Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

Brazil wants to triple trade with India,

SEBI to loosen credit rating restrictions,

and India’s government is stepping up pressure on domestic coal producers to improve fuel quality

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

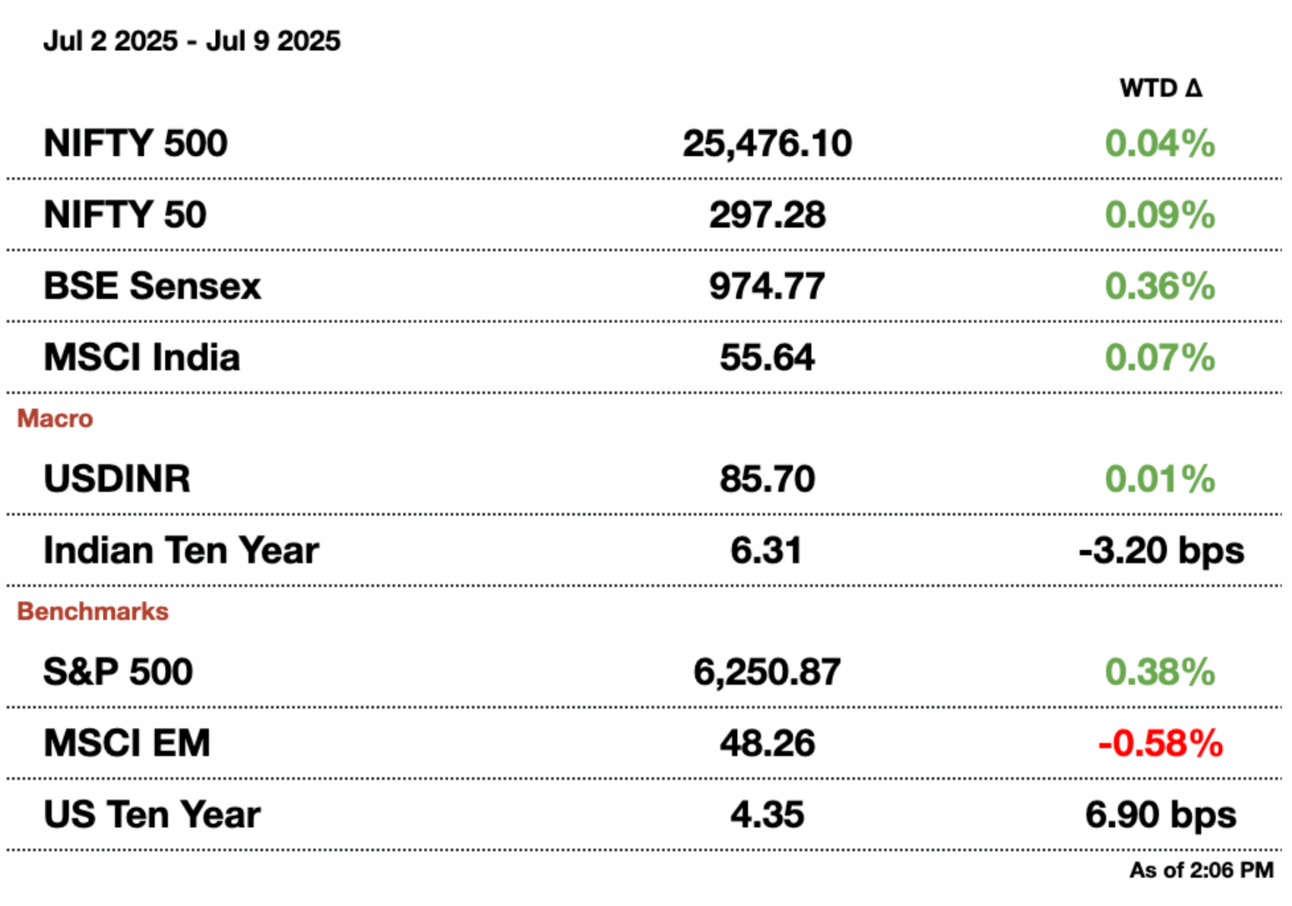

Market Update.

India-Brazil Trade to Triple?

Brazilian President Luiz Inacio Lula da Silva has set an ambitious goal to triple trade flows with India “in the short term,” aiming to build on the $12 billion (₹1 trillion) exchanged last year as both countries look to unlock more South-South economic potential. The comments came during Indian Prime Minister Narendra Modi’s state visit to Brasilia, where both leaders signaled a renewed push to remove barriers and deepen commercial ties.

