Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we analyze RBI’s latest regulations to improve the safety of Indian stock markets.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

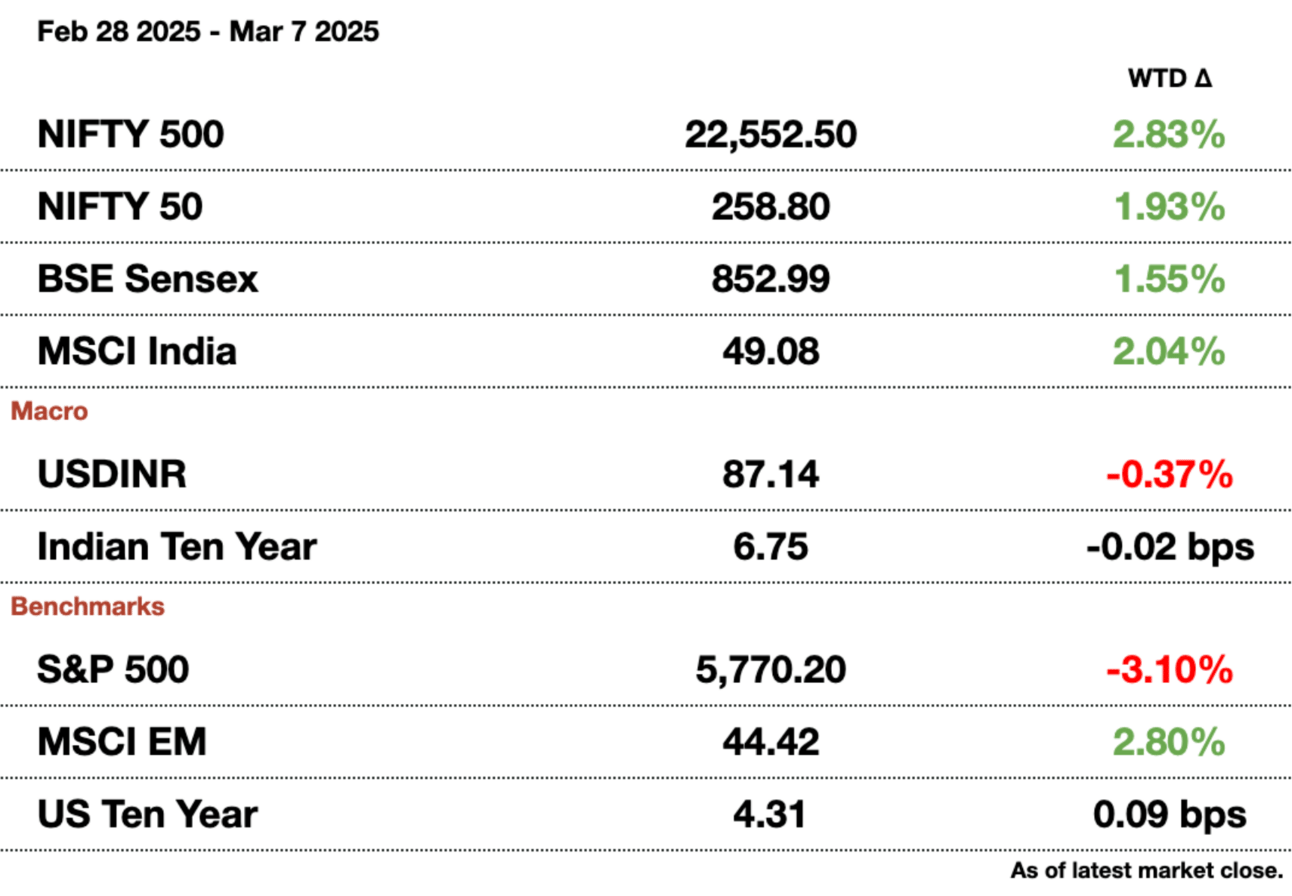

Market Update.

Latest RBI Regulations, Explained.

The RBI has introduced several key regulatory and developmental policies aimed at strengthening India’s financial markets, cybersecurity, and payment systems.

New trading and hedging options, literally: The RBI continues to expand interest rate derivative products to help market participants manage risks effectively. In response to industry feedback, the RBI is introducing forward contracts in government securities, enabling long-term investors like insurance funds to hedge interest rate risks efficiently. By enabling the purchase of government securities at predetermined future dates and prices, these forward contracts also aim to facilitate more efficient pricing of derivatives linked to these securities. Derivatives will include things such as interest rate options, rate swaptions, and forward rate agreements. All of these can be used in a hedging or speculative manner. Eligible participants include residents and non-residents authorized to invest in government securities under the Foreign Exchange Management (Debt Instruments) Regulations, 2019. After issuing draft directions in December 2023, the final guidelines will be released soon.

