Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

Apple assembled ~$22 billion of iPhones in India in the last 12 months,

Global investors are increasingly eyeing Indian assets as a relative safe haven,

and India’s polished diamond exports plunged to their lowest level in nearly two decades.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

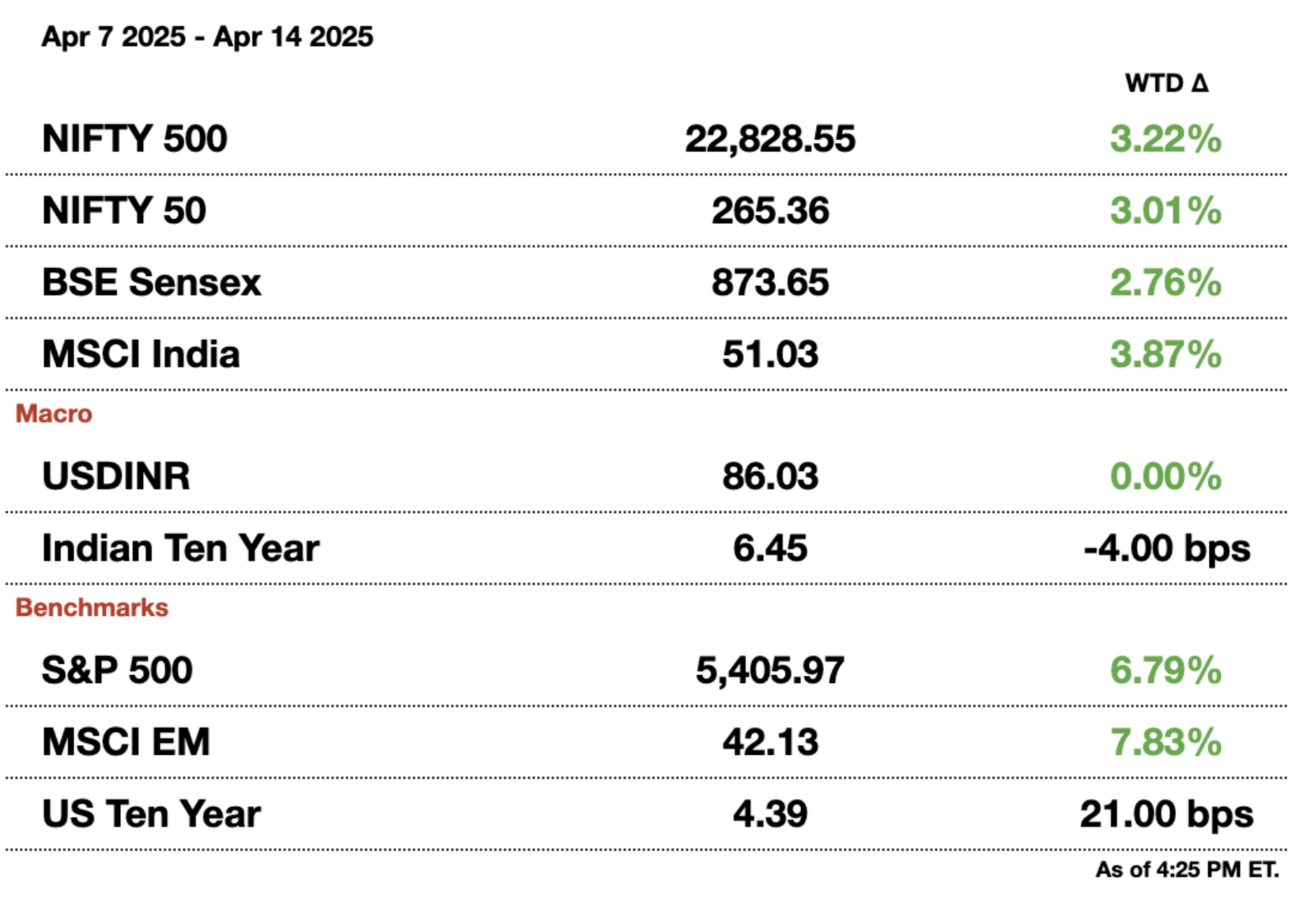

Market Update.

Apple is Ramping Up in India.

Apple has significantly ramped up its operations in India, assembling approximately $22 billion (₹1.9 trillion) worth of iPhones in the last twelve months — a nearly 60 percent jump over the previous year. This surge underscores the tech giant’s ongoing effort to diversify its supply chain away from China, a shift accelerated by earlier disruptions during the pandemic. With one in every five iPhones now assembled in India, the company is increasingly leaning on its South Asian facilities as a strategic alternative to its traditional Chinese base.

An Apple store in Mumbai

The bulk of India’s production takes place at Foxconn’s facility in the south, with support from key local suppliers such as Tata Group’s electronics manufacturing arm, which acquired stakes in both Wistron and Pegatron operations. This expansion is not merely a response to past production hiccups but a calculated pivot driven by evolving global trade dynamics.

Continued growth: Following President Trump’s announcement of reciprocal tariffs, shipments of iPhones from India to the US surged, with exports reaching an estimated $17.4 billion (₹1.5 trillion) in the fiscal year ending in March. Recent developments further bolster Apple’s India play. When the Trump administration exempted electronics from its tariff regime, it opened a window for Apple to continue its aggressive supply chain realignment without incurring additional duties on its India-made devices. However, challenges remain: the company still depends on nearly 200 suppliers and retains a heavy reliance on China, making a complete transition a long-term endeavor. An estimate found that relocating 10 percent of Apple’s total production from China could take up to eight years.

Benefits for India: Manufacturing in India has not only allowed Apple to navigate tariff pressures but also aligns with Modi’s broader vision of transforming the country into a global manufacturing hub. State subsidies and new financial incentives worth $2.7 billion (₹232.3 billion) are being funneled into expanding the electronics component sector and advancing semiconductor capabilities, further entrenching India’s role in the global tech ecosystem.

In addition to ramping up production of standard models, Apple now assembles its entire iPhone range in India, including the premium titanium Pro models. With a growing 8 percent market share in India’s smartphone sector and fiscal 2024 sales nearing $8 billion (₹688 billion), the company’s India venture is proving successful both as an export powerhouse and as a critical domestic revenue driver.

Global Markets See India as Haven, Not EM.

As the US-China trade war intensifies following Trump’s tariffs, global investors are increasingly eyeing Indian assets as a relative safe haven. An MSCI gauge of India’s stocks has dipped by less than 3 percent since the April 2 tariff barrage—roughly half the decline observed across other Asian markets. Indian bonds, buoyed by a more accommodating stance from the RBI, have similarly bucked the global selloff, underlining a broader confidence in the nation’s economic fundamentals.

A more robust domestic economy: This sentiment is further reinforced by New Delhi’s pragmatic approach to trade negotiations. Unlike Beijing’s aggressive retaliatory measures, the Indian government has adopted a conciliatory tone, actively pursuing a provisional trade agreement with the Trump administration within the next 90 days. Such diplomacy not only mitigates immediate tariff risks but also positions India as an attractive manufacturing alternative as supply chains gradually shift away from China.

Manufacturing capabilities: Recent reports indicate that India’s smartphone shipments surged by 54 percent in the fiscal year through March 2025, with Apple exporting more than $17.4 billion (₹1.5 trillion) worth of iPhones from the country during the same period. Investors view this diversification away from China as a promising indicator of long-term growth potential. Sectors less exposed to volatile trade dynamics, supported by active domestic capital flows — