Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we investigate a widespread yet little discussed crisis facing India’s global competitiveness: its trigger-happy tax litigators.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

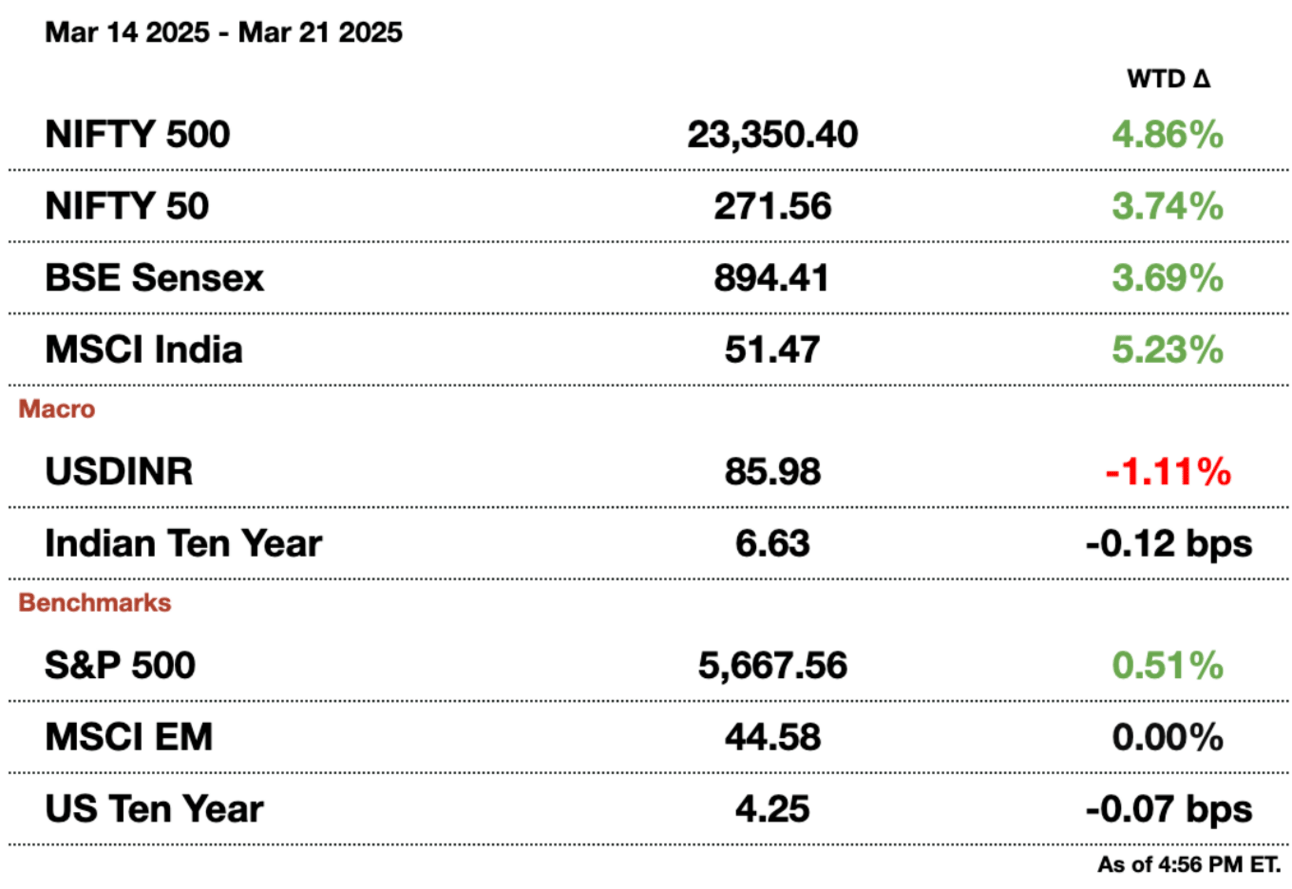

Market Update.

India’s Tax Litigation Crisis.

India’s tax authorities have long fostered a confrontational relationship with citizens, harming businesses and deterring investment. The 2025 budget offered hope with tax cuts and a promise to simplify income tax laws. However, the new bill fell short of expectations and does little to ease the public’s core concern: that tax demands are arbitrary and unpredictable.

The “withholding” system places the burden of tax administration on businesses, making them globally uncompetitive. India’s tax office litigators have become increasingly trigger-happy, with the amount of tax money being contested in 2021 increasing six-fold compared to 2010. Disputes are rampant, with over a year’s worth of tax collections stuck in litigation, and the government wins fewer than 8 percent of cases in court.

