We are incredibly excited to announce the launch of Samosa Capital’s Investors Club! By joining, every month you’ll receive a research book giving you actionable information on an India-based opportunity. Each report is written through extensive data-driven research and interviews with experts.

To give you a sense of what we do, we’re offering all readers a complimentary Investing in India book that breaks down the opportunity, the macroeconomic landscape, and key investing themes.

You can download the report below, or click here.

Joining our investors club requires an annual subscription of $299. If you would rather get another taste of our monthly investment books first, you can just buy our January 2026 Research Report below.

Ready to join our Investors Club? Click below.

Anyways, onto today’s daily briefing: India’s FY26–27 budget is walking a tightrope: tighten the purse strings without killing growth. Today, we explain more.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

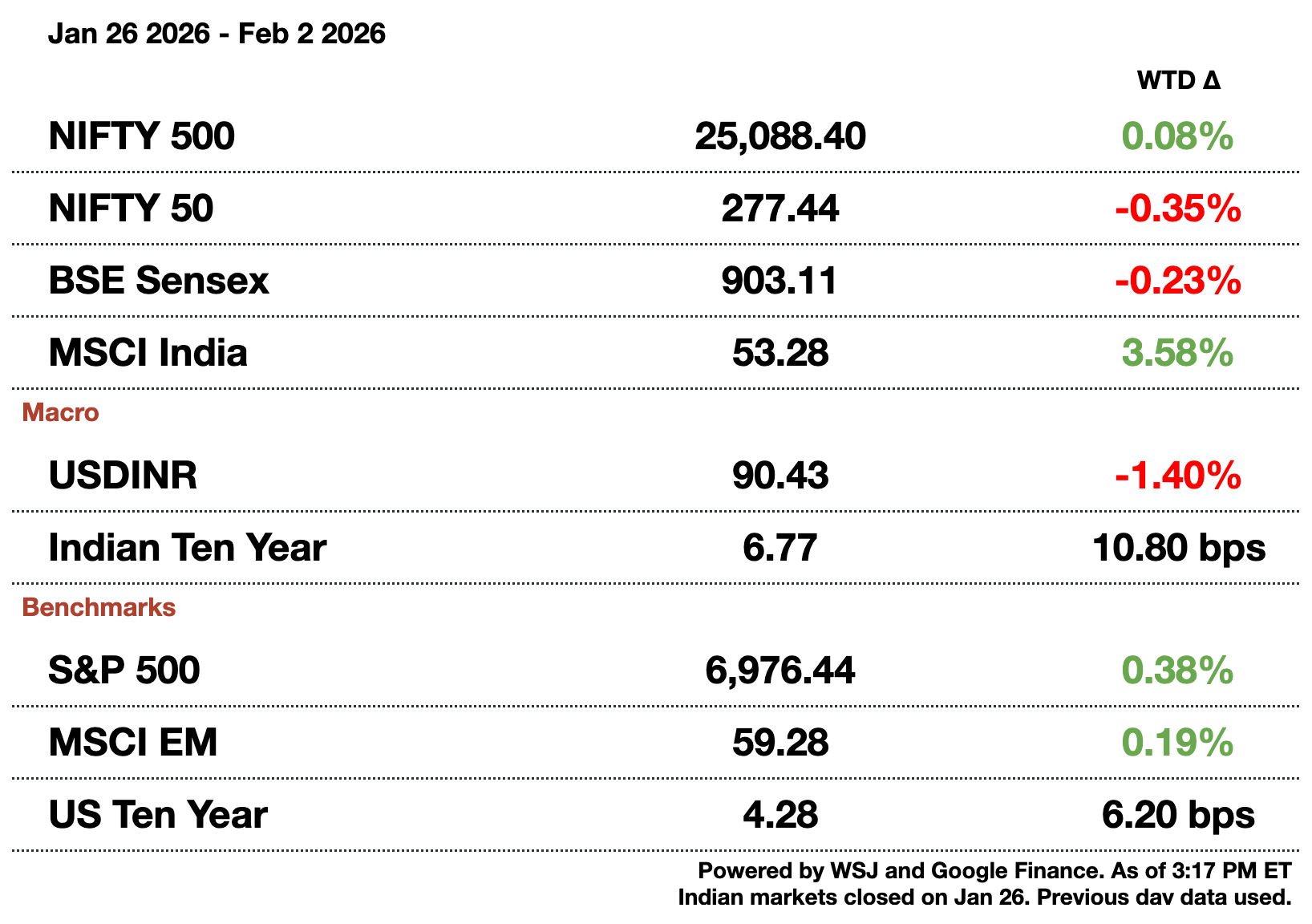

Macro

The rupee, weighed against 40 other currencies, is now at its weakest level since 2014. Weak currencies normally draw in global investors but India still faces a growing share selloff.