Lula said that broadening the preferential trade agreement between India and the Mercosur bloc, which includes Brazil, Argentina, Uruguay, and Paraguay, could help lower tariff and non-tariff hurdles that have historically constrained bilateral trade. For India, this could create fresh opportunities for exporters in sectors like pharma, machinery, and IT services, while giving Brazil more access to India’s vast consumer market for commodities and aircraft.

Brazilian planemaker Embraer, for instance, sees India’s fast-growing aviation sector as fertile ground for expansion and is seeking new partnerships with local companies to boost its footprint.

Strategically, closer Brazil–India trade ties fit squarely into both nations’ efforts to diversify supply chains and hedge against developed-market volatility. For India, deeper engagement with Latin America complements its broader pivot to new markets and aligns with its BRICS agenda to rebalance global trade flows. With both sides signaling clear political will, an expanded deal with Mercosur could mark a tangible step toward a more resilient, multi-polar trade architecture that supports their longer-term growth ambitions.

India Wants to Loosen Credit Rating Restrictions.

India’s market regulator SEBI is weighing a move to allow credit rating agencies to expand their scope beyond instruments it directly regulates, a shift that could add depth to the country’s evolving credit ecosystem. In a consultation paper released Wednesday, SEBI proposed that agencies could rate financial instruments overseen by other regulators, including unlisted securities and products outside traditional capital markets.

Under the draft plan, any agency wishing to rate such non-SEBI instruments would need to create a separate business unit within six months and maintain strict operational independence from its SEBI-regulated ratings operations. The move aims to prevent conflicts of interest and ensure credibility as agencies diversify revenue streams. Importantly, ratings for these instruments must be fee-based, a push to curb any potential ‘rating shopping’ or free advisory overlap.

The proposal, under new SEBI Chairman Tuhin Kanta Pandey, reflects a more pragmatic regulatory stance and comes amid calls from industry stakeholders for clearer avenues to assess risk in India’s growing pool of unlisted and alternative credit products.

For India’s broader macro landscape, expanding the role of rating agencies could support financial deepening, improve transparency in private debt and structured finance, and help investors better price risk in segments that have historically lacked standardized benchmarks. If implemented thoughtfully, it may strengthen investor confidence and fuel demand for more sophisticated credit instruments, a key pillar as India pushes to channel more household savings into productive long-term capital.

India Cracks Down on Poor Coal Quality.

India’s government is stepping up pressure on domestic coal producers to improve fuel quality, responding to mounting complaints from the power sector about stone-tainted, low-grade shipments that raise costs and strain the country’s power supply chain. The power ministry has proposed tougher measures, including mandatory testing of coal quality upon arrival at plants and more rigorous sampling from deeper layers of stockpiles, a practice meant to catch discrepancies that surface checks often miss.

The push marks a significant shift for Coal India Ltd. and other suppliers, who have long billed customers based on quality assessments made at the mine site, where discrepancies often go unchecked once the coal is loaded. When plants receive coal with lower calorific value or unwanted debris like mud and stones, they must burn more fuel to generate the same power, driving up costs and increasing pressure on India’s already stretched railway network.

The stakes are high for a power sector that still depends on coal for over 70 percent of its generation capacity. Poor coal quality not only erodes profit margins for utilities but also passes hidden costs onto consumers in the form of higher tariffs and unreliable supply.

“India is turning from a seller’s market into a buyer’s market for coal,” said Rupesh Sankhe of Elara Capital, warning producers that customer scrutiny will only intensify. For India’s broader energy security and inflation outlook, more accountability in the coal supply chain could help reduce transport bottlenecks, cut wastage, and ease the burden on households already facing rising utility bills.

Gupshup.

Macro

India’s fear gauge has dropped to its lowest in nearly a year, showing that worries over the Jane Street probe and US trade deal delays aren’t shaking markets. Traders say low volatility and steady hedging costs suggest minimal impact on equities.

India plans to launch a $290 million (₹24.9 billion) incentive program to boost domestic rare-earth magnet production and cut its dependence on China. Companies like Vedanta and JSW are interested, but success will hinge on local mining, tech partnerships, and overcoming China’s market dominance.