Companies and high-net-worth individuals avoid investing or even leaving the country due to concerns over tax litigation and the unpredictability of tax authorities. Examples like Nokia’s exclusion of Indian assets from its sale to Microsoft in 2013 illustrate the real-world consequences of tax-related disputes.

Despite these issues, the government believes it has made significant strides by implementing digital payment systems and improving filing procedures. However, public perception remains that these changes are merely procedural and do not fundamentally shift the combative mindset that dominates India’s tax environment. Political rhetoric around tax evasion and frequent raids only serves to deepen the sense of mistrust.

India’s excessive litigation is having a real impact on foreign companies looking to do business in India, but are instead being made into examples for the rest of the world to use as warnings. Kia is accused of dodging $155 million in taxes by misclassifying imports, while Volkswagen contests a $1.4 billion tax notice over part imports. Vodafone was slapped with a $2 billion demand in 2007, later winning an arbitration case in 2020. Cairn Energy faced a $1.4 billion tax demand, settled in 2021 with a refund. Pernod Ricard is fighting a $250 million back tax demand.

While some of the lawsuits may have some merit, the Indian government is suing for enormously large sums while prolonging the litigation process for on average six years, deterring companies from wanting to enter the country.

Even for companies not embroiled in lawsuits, entering India’s market requires carefully navigating a complicated regulatory regime, which comes with high compliance costs. Despite efforts like digital payments and lower rates, India’s tax system still centers on revenue collection, not taxpayer rights. For growth and investment to thrive, India needs a tax system that is predictable, transparent, and cooperative, not combative. Without reform, India’s economy will continue to underperform.

Want to sponsor our next newsletter?

Email [email protected]!

Gupshup.

Macro

An Indian parliamentary committee has urged the government to cut import tariffs on raw materials to help local manufacturers stay competitive, especially as trade talks with the U.S. and other partners approach. The panel aims to fix inverted duty structures that currently make it cheaper to import finished goods than produce them domestically.

India's foreign exchange reserves rose by $300 million to $654.27 billion as of March 14, marking a three-month high. This follows a $15.3 billion increase the previous week, the largest since August 2021.

Equities

India's IT sector, already facing a tough year, may continue struggling in fiscal 2026 due to weak U.S. spending and global uncertainties. Analysts expect modest revenue growth, with companies like TCS and Infosys down 11-18 percent this year.

Mahindra and Mahindra will raise vehicle prices by up to 3 percent starting in April, following other Indian automakers like Maruti Suzuki and Tata Motors. This price hike is driven by rising commodity costs, higher import duties, and supply chain issues.

Metropolis Healthcare aims to acquire 2-3 companies annually in the coming years to expand its footprint, particularly in northern and eastern India, while boosting its specialty testing business, according to executive chairperson Ameera Shah.

Alts

Surging demand from India’s young and wealthy is driving record sales for Lamborghini and Mercedes-Maybach, with Lamborghini selling 113 cars in 2024—up 10 percent from the previous year—and considering a fourth showroom. Mercedes-Maybach, seeing India as a potential top-five market, joins Lamborghini in capitalizing on a wave of under-40 buyers, many from successful startups and family businesses, fueling an 18-month order backlog for models like the $500,000 Urus SUV.

India’s antitrust raids on top media agencies, including GroupM, Interpublic, Publicis, and Dentsu, were triggered by tip-offs under a leniency scheme, with Dentsu submitting evidence last year on alleged collusion over ad prices and discounts, sources say. The investigation, tied to pricing arrangements involving the Advertising Agencies Association of India and IBDF, targets a market worth $18.5 billion and could lead to penalties of up to three times annual profits or 10 percent of turnover.

Policy

India will let its $23 billion manufacturing incentive scheme lapse after disbursing less than 8 percent of allocated funds by October 2024, with officials citing disappointing results outside mobile phones and pharma. Despite 750 firms joining, including Foxconn and Reliance, the program only achieved 37 percent of its production target.

The Reserve Bank of India has reportedly urged the CEO and deputy CEO of IndusInd Bank to step down following significant accounting lapses, but the bank strongly denies the claims. The bank, with a $63 billion balance sheet, revealed a $175 million overvaluation in its derivatives portfolio in March.

India’s SEBI has mandated that market intermediaries register their official email and mobile numbers on social media platforms before publishing ads, aiming to curb rising securities fraud on sites like YouTube, Facebook, and X.

India has submitted an expression of interest to host the 2030 Commonwealth Games, which could serve as a precursor to its bid for the 2036 Olympics. The country aims to capitalize on the Commonwealth Games' recent difficulties in securing hosts.

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.