The Ministry of Statistics and Programme Implementation recommends reducing the weight of food in inflation gauges. The reduction would take it to 36.75 percent from 45.86 percent; food inflation rarely is affected by monetary policy and is rather affected more by supply-side inflation. This would majorly affect how the RBI sets its rates to keep inflation from 2-6 percent.

Gold imports dropped 11 percent y-o-y to 710.9 tons in 2025 and is expected to further decline.Gold has risen over 25 percent (even with today’s hit). Global consumption volumes slumped to a 5y low of 1,542 tons with demand falling across all key markets; demand in India slumped by 24 percent.

Equities

CNBC is predicting a NSE IPO within the next 7-8 months. The NSE recently settled two litigations with SEBI for $141 million (₹13 billion) which cleared the way for SEBI to approve the IPO process just last week.

Key share sellers in the NSE $2.5 billion (₹229.8 billion) are going to be Temasek and the Life Insurance Corp of India. Existing shareholders will likely offer up between 4 to 5 percent of the company, valuing it at about $58 billion (₹5.3 trillion) in the current private market, making it the world’s 4th most valuable exchange.

Alts

Global LNG producers were dismayed after India's energy conference with import growth stalling. India is the 4th largest global importer but is stalling on locking decades-long contracts until prices fall at least 10 percent. Indian buyers are confident the world will tip into oversupply but production costs have risen, particularly in the world’s largest exporter the US.

Policy

India's Economic Survey puts the pressure on age-restrictions on social media apps, not the state. While Andhra Pradesh is looking at Australia’s social media laws for state enforcement, the federal government is open to letting companies enforce rules.

Coking coal has been classified as a critical mineral to boost supply. 95 percent of coking coal — used for creating steel — is imported from overseas. The government is trying to boost private sector investment especially since coking coal is even used for heating and energy at times.

At the same time, the US and India discussed expanding coal trade. India would use US technology for coal gasification and carbon capture. For the US, it accounts for only 10 percent of India’s met coal imports and it can tap into the growing market.

Indian Parliament

An Overlook of India’s New Budget Changes

India’s FY26–27 budget is walking a tightrope: tighten spending without killing growth. The government pegged nominal GDP growth for FY27 at 10 percent, with the fiscal deficit targeted to narrow to 4.3 percent of GDP, down from 4.4 percent a year earlier. Public debt is projected to decline gradually, with policymakers reiterating a medium-term goal of bringing the debt-to-GDP ratio to about 50 percent by FY31.

Tax buoyancy assumptions softened, with gross tax revenue growth budgeted at 8 percent y-o-y, reflecting slower indirect tax growth amid a contraction in GST receipts. Direct taxes remain the primary driver, expected to rise more than 11 percent. On the spending side, capital expenditure was held steady at $132.8 billion (₹12.2 trillion), equivalent to 3.1 percent of GDP, underscoring the government’s continued reliance on public investment to bring in private capital.

A centerpiece of the budget was a renewed focus on scaling up manufacturing across seven strategic sectors, including semiconductors, electronics components, biopharma, chemicals, rare earths and textiles. The government expanded the Electronics Components Manufacturing Scheme to $4.4 billion (₹400 billion) and announced “Semiconductor Mission 2.0” to deepen domestic capabilities. Dedicated rare earth corridors and new chemical parks aim to reduce import dependence in critical supply chains.

Infrastructure and logistics also received sustained attention. New freight corridors, 20 national waterways and seven high-speed rail links are intended to lower transport costs and improve connectivity between industrial clusters. An Infrastructure Risk Guarantee Fund will be set up to mitigate construction-phase risks for private developers.

The budget introduced sweeping changes to the tax framework to improve certainty and ease of doing business. Corporate tax reforms included a reduction in the Minimum Alternate Tax rate to 14 percent, changes to buyback taxation, and a significant extension of tax holidays for units in International Financial Services Centres, with post-holiday income taxed at 15 percent. Transfer pricing rules were simplified through expanded safe-harbor regimes for IT services and data centers, while penalties were increasingly replaced with fee-based compliance mechanisms.

Sector-specific incentives featured prominently. Defense spending rose sharply, with capital outlays up nearly 22 percent, while the government unveiled a $1.1 billion (₹100 billion) “Biopharma SHAKTI” program to build a global pharmaceutical manufacturing hub. Agriculture policy emphasized technology adoption, high-value crops and AI-enabled advisory platforms to boost farm productivity and incomes.

Taken together, the budget signaled continuity rather than surprise: disciplined fiscal math paired with targeted industrial policy, reflecting India’s ambition to anchor growth in manufacturing, exports and infrastructure while keeping public finances on a tightening path.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.