Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we’re discussing

Indian defense stocks are rallying,

the Supreme Court is dismissing waiver petitions from Bharti Airtel and Vodafone,

and Apple’s primary supplier invests $1.5 billion in India.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

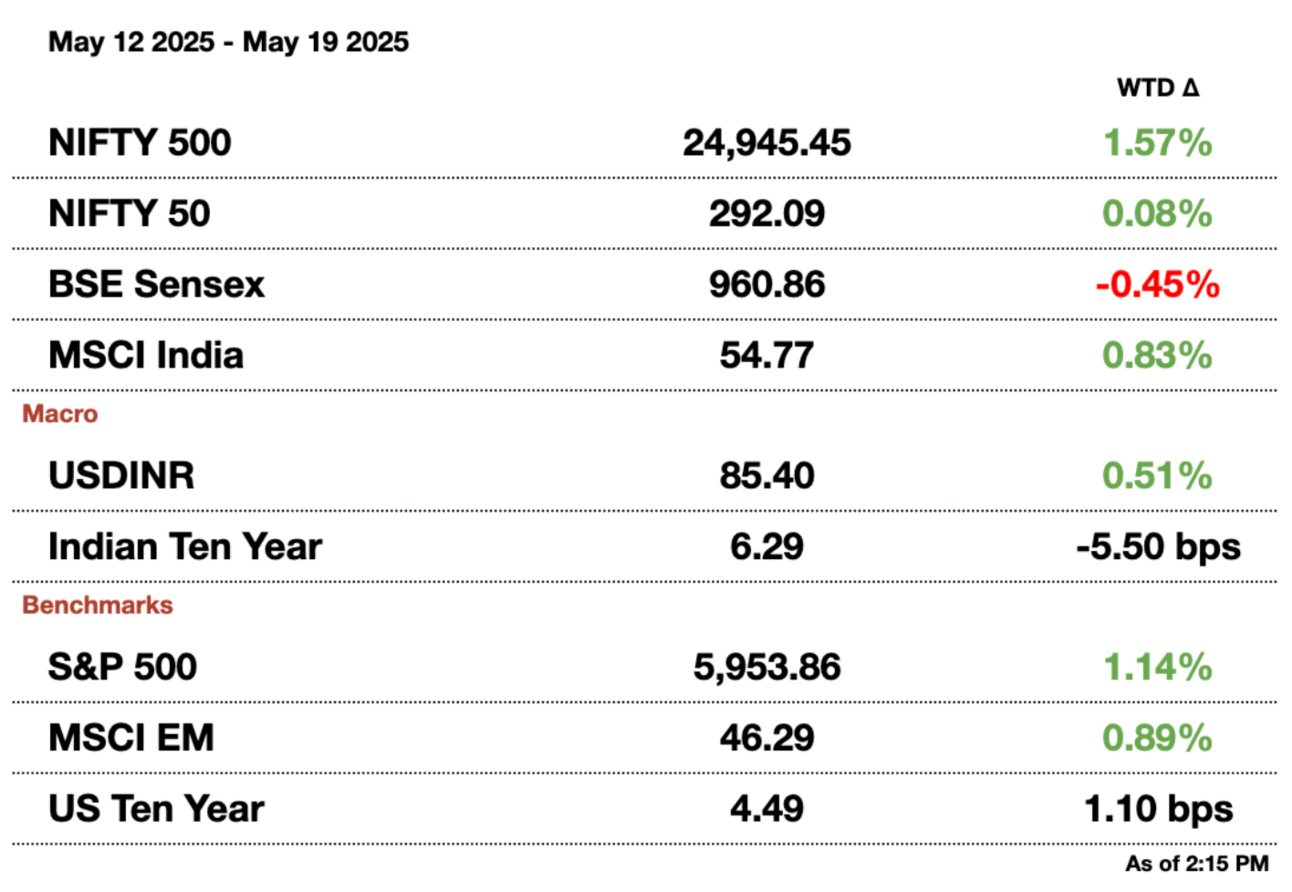

Market Update.

Defense Stocks Rally Behind India’s Rising Government Focus on Military Spending.

Indian defense stocks continued their impressive rally on Monday, building on last week’s momentum driven by strong corporate earnings and growing optimism around increased defense spending. The sector has emerged as a standout performer in India’s equity markets, bolstered by both domestic demand and geopolitical developments.

The Nifty Defense Index rose to a record high, bringing its y-t-d gains to 28 percent, the highest among thematic indices tracked in the country. The surge comes as investors bet on stronger order pipelines, improved execution, and sustained policy support for the sector.

