAME II scheme taper off for mid-sized EVs, potentially limiting their appeal compared to lower-cost options.

Tata Motors’ 5.1 percent sales decline signals a more mixed picture: smaller cars are selling at near-capacity rates, while larger SUVs have seen inventory build-ups of 15–20 days, suggesting consumer caution on larger, higher-ticket SUVs amidst inflationary pressures. Tata’s recent price hikes limited steel and electronic costs with a raise of $400 (₹30,000) but may have further dampened demand.

In sharp contrast, Mahindra & Mahindra’s 27.6 percent surge confirms the enduring strength of its XUV300 and five-door Thar, which together have commanded 35 percent share of its monthly SUV sales. Aggressive whole-life EMI offers, extending loan tenures from 60 to 84 months, and an expanded urban SUV showroom footprint have propelled Mahindra ahead of both Hyundai and Tata in April.

Smaller players are also gaining ground: Toyota sales jumped 32.8 percent, buoyed by rising business-class and government tenders. Kia India added 18.3 percent from recalibrated pricing and feature upgrades — key for retaining share in the $18,000 (₹1.5 million) mass-market SUV segment.

Air India Asks for a Subsidy Amid Growing Border Tensions.

Air India’s April request for a subsidy from New Delhi underscores the severe financial pain inflicted by Pakistan’s sudden airspace closure. The carrier projects over $600 million (₹50 billion) in incremental costs if the ban persists, driven primarily by extended routings that add 500–800 nautical miles on Europe-bound flights. There would be $250 million (₹21.1 billion) in fuel bills, while the need for additional crew rest allowances and overnight layovers contributes another $150-200 million (₹12.7-16.9 billion) in incremental payroll and accommodation expenses.

These cost pressures come as Air India is already in the red with a $520 million (₹43.9 billion) loss on $4.6 billion (₹388.7 billion) revenue in FY24. With a 26.5 percent domestic share, but a disproportionately large footprint on long-haul routes compared to rivals such as IndiGo, Air India stands to lose competitive ground on critical corridors to North America and Europe. In April alone, combined schedules through New Delhi to the West numbered some 1,200 weekly rotations across Air India, Air India Express and IndiGo; diverting each by 30–45 minutes implies cumulative network delays of 600–900 flight-hours, eroding asset utilization and raising per-seat costs by as much as 8 cents per available seat-kilometer.

Operational change: Operational workarounds are technically feasible but fraught with logistical and diplomatic hurdles. Routing over China via the Karakoram and Tibetan plateaus adds both distance and complexity: the high-altitude airspace demands payload restrictions of 5-10 percent less than normal to ensure obstacle clearance, which in turn reduces seat availability or necessitates technical stops for refueling. Meanwhile, adding extra pilots for longer sectors — another request to the Ministry — would strain finite cockpit manpower, given current ratios of two pilots per flight and regulatory limits on cumulative duty hours.

New Delhi’s options for mitigating the fallout include direct financial subsidies, but these risk setting a precedent for other sectors affected by geopolitical spillovers. Temporary waivers on passenger-related levies, such as the airport development fee for long-haul travelers, might preserve demand elasticity at a time when ticket yields are already under pressure from higher operating costs.

Other change: Longer term, diversifying gateway traffic through southern hubs like Bengaluru or Chennai could partially circumvent the northern airspace closure, though this entails shifting infrastructure investments and negotiating bilateral fifth-freedom rights with European and North American carriers. Such realignments would dilute Delhi’s status as the principal hub for Westbound travel, a strategic asset that carriers and policymakers alike have cultivated for decades. Additionally, accelerating New Delhi’s open-skies negotiations with the European Union and the UK could provide alternate fifth-freedom traffic rights, but these arrangements typically take years to finalize.

Adani Pauses Semiconductor Plans.

Adani’s decision to press pause on the proposed $10 billion (₹845 billion) wafer‐fab partnership with Israel’s Tower Semiconductor underscores the persistent strategic and commercial uncertainties clouding India’s chip‐manufacturing ambitions. Maharashtra’s September 2024 approval for an 80,000 wafers‐per‐month facility employing 5,000 workers was hailed as a flagship, yet internal due diligence by the Adani Group revealed that domestic demand at just 6.5 percent of global semiconductor consumption remains too nascent to underwrite the enormous upfront capex.

Capital contributions: Tower Semiconductor, which would have supplied analog and mixed‐signal process know-how, was unwilling to match Adani’s funding scale. Insistence on greater involvement reflects a broader shift among Indian conglomerates toward risk-sharing in JVs, particularly after the collapse of Vedanta-Foxconn’s $19.5 billion (₹1.6 trillion) JV in mid-2023 due to cost overruns and incentive delays.