Equities

Vedanta shares dropped after short-seller Viceroy Research called its parent group’s structure a hidden risk to creditors. Vedanta rejected the report as misleading, but investors remain wary about transparency and debt refinancing.

Bernstein says India’s stock momentum will rely more on earnings upgrades as valuations stay stretched. The firm now recommends buying companies with improving profit outlooks, especially in tech, materials, and energy.

Indian stocks are bracing for a volatile session as Trump’s fresh tariff threats on copper and pharma imports add to jitters about possible new curbs on derivatives trading. BSE options volumes have held steady after the Jane Street ban, but market players remain cautious amid pressure on capital market stocks and concerns over individual investor losses in derivatives.

IHH Healthcare plans to expand into Indonesia and Vietnam as it builds scale to manage rising healthcare costs across the region. The Malaysian hospital operator also aims to grow in China and boost out-of-hospital services in existing markets like India and Singapore to diversify its revenue and control expenses.

ICICI Prudential Asset Management has filed for a $1.2 billion (₹102.8 billion) IPO, likely to be India’s second-biggest this year. The country’s second-largest mutual fund aims to unlock value for UK-based Prudential, which will trim its stake ahead of the listing.

Reliance Jio has decided to delay its highly anticipated India IPO beyond this year to grow revenue and expand its digital businesses first. The Ambani-led company, valued at over $100 billion (₹8.6 trillion), aims to boost its valuation before tapping public markets.

Elon Musk’s Starlink has received its final regulatory approval to launch commercial operations in India. The satellite provider now joins OneWeb and Reliance Jio but must still secure spectrum, build ground infrastructure, and pass security checks.

Asian Paints has sold its entire 4.42 percent stake in Akzo Nobel India for about $85.7 million (₹7.34 billion) through bulk deals. The exit comes just weeks after JSW Paints announced India’s biggest paint sector deal to buy Akzo Nobel’s local arm, signaling intensifying industry competition.

Alts

Two Adani Group units are close to raising $250 million (₹21.4 billion) in offshore loans from MUFG as investor confidence improves. The funding follows an oversubscribed bond sale and shows lenders backing the conglomerate despite past controversies.

IndianOil-Adani Gas plans to raise up to $161 million (₹13.8 billion) through convertible bonds to fund its city gas distribution expansion. The move supports India’s push to boost natural gas’s share in the energy mix to 15 percent by 2030.

India will release a preliminary report this week on the deadly Air India Boeing 787 crash that killed nearly all on board. The findings will give the first official explanation, based on cockpit and flight data recorders, as global airlines watch closely.

Ten people were killed when a bridge collapsed in Gujarat’s Vadodara district, according to NDTV. Rescuers are searching for survivors at the site of the disaster in India’s western state.

India’s Zepto is set to raise $450–$500 million (₹38.6-Rs.42.8 billion) at a $7 billion (₹600 billion) valuation, up 40 percent from last year. The grocery delivery startup is reportedly finalizing the deal as it gears up for a future India listing after shifting its base from Singapore.

Adani Enterprises’ latest public bond issue was oversubscribed on launch day, with bids reaching $175 million (₹15 billion) against a target of $117 million (₹10 billion). Bankers say the strong demand could see the company tap the bond market more frequently as it offers attractive coupons and trims its debt schedule.

GAIL India has extended its gas supply agreement with Oil India for 15 more years, ensuring up to 900,000 standard cubic meters per day will flow to a Rajasthan power plant. The deal strengthens GAIL’s pipeline network utilization as it continues to expand its role in India’s energy infrastructure.

Policy

Trump’s threat to impose new tariffs on India over its BRICS role complicates New Delhi’s push to secure a favorable US trade deal. Officials hope India’s neutral stance on a BRICS currency will help ease tensions and keep the trade talks on track.

India plans to launch a $290 million (₹24.9 billion) incentive program to boost domestic rare-earth magnet production and cut its dependence on China. Companies like Vedanta and JSW are interested, but success will hinge on local mining, tech partnerships, and overcoming China’s market dominance.

India’s iron ore pellet makers have asked the government to curb a surge in imports they claim are Iranian-origin pellets routed through Oman to bypass US sanctions. The industry warns that these cheaper imports, driven by high domestic prices, could hurt local manufacturers and has petitioned the steel ministry to investigate.

See you Thursday.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.