Top performers: Hindustan Aeronautics (HAL) gained over 2 percent after reaffirming its delivery schedule for 12 Tejas fighter jets by year-end. The state-owned aerospace giant had previously faced delays due to engine procurement issues, but has since resolved the supply chain bottlenecks. The timely deliveries mark a critical milestone in India’s push for indigenized defense manufacturing under the “Make in India” initiative.

Jet built by Hindustan Aeronautics

Meanwhile, Data Patterns, a key supplier of electronic systems to the defense and aerospace sectors, posted a stellar 60 percent y-o-y increase in net profit for the March quarter. The company reported robust demand for its radar, avionics, and space equipment products, highlighting rising procurement from both the Indian armed forces and strategic agencies like ISRO and DRDO.

Breaking down the rally: The broader bullish sentiment in defense stocks is also being fueled by heightened military activity along India’s borders. Last week, tensions flared again between India and Pakistan, with both sides reportedly carrying out limited military strikes. This geopolitical uncertainty is driving increased attention to defense preparedness and modernization, further strengthening the investment case for the sector.

Investors are also eyeing the upcoming Union Budget, where expectations are mounting for a higher allocation to defense, especially capital expenditure. The government has already committed to boosting domestic production and reducing reliance on imports, with major contracts lined up for naval vessels, missile systems, and next-generation combat platforms.

India’s Top Court Rejects Airtel, Vodafone Pleas for Relief on Telecom Dues.

India’s Supreme Court has dismissed fresh petitions from Bharti Airtel and Vodafone seeking waivers on long-standing dues owed to the government, dealing a significant blow to the telecom sector’s hopes for legal reprieve.

India’s Supreme Court

The decision reaffirms the court’s earlier stance on the contentious adjusted gross revenue (AGR) case, in which telecom operators were ordered to pay billions in dues, including penalties and interest, to the government. Vodafone, already battling severe financial stress, saw its shares drop as much as 10 percent following the verdict, before recovering slightly. Airtel, India’s second-largest wireless carrier, was relatively unaffected, with shares closing largely flat.

The telecom plan of action: Vodafone had petitioned the court to waive penalties and interest charges amounting to $3.5 billion (₹300 billion) in AGR dues. The debt-laden telco has been struggling to stay afloat amid mounting losses and subscriber erosion. The government recently increased its stake in the company to 49 percent through a debt-to-equity conversion, effectively becoming the largest shareholder, yet not assuming operational control.

Airtel had filed a similar petition, though its financial position remains far stronger than its rival. Still, the dismissal underscores the judiciary’s rigid approach toward the AGR liabilities, which have loomed over the industry since the court’s landmark 2019 ruling.

That ruling broadly redefined what counts as revenue for calculating telecom dues, including non-core income like rent and interest, an interpretation fiercely contested by the carriers. While the government had offered some relief through extended payment timelines, it stopped short of waiving interest or penalties, prompting renewed legal efforts by the operators.

Investors are now watching for Vodafone’s next steps, including potential fundraising or strategic partnerships. The company recently outlined plans to raise $2.3 billion (₹200 billion) to invest in 5G rollout and strengthen its network, though material progress on that front remains limited.

The Supreme Court’s decision also sends a broader message about the sanctity of its rulings, particularly in disputes involving large sums and regulatory clarity. For India’s telecom landscape, already reduced to a three-player market, this ruling cements a hard path forward, especially for firms operating on thin margins and heavy debt.

Apple Supplier Hon Hai/Foxconn Injects $1.5 Billion into India Amid China Shift.

Hon Hai Precision (aka Foxconn), the world’s largest contract electronics manufacturer and Apple’s primary iPhone assembler, is investing $1.5 billion (₹128.1 billion) into its India unit as part of a broader strategy to diversify production beyond China. The capital infusion reflects Hon Hai’s and Apple’s increasing reliance on India as a key manufacturing hub amid rising geopolitical risks and global supply chain realignment.

The Taiwan-based company disclosed in a stock exchange filing Monday that the investment was routed through its Singaporean subsidiary. The move supports ongoing efforts to expand Hon Hai’s footprint in India, where it is building new facilities and ramping up production capacity, particularly in the southern states of Tamil Nadu and Karnataka.

The announcement comes at a time when Apple is aggressively scaling up its Indian manufacturing. The tech giant reportedly plans to produce the majority of iPhones it sells in the US from India by the end of 2026, marking a major shift away from its traditional reliance on China. This pivot has drawn criticism from former Trump, who claimed last week that he urged CEO Tim Cook to halt the company’s Indian expansion, arguing it undermines domestic manufacturing.