Streamlining bond trading: The RBI has expanded access to the Negotiated Dealing System – Order Matching (NDS-OM), an electronic platform for secondary market transactions in government securities, by allowing non-bank brokers registered with the Securities and Exchange Board of India (SEBI) to participate directly on behalf of their clients. Previously, access to NDS-OM was limited to regulated entities and clients of banks and standalone primary dealers. This change is expected to widen participation in the government securities market, enhancing liquidity and promoting more efficient price discovery.

Recognizing the need for synchronized and complementary trading and settlement timings across various financial market segments, the RBI has established a working group to conduct a comprehensive review of these timings. This initiative considers developments such as increased electronification of trading, the availability of certain markets on a 24x5 basis, greater participation of non-residents in domestic financial markets, and the continuous availability of payment systems. The working group is expected to submit its report by April 30, 2025.

Working with fintechs against fraud: To combat rising fraud in digital payments, the RBI is introducing exclusive internet domains for financial institutions. Banks in India will soon operate under the ‘bank.in’ domain, while non-bank financial entities will have a dedicated ‘fin.in’ domain. This initiative, managed by the Institute for Development and Research in Banking Technology (IDRBT), aims to mitigate cyber threats such as phishing and enhance trust in digital banking. Registrations for these domains will commence in April 2025, with detailed guidelines forthcoming.

To enhance the security of cross-border digital transactions, the RBI is introducing an Additional Factor of Authentication (AFA) for online international transactions using Indian-issued cards. Currently, AFA is mandatory only for domestic transactions, but extending it to international transactions will provide an added layer of security when overseas merchants support AFA. A draft circular will be issued soon to gather stakeholder feedback.

Message from our Sponsor

Apple’s Starlink Update Sparks Huge Earning Opportunity

Apple just secretly added Starlink satellite support to iPhones through iOS 18.3.

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone already reaches +45M users that have earned over $325M, and that’s before global satellite coverage. With SpaceX eliminating "dead zones" worldwide, Mode's earning technology can now reach billions more.

Mode is now gearing up for a possible Nasdaq listing (ticker: MODE) but you can still invest in their pre-IPO offering at $0.26/share.

Gupshup.

Macro

India is overcoming its liquidity deficit due to RBI emergency measures. The liquidity shortfall is now just $9 billion (₹793 billion) compared to $37.9 billion (₹3.3 trillion) just a month ago. The RBI has had to do cash infusions of $68 billion (₹5.9 trillion) as rates also start to come down. The deficit had been caused by a restrictive rate environment, RBI dollar sales, and harmful loan policies.

Equities

Ola Electric's rapid store growth is causing raids and seizures due to certification rules. 95 percent of their 4,000 new stores lack the certifications to actually sell or display these motorcycles. There are now at least six officials probing the company and multiple show-notices have been sent as well. Shares have plunged 60 percent due to government and consumer backlash since August.

Blackstone backed trust files for a REIT IPO.REITs invest in real estate allowing for investors to own slivers of different properties. Knowledge Realty Trust is looking for a $711 million (₹61.9 billion) raise. The Trust owns office properties in large cities across India and wants to use the equity raise to pay down debt.

Alts

The health ministry asks the IPL to stop promoting "sin stocks" during games. The ministry wants to stop advertisements of tobacco and alcohol companies in order to reduce the manufacturing of bad goods. They want to stop all ads including surrogate ones, just three weeks before the IPL season starts.

Alpha Alternatives ups commodity derivatives exposure to $270 million (₹23.5 billion).The multi-strategy firm manages $2.5 billion (₹217.5 billion) and has never had a negative quarter in 11 years.

Policy

US Commerce Secretary Lutnick wants to reach a broad India FTA, but cited a few issues regarding tariff imbalances, Indian weapons purchases from Russia, and use of the dollar in trade. India has already started to cave on tariffs on motorcycles and alcohol. Additionally, weapons and industrial purchases are increasing in an effort to reduce the American trade deficit.

India names consultant Vikas Kaushal to head state-run Hindustan Petroleum. The appointment is for at least five years and is seen as breaking a mold given the external hire. The refiner has missed profit expectations for the last three quarters in a row.

Trump continues to slam high Indian tariffs and guarantees reciprocal ones on April 2nd unless the status quo changes. Indian trade minister Piyush Goyal is currently in DC to work out arrangements to avoid tariffs being set in. Tariffs on industrial goods and service exports would be disastrous for India’s economy given the US is its largest trading partner for both exports.

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.