Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we investigate a widespread yet little discussed crisis facing India: the country’s judicial system is criticized for its corruption, but that is not even the worst way the courts are holding the country’s economic growth back.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

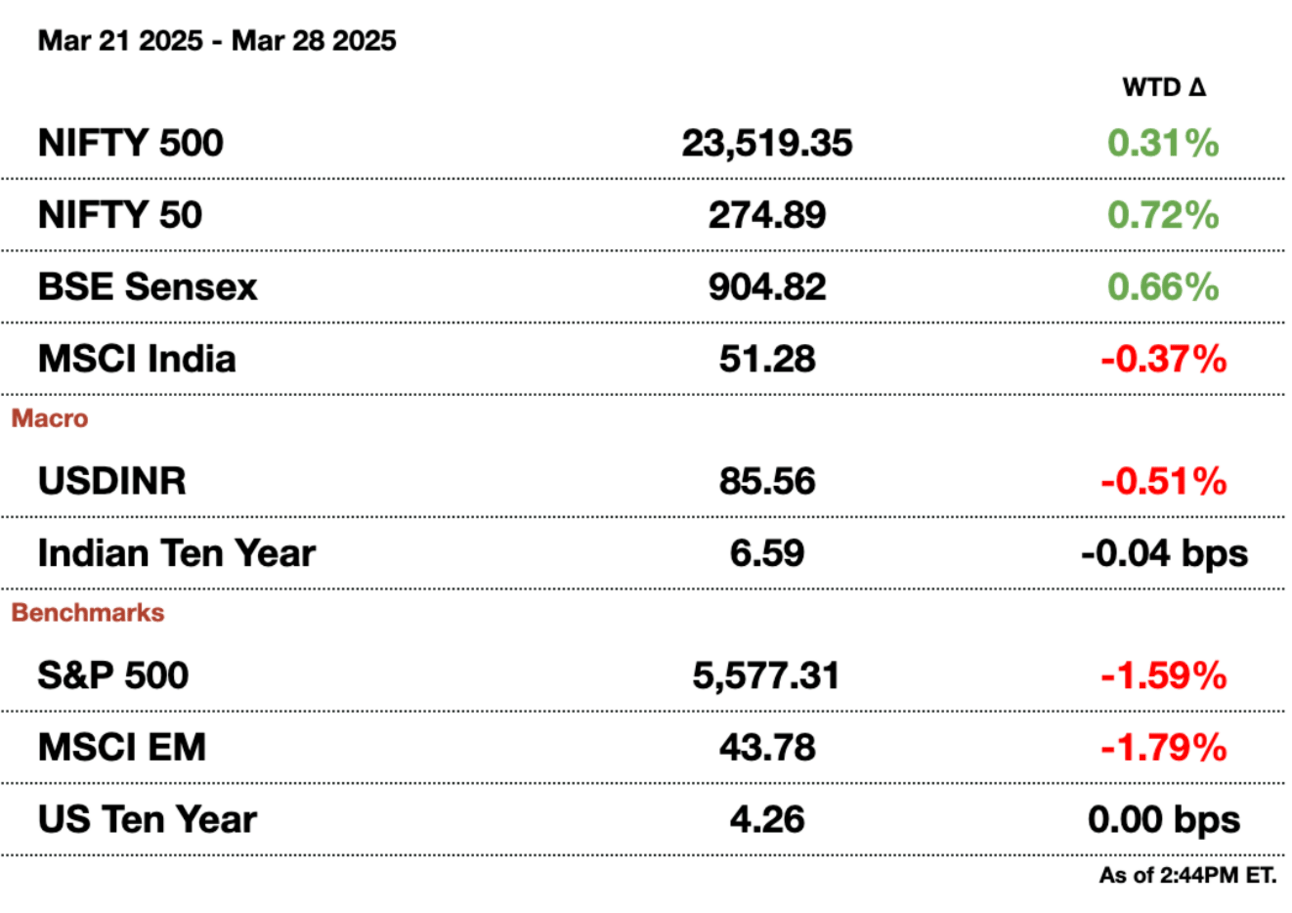

Market Update.

How India’s Courts Are Slowing Down Prosperity.

India’s judiciary is now facing a severe crisis of credibility, efficiency, and independence. The discovery of burnt currency notes at the residence of Delhi High Court judge Yashwant Varma has only intensified growing concerns about corruption within the system. While Justice Varma has strongly denied any involvement, the problem is not just him. It is a system that falls incredibly short of a growing economy’s needs.

India’s Supreme Court building in New Delhi

Here is a frightening statistic: India has just 21 judges per million people, one of the lowest ratios in the world. Compare this to other high-flying economies like the US with 150 per million and China with 300 per million. Smaller, similar geographies like Indonesia have 50 judges per million and even Vietnan has 130 judges per million. This shortfall is exacerbated by nearly 6,000 judicial vacancies across various courts, with approximately 4,000 courtroom facilities still required to accommodate new appointments.

Thus, India’s judicial system is overwhelmed by an enormous backlog of cases, with more than 45 million pending cases clogging the courts. In February alone, 1.77 million new cases were instituted, while only 1.18 million were disposed of, making it nearly impossible to clear the backlog at the current pace.

Another reason why: Former Bombay High Court judge Gautam Patel cites other systemic inefficiencies as a key cause. For example, serving notices to defendants, filing petitions, and even enforcing court rulings are frequently delayed due to procedural bottlenecks that vary across different courts and jurisdictions. Patel emphasizes that unless these inefficiencies are addressed, even increasing the number of judges or funding judicial infrastructure will have little impact on clearing the backlog.

Recognizing the need for judicial efficiency, India has been working on digitizing court processes for over two decades. While some progress has been made with e-filing systems, online case tracking, and virtual hearings, implementation has been inconsistent. Many courts still operate in an analog-digital hybrid mode, leading to inefficiencies that defeat the purpose of digitalization. A great story Patel relayed was how a judge was engaged in a month long saga of passing notes on fixing a clerk's written language rather than a concise, one-time email.

Despite the urgent need for reform, digitalization has largely been left to individual judges and court administrators, many of whom lack the expertise or the time to drive meaningful change. Patel argues that if the judiciary were run like a corporate entity, such inefficiencies would have been outsourced to professional firms specializing in process optimization.

Backroom dealing: Beyond inefficiency and corruption concerns, the judiciary’s independence is increasingly under scrutiny. Critics argue that the current system of judicial appointments — dominated by judges rather than an independent commission — has led to opacity and allegations of government influence over the courts.

Several recent high-profile cases have raised alarms about judicial impartiality. The jailing of activists, journalists, and comedians has led to accusations that some judges are favoring the government rather than upholding constitutional principles. This perception, whether true or not, further erodes trust in the judiciary and raises concerns about the rule of law in India.

A dysfunctional judicial system has far-reaching consequences beyond just the legal domain — it directly affects India’s economy and business environment. Delays in resolving commercial disputes, property claims, and contract enforcement discourage foreign and domestic investment. Businesses often wait decades for verdicts, making India one of the most challenging places in the world to settle disputes through the courts.

Financial ramifications: Some specifics include over $60 billion (₹5.1 trillion) in investment capital locked up due to pending legal disputes. These corporate lawsuits take an average of 4 years to resolve. This past week we discussed how foreign investors balk at the high capital gains tax they face in India. There also is $15 billion (₹1.3 trillion) in unresolved tax litigation, further dissuading trading and FDI. Just look at Volkswagen's $1.4 billion (₹119.7 billion) tax settlement. While they were in the wrong and deserved that penalty, it took 12 years to actually hand out. It's hard to estimate how much GDP shrinks due to the justice system, but 1-2 percent seems likely; investors not only are stuck in courts but they also. have to weigh potential judicial issues before beginning any projects.

Global investors and corporations take judicial efficiency into account when deciding where to allocate capital. If businesses cannot trust that their contracts will be upheld in a timely manner, they may look elsewhere, dampening India’s long-term economic prospects. A strong and independent judiciary is a fundamental requirement for maintaining investor confidence and improving India’s ranking in global ease-of-doing-business indices.

Message from our sponsor.

Email [email protected] to sponsor the next newsletter.

Apple’s Starlink Update Sparks Huge Earning Opportunity

Apple just secretly added Starlink satellite support to iPhones through iOS 18.3.

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone already reaches +45M users that have earned over $325M, and that’s before global satellite coverage. With SpaceX eliminating "dead zones" worldwide, Mode's earning technology can now reach billions more.

Mode is now gearing up for a possible Nasdaq listing (ticker: MODE) but you can still invest in their pre-IPO offering at $0.26/share.

Gupshup.

Macro

India’s infrastructure output grew 2.9 percent in February, the slowest in five months, as crude oil and natural gas production saw sharp declines. Despite this slowdown, cement and steel output continued to rise, while overall infrastructure growth for April-February stood at 4.4 percent.

India's fiscal deficit for April-February reached $157.62 billion (₹13.47 trillion), or 85.8 percent of the full-year target, according to government data. Net tax receipts totaled $157.62 billion (₹20.16 trillion), or 78.8 percent of the annual goal, while total government expenditure was $454.15 billion (₹38.93 trillion), or 82.5 percent of the target.

India is considering scrapping its import tax on U.S. liquefied natural gas (LNG) to boost purchases and reduce its trade surplus with Washington, sources say. The move would make U.S. LNG more competitive, support India’s growing energy demand, and align with a broader push to increase bilateral trade, with Indian firms already in talks for long-term U.S. LNG deals.

India has proposed lowering tariffs on U.S. farm imports, including almonds and cranberries, to ease trade tensions and prevent Trump’s planned retaliatory tariffs, government sources say. Negotiations with U.S. trade officials are progressing, with India also seeking greater market access for its fruits and rice exports.

India’s central bank may reinstate fixed daily liquidity funding to address market volatility, with banks seeking up to 1 percent of total deposits, sources say. The move follows recent cash deficits and could shape monetary policy ahead of the April review.

India's airline industry may see ticket prices drop as capacity expansion outpaces demand, according to Air India Express CEO Aloke Singh. The budget carrier plans to add 15 aircraft next fiscal year and deepen partnerships with global low-cost airlines.

India's current account deficit for Q3 of FY 2024-25 stood at $11.5 billion, slightly higher than the previous year's $10.4 billion but lower than the expected $12 billion, supported by strong services exports. The deficit remained at 1.1 percent of GDP, with net services receipts rising to $51.2 billion, while the merchandise trade gap widened to $79.2 billion, reflecting global trade uncertainties.

Equities

India’s Nifty 50 surged 6.3 percent in March—its best gain in 15 months—helping it end fiscal 2025 up 5.34 percent despite a historic five-month losing streak. A rebound in foreign inflows and improving economic signals fueled the rally, though the index remains 10.5 percent below its late-September peak.

Alts

Foreign ownership of India's government bonds has exceeded 3 trillion rupees ($35 billion) as investors anticipate an interest rate cut by the Reserve Bank of India in April. Inflows are expected to rise further due to expectations of aggressive rate cuts, stable inflation, and a stable currency.

ArcelorMittal Nippon Steel India has secured land in Andhra Pradesh for a new steel plant with an initial capacity of 7.3 million tonnes, advancing its expansion plans. The company is also expanding its Gujarat facility while navigating India’s import restrictions on key raw materials.

India has signed a $7.3 billion deal to acquire 156 ‘Prachand’ combat helicopters for its air force and army, boosting military modernization and self-reliance. The domestically built helicopters, co-developed with France’s Safran, will begin delivery in three years.

Four Indian state-run companies, led by KABIL, are negotiating with Chilean miner SQM to acquire a 20 percent stake in its Australian lithium projects for $600 million, marking India's largest push to secure supplies of the key EV battery metal. This effort includes Coal India, Oil India, and ONGC Videsh, as India intensifies its drive to secure critical minerals for its growing electric vehicle sector.

Indian mutual funds have increased their investments in state and corporate bonds while selling federal government debt to capitalize on rising yield differentials. The spread between state bonds and government debt reached over 50 basis points, and the gap for corporate bonds widened to 90 basis points, prompting funds to shift their focus to higher-yielding assets.

Policy

India has criticized Elon Musk’s X for calling an official website a "censorship portal," arguing that it merely notifies tech firms about harmful content, as court filings reveal. The dispute escalates tensions between X and Modi’s government over content takedown rules as Musk prepares to launch Starlink and Tesla in India.

India's cabinet has approved a $2.7 billion plan to boost electronics components manufacturing, aiming to create nearly 92,000 direct jobs. The initiative is expected to support sectors like telecom, automobiles, and power, with a focus on employment-linked incentives.

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.