Still, the momentum behind Apple’s India push appears unstoppable. In the 12 months through March, Apple assembled $22 billion (₹1.88 trillion) worth of iPhones in India, a staggering 60 percent increase from the previous year. Much of that production takes place at Hon Hai’s Indian facilities, but Tata has also emerged as a major player after acquiring Wistron’s local business and taking over Pegatron’s operations in the country.

The $1.5 billion (₹128.1 billion) injection is the latest in a string of moves by Hon Hai to deepen its commitment to India while also managing geopolitical risk, including potential tariffs and tensions between the US and China. The company has likewise pledged to increase its US investments, seeking to strike a balance between global diversification and political pressure from Washington.

A win-win: Analysts say the investment underscores how India is no longer a secondary or backup site for electronics manufacturing but is becoming a central node in global tech supply chains. With its large workforce, improving infrastructure, and government incentives under programs like “Make in India”, the country is quickly establishing itself as a credible alternative to China in high-end electronics production. For Hon Hai, the Indian expansion not only satisfies Apple’s demand for greater supply chain resilience but also positions the company for long-term growth in the world’s fastest-growing smartphone market.

Message from our sponsor.

Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

Gupshup.

Macro

The IMF is tightening conditions for Pakistan to receive more loans and disbursements. India tried to place pressure on the IMF to reduce financial support, but was likely rebuffed earlier during the conflict. Now, the IMF is raising budget, tax, and industrial reform requirements to keep external financing. IMF economists predict the nation needs $100 billion (₹8.5 trillion) of external financing commitments through 2029 to avoid default.

India is restricting garment and food imports from Bangladesh due to souring relations. Former PM Hasina was expelled from the country and has been harbored by India. Poor treatment of Hindus by Bangladesh has led to relations souring since Hasina’s exit. The new trade announcement affects 42 percent of Bangla’s exports or $770 million (₹65.8 billion). Sea routes are exempt from the changes, but those take 2 weeks as compared to land exports of 3 days.

Pakistan and its allies are facing Indian boycotts. India has outlawed all Pakistani imports, and trade bodies are cutting off Turkey and Azerbaijan as well. For context, bilateral trade between India and Turkey was $10.4 billion (₹888.2 billion) last year. Merchants and jewelers are also stopping imports of goods from those areas, such as apples, marble, and gold.

Equities

India's bull rally continues to be unequal. MSCI India is up 14 percent since April and the index regained a key level from last September’s peaks. At the same time, 75 percent of India’s top 700 stocks remain below their September peaks, reflecting that only blue-chip companies have appreciated in the recent risky investment regime.

Hindustan Aeronautics reported earnings above consensus due to a push to on-shore defense manufacturing. Since the Pakistan conflict, the company has appreciated by 20 percent, but this was justified due to increased net income after resolving a one-time expense from delayed jet deliveries. HAL is also boosting drone manufacturing capabilities, citing their importance in the border conflict.

Indian businesses are willing to lower revenues to retaliate against Pakistan. MakeMyTrip, EasyTrip, and Cox & Kings all stopped offering services to Pakistan and Turkey, all of which were cheap international options for Indian travelers. Air India has also lobbied the government to revoke IndiGo’s partnership with Turkish Air. Online retailers like Walmart, Amazon, and Flipkart have stopped selling all Pakistani merchandise in India.

Alts

India is requiring gas-fired power stations to meet rising summer demand. Gas-powered stations have a combined capacity of 20 GW and will continually be required to produce during high-demand periods. The units will get a 2-week notice for high production to give enough lead time for energy supplies. Gas stations normally operate at a fifth of capacity due to difficulty in sourcing inputs.

Turkish airport luggage company Celebi is cooperating with India after it revoked airport clearance. The company provides luggage services at airports, but was banned after Turkey supported Pakistan during the recent conflict. Celebi said it’s cooperating fully and cited that it had never received any security complaints before from any country it operates in, including the Americas, Europe, and the Middle East.

Policy

Indian defense groups allege that China gave Pakistan satellite support. Beijing likely supplied air defense and radar support as well to block troop and air attacks from India. Increased satellite help also gave a better view of India’s military plans. Pakistan and China have not responded to these accusations.

Trump has opened Modi to criticism at home from trade and Kashmir. By taking credit for the ceasefire, Washington has placed itself into the Kashmir dispute directly, rather than how India indirectly refers to the US during Pakistan talks. Additionally, the lever of trade bringing about Trump’s supposed ceasefire puts pressure back on Modi to bring up an equitable trade deal.

See you Tuesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.