The timing of Adani’s withdrawal also highlights the fraught interplay between geopolitical ambitions and market realities. Modi has been offering over $10 billion (₹845 billion) in PLIs across fabs, packaging plants, and R&D hubs, but India still lacks an operational front-end fab. There are backend facilities with Tata Group’s $11 billion (₹929.5 billion) fab and Micron’s $2.7 billion (₹228.2 billion) packaging facility, but companies are wary of unsold inventories and unpredictable technology licensing cycles.

Operations further dampen prospects. Fabrication lines demand uninterrupted power and ultra-pure water, which is unevenly distributed across Maharashtra, while specialized talent pipelines for process engineers remain underdeveloped. Recent IEA data show India’s electricity grid sustains 7 percent annual demand growth, yet downstream distribution losses hover at 18 percent, raising concerns about the reliability needed for lithography tools. Similarly, IIT engineering churns out only 1,000 semi-specialized graduates annually, a fraction of the 10,000 required to staff a single fab line.

Looking ahead, Adani’s “wait-and-watch” stance may prove prudent: fabs dating from concept to production readiness typically require 3-4 years, followed by customer certification processes that can consume an additional 12–24 months before generating cash flow. By postponing binding agreements until local demand thresholds become more credible, Adani positions itself to negotiate stronger equity stakes or government co-guarantees in subsequent rounds.

Message from our sponsor.

The 5 Advantages of a Gold IRA

With everything going on in the world today - inflation, tariffs, market volatility - it’s more important than ever to stay informed.

That’s why you need to get all the facts when it comes to protecting your retirement savings.

Did you know that Gold IRAs can help safeguard your money?

Request a free digital copy of The Beginner’s Guide To Gold IRAs to arm you with the facts.

In the Beginner’s Guide to Gold IRAs, you’ll get…

The Top 5 Advantages to a Gold IRA

How To Move Your 401K To Gold Penalty Free

A Simple Checklist For How to Get Started

Don’t miss this opportunity to get the facts about how a Gold IRA can help you protect and diversify your retirement savings.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.

Reach out to [email protected] to sponsor the next newsletter!

Gupshup.

Macro

The last major hurdle for trade is agricultural tariffs. The farms in India employ 45 percent of people and contribute 16 percent to GDP, but are far less efficient and more protected by imports. The Trump admin wants to review all tariff and non-tariff trade barriers on the sector, but India is hard pressed to allow that.

Equities

Adani Enterprises sees a 19 percent rise in EBITDA even with revenue flat. There was strong performance in hydrogen, green energy, and airports, which all have higher operating leverage, allowing the company to gain from those segments even if other divisions slowed. Enterprises look to add $1.8 billion (₹150 billion).

Jubilant got approval to acquire a 40 percent stake in Hindustan Coca-Cola. Hindustan Coca-Cola is a subsidiary of Coca-Cola based in the US. The company works in the preparation and distribution of coke beverages across India. The parent company is selling subsidiary stakes to become more asset-light.

Food delivery company Eternal, formerly Tomato, saw net profit fall 78 percent y-o-y. Expenses jumped by 68 percent, plus there was a higher investment in building out quick commerce verticals.

Alts

WAVES summit is projected to boost the creator economy with a $1 billion (₹84.5 billion) fund. Modi is going to inaugurate it, which should attract the global economy as well. The summit intends to empower digital creators through funding, skill development, and global market access.

The University of Western Australia wants to build branch campuses in Mumbai. This aligns well with India’s Education Plans for 2020, which are to attract foreign universities to build satellite areas. There will continue to be strong research collaborations in agriculture, plant sciences, and business between UWA and Indian students.

The TRAI chairman believes that streaming and traditional broadcasting should have similar regulations. He is aiming for a regulation that helps advanced platforms continue growing while minimizing the downside to legacy media. There have been concerns that over-regulation on distribution could stifle creativity, and there have been calls to monitor online content and promote credible content creation.

Policy

India continues to call for justice after Rubio urges de-escalation. Rubio called for peace with Jaishankar and also talked to PM Sharif in Pakistan, saying the country had to condemn the attack and resume open lines of communication. Sharif’s team has reiterated that the country is open to joining a joint probe with India.

India easily has the most to gain from Trump being in the White House. Moving supply chains for various automobile and tech companies to India signals a larger trend of India becoming the ‘factory of the world’. India is going to grow at least 6 percent this year, making it the fastest-growing large economy, with more potential upside depending on supply chain adoption.

SEBI chief Pandey believes the system has enough checks to tackle fraud. He warned during a fireside chat that industry leaders believe there is no proper system based on anecdotal evidence, but statistically, India catches more fraud each year. Auditing has also strengthened in recent times.

See you Friday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.