Today’s deep dives: India’s plans to massively expand steelmaking get challenged by China’s cheap alternatives. India’s exporters ask Modi for subsidies to cushion blow for U.S. tariffs. The RBI intervened in currency markets Tuesday to steady the rupee after it slid close to record lows.

We want to talk to you! Just respond to this email and we’ll set up a time to learn more about how Samosa Capital can be more helpful in your work.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

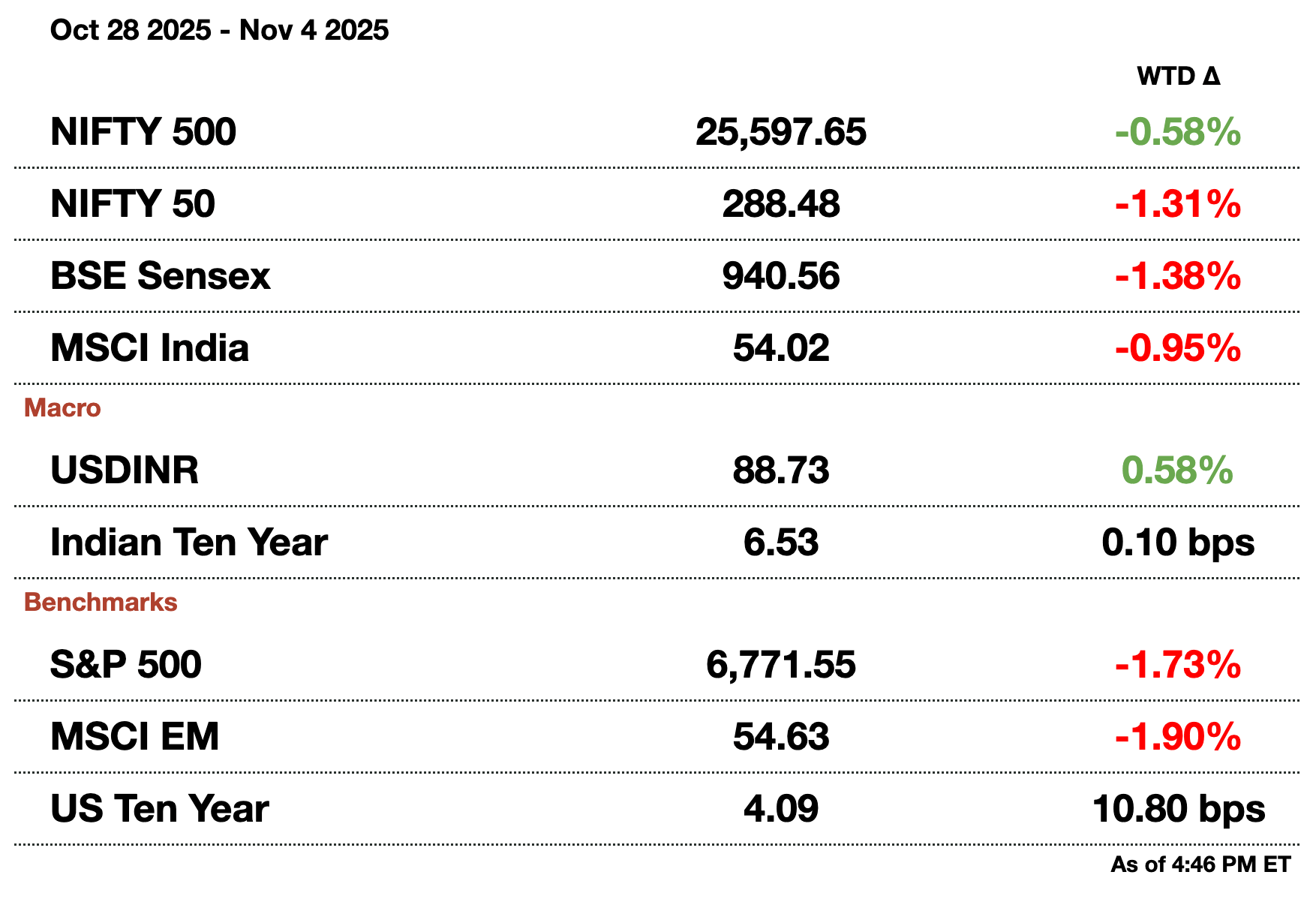

Macro

India may cancel several renewable energy projects struggling to secure buyers, reflecting weak demand for green power contracts. Officials aim to redirect resources toward viable ventures as the nation recalibrates its energy transition strategy.

Foreign investors are paring exposure to India’s consumer stocks despite recent tax cuts, citing rich valuations and moderating rural demand. The pullback highlights shifting global fund flows toward value-oriented and industrial sectors.

Equities

IndiGo reported a larger-than-expected quarterly loss as higher fuel and maintenance costs outweighed record passenger traffic. The results underscore mounting margin pressures across India’s aviation sector amid elevated oil prices and rupee weakness.

Adani Enterprises posted an 84 percent surge in quarterly profit, driven by its energy and airport businesses, and plans to raise $2.5 billion (₹221.8 billion) for new projects. The results mark a sharp rebound in investor sentiment following last year’s short-seller turbulence.

State Bank of India’s profit topped forecasts as strong loan growth and improving asset quality boosted earnings. The upbeat results reinforce SBI’s dominant position in India’s credit cycle recovery amid resilient retail demand.

Tesla is set to hire a former Lamborghini India head to lead its local operations, signaling renewed commitment to the Indian market. The move comes as Tesla prepares for a long-awaited product launch amid EV policy tailwinds.

Top Indian brokerage Groww has opened order books for its $747 million (₹66.3 billion) IPO, testing investor appetite after a string of blockbuster listings. The offering underscores fintech’s growing mainstream traction in India’s retail investing boom.

Alts

State Street Corp. is in advanced talks to acquire a stake in an Indian mutual fund firm, seeking to deepen exposure to the country’s fast-growing asset management market. The move aligns with Wall Street’s broader push into India’s wealth sector.

KKR plans to expand its insurance business in India, eyeing new investments and potential partnerships to capture rising household savings. The move reflects private equity’s increasing focus on India’s underpenetrated financial services sector.

Policy

India has escalated its humanitarian response following the Kunar quake, dispatching thousands of tents, food supplies and relief teams, signalling a heightened diplomatic push for influence in Afghanistan amid broader regional competition.

India’s financial crime agency has provisionally frozen about $351 million (₹30.84 billion) in assets tied to the Reliance Anil Ambani Group over alleged money-laundering involving loans from YES Bank, escalating scrutiny on the group’s financial dealings.

India’s top exchange has allocated nearly $148 million (₹13 billion) to resolve long-running regulatory disputes with the SEBI, clearing a major obstacle to its IPO and signalling a drive to clean up governance issues.

More than $10k in debt? We can help.

Debt happens. Getting out starts here.

Millions of Americans are tackling debt right now.

Whether it’s credit cards, loans, or medical bills, the right plan can help you take control again. Money.com's team researched trusted debt relief programs that actually work.

Answer a few quick questions to find your best path forward and see how much you could save. answer a few short questions, and get your free rate today.

Reach out to [email protected] to reach our audience and see your advertisement here.

1. India’s Steel Ambitions Hit by Wave of Cheap Chinese Imports

India’s plans to massively expand its steelmaking capacity are being tested as a surge in cheap imports, largely from China, drives domestic prices to multi-year lows and forces smaller mills to shut down.

According to Steel Ministry Secretary Sandeep Poundrik, about 150 mills have halted operations and another 50 have cut output as margins collapse. “All players are facing problems,” he said at a New Delhi industry conference, noting that even major producers like JSW Steel Ltd. have seen profits squeezed.

India, the world’s second-largest steelmaker, has seen consumption surge amid rapid infrastructure spending and industrial growth, a dynamic that should have favored local producers. Instead, Chinese mills, grappling with a supply glut at home, have flooded the Indian market with cheaper steel, undermining domestic prices.

Poundrik warned that persistent low prices threaten India’s $100 billion (₹8.9 trillion) plan to add 100 million tons of new capacity, vital to sustaining the nation’s infrastructure boom. The government has intensified quality checks to curb substandard imports and currently imposes a 12 percent safeguard duty on many steel products — a measure set to expire this week.

With the trade authority recommending a three-year extension of the duty, the decision will test how far India is willing to go to defend its domestic industry without reigniting trade tensions with key partners.

2. Modi Pressured to Cushion Exporters From Trump’s Tariffs

Indian exporters are urging Modi to step in with relief measures as President Trump’s 50 percent tariffs hammer key labor-intensive sectors and threaten to slow economic growth.

At a closed-door meeting Monday, exporters from industries including footwear, textiles, handicrafts, and engineering pushed for immediate government support, according to people familiar with the talks. Their demands include loan repayment moratoriums, subsidized credit, and export incentives to offset collapsing competitiveness in the U.S. market.

The tariffs, the highest in Asia, have hit India’s small and mid-sized manufacturers particularly hard. Exports to the U.S. plunged nearly 12 percent in September, while economists at Citigroup warn the measures could shave 0.6–0.8 percentage points off India’s annual GDP growth.

Trump’s move was framed as retaliation for India’s continued Russian oil imports and reluctance to open its markets to U.S. goods. While New Delhi has hinted that a trade deal could be close, Commerce Minister Piyush Goyal has publicly rejected the idea of signing an agreement “under pressure.”

Exporters say that uncertainty has fueled anxiety across industries already squeezed by weak global demand and a strong dollar. Some have also appealed to the RBI to let the rupee depreciate further to soften the blow — though policymakers remain cautious about risking inflation.

The Modi government is now weighing options to prevent further job losses in sectors critical to India’s export engine.

3. RBI Steps In to Defend Rupee as Currency Nears Record Low

The RBI intervened in currency markets Tuesday to steady the rupee after it slid close to record lows, selling dollars in offshore markets before domestic trading opened. The move lifted the rupee as much as 0.4 percent to 88.39 per dollar, its sharpest gain in nearly three weeks, before modestly paring back.

The RBI has been quietly defending the currency over the past several sessions, deploying small but steady interventions to prevent a break past the key 88.8050 level, last breached in September. “There is clearly a wall of resistance around that level,” said VRC Reddy, head of treasury at Karur Vysya Bank.

A weaker rupee raises risks of imported inflation and diminishes returns for foreign investors, making the central bank’s moves critical amid fragile sentiment. Bonds also advanced, with the 10-year yield falling two basis points to 6.52 percent, after data showed the RBI and other entities bought $456 million (₹40.4 billion) in sovereign debt Monday.

The rupee has depreciated 3.3 percent year-to-date, underperforming most Asian peers, as Trump’s tariffs on Indian exports and fading hopes for a Federal Reserve rate cut fuel dollar strength.

“The RBI does not want the 89 level to breach until a trade deal has been agreed upon,” said Anil Bhansali of Finrex Treasury Advisors. Analysts expect the bank to maintain support until bilateral negotiations with Washington stabilize market confidence.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.