Hello. The U.S. charges against Gautam Adani and other Indian executives of Adani Green Energy Ltd. and Azure Power Global Ltd. have been given far more color. We’ll explain more, and then close with Gupshup, a round-up of the most important headlines.

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

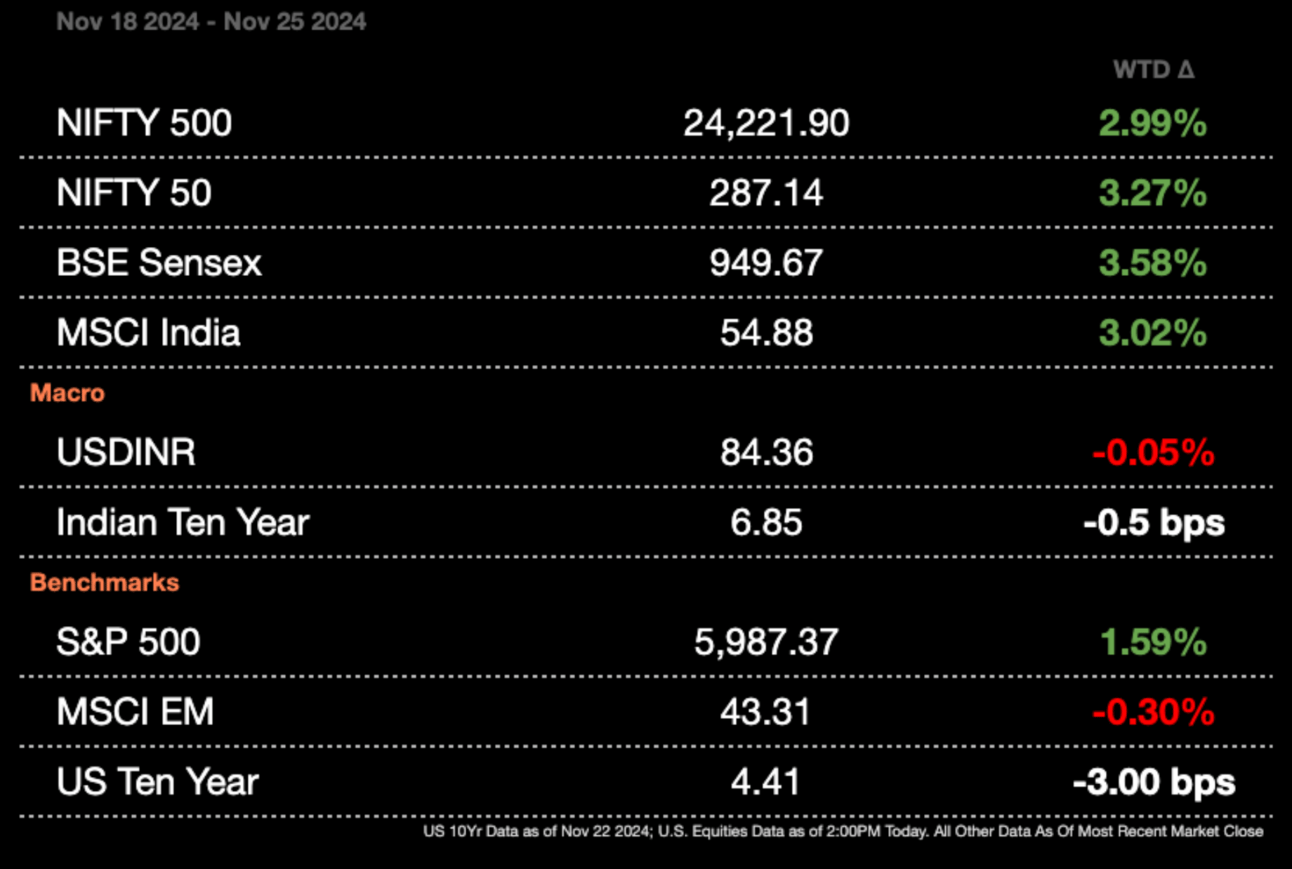

Markets

Read here for an appendix on the above.

Analysis

Breaking Down The Case Against Adani

As mentioned on Friday, Gautam Adani and related executives were charged by U.S. officials for bribing Indian officials with $265 million over the years. Since then, much more context about the case has been made available. Most interesting, the entire alleged bribery scheme revolved around green energy to secure solar energy contracts in India with $265 million in bribes. While bribery is illegal in India, the U.S. had to use domestic arguments to charge Adani; two factors contributed to them finding domestic jurisdiction.

The first was the dealings with Azure, a company listed on the NYSE, making it so bribery also affected American investors and markets. The second factor is defrauding investors in the U.S: Adani Green presented itself as a leader in ESG principles while also emphasizing dealing in good faith. $175 million of the $750 million bond offering went to US investors who the SEC says were misled. Those investors suffered fraud since they bought more risk than what was represented to them.

One thing to keep in mind with the shift in recognizing fraud is the changing administration. Gary Gensler, SEC chair and Biden appointee, will certainly be replaced in the coming months with Trump’s own pick which could lead to charges being dropped given the minor importance given to ESG fraud within changing admins.

Corruption in Indian Government

Looking at the Indian government, the bribery came from the fact that state governments refused to pay the amount that the federal government had agreed to with Adani Green. Executives at both Adani Green and Azure then started to pay incentives to state governments. A key difference maker, evidenced by email and message communications, is that those incentives were not paid to the state institutions but rather officials. If the power companies had given kickbacks to the state governments then the contracts could have been seen as struck at market price versus paying officials under the table.

Since news broke late last week, Adani has come out to deny all the allegations (NDTV, owned by him, published only a few pieces regarding the allegations calling them phony). Additionally, Adani Group reassured investors that the conglomerate had enough cash and cash equivalents to stay financed for at least the next 12 months. Over half of Adani’s debt is foreign-denominated which made domestic investors like GQG Partners balk since foreign credit lines will likely close following the fraud allegations. Foreign partners such as TotalEnergies, a French oil major, have also stopped additional investment into Adani Group. At the same time, analysts do not expect domestic credit (making up 42 percent of borrowing) to close up anytime soon.

Gautam Adani faces both civil and criminal charges and if he were to continue in the trial process and lose, he would have to be extradited first. At this point, Adani would also have to be charged in India which would lead to a much longer legal process. While monetary damages are hard to ascertain given how long the trial will take, criminal charges are easier to measure. Adani would face up to five years for foreign bribery and up to another 20 for securities fraud, wire fraud, obstruction of justice, and conspiracy charges. Given the seven co-defendants across Adani Group, Adani Green, and Azure, the trial, if even permitted, would take years to get underway. Since current SEC Chair Gensler is stepping down at the end of Biden’s term it gives less legs to the case. Trump’s appointee is far less likely to care about ESG driven cases and could easily be dismissed.

Macro

India aims to finalize carbon deals with Japan, Singapore, Sweden, South Korea, and Germany. India is looking to attract investment and technology to be deployed on projects to generate carbon credits which could be traded internationally to curb companies' emissions. A bilateral agreement with Japan is likely to be signed by 2H25 and other countries nearer to 2026. Implementation and talks regarding deals came about under the Paris Agreement and COP29 talks. (Business Standard)

Equities

Unilever plans on listing its ice cream brand to raise more capital and let the company operate more dynamically. Unilever has a 20 percent stake in the global ice cream market and the listing will allow Unilever to become more competitive without having to sell off the entire business. The Mumbai-based business has missed quarterly estimates the last four earnings seasons. (BBG)

India’s largest IVF provider, Indira, is weighing a $400 million (Rs. 33.6 billion) IPO backed by EQT. The Stockholm-based investment fund is currently weighing decisions and nothing has been set in stone including time, size, or valuation. Experts value Indira around $2.5 billion (Rs. 210 billion). Indira completes around 40,000 IVF cycles each year in India. (Economic Times)

Adani Green slumps as foreign investors halt capital flows amid the US probe. Shares of Adani Green fell 11 percent after Gautam Adani was indicted in the US on bribery charges. Companies like TotalEnergies have halted investment since others are worried about Adani’s ability to continue expanding now that foreign credit could be difficult to acquire. TotalEnergies owns nearly 20 percent of Adani Green but has a fiduciary duty to protect its European investors; it is unclear on if they plan on selling any of their minority stake. (Reuters)

India’s stocks extend rally as the BJP wins more seats in Maharashtra. The BJP sweep in some of the most important economic state polls led to a 1.3% gain in Indian indices. The elections also gave a catalyst to markets which have recently fallen near correction territory since the BJP stands as the pro market party still. (Reuters)

Alts

Adani’s legal troubles are likely to worsen due to investor lawsuits. Companies like Avon and Petrobras have had to pay a few million up to $3 billion (Rs. 252 billion) to settle investor lawsuits after the US government brought action against them. Additionally, since the Justice Department is bringing a criminal suit Adani could become a prisoner of his own country since Interpol can put such individuals on an international arrest list. (BBG)

Vedanta offers a dollar-bond in test of international demand for Indian offerings post the Adani scandal coming to light. The sale was meant to happen last week but was halted after the SEC and DoJ indicted Adani on calls of volatility. The offering is the second in two months for the precious metals mining company. The note is going to be callable and will be offered in two tenors, one in 3.5 years and one maturing in 7 years. Vedanta is looking to improve its own financial positioning by extending some maturities and offering refinanced debt. (BBG)

Policy

Silence from BJP and other political allies shows that Adani has some political cover. While Modi and other BJP parliamentary members are facing questions regarding involvement from Adani, the infra company is key to development for many states. Silence from Modi and other allies gives Adani cover from being investigated further within India. Parties in Andhra Pradesh and Bihar have particularly stayed quiet since major infrastructure projects were completed by Adani. (Reuters)

Indian clearing firms see likely diversification of ownership. Currently, the NSE and the BSE have the largest stakes in clearing firms which SEBI is looking to diversify. SEBI wants to make clearing houses more diversified in order to strengthen their position as public utilities. This would cut profits immensely at both the NSE and BSE, both of whom operate different major indices since they would have to offload at least 49% of their shares. Both entities received 17-19% of their net income from clearing houses. (Economic Times)

See you Wednesday

Written by Yash Tibrewal, Edited by Shreyas Sinha

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 84.36 Indian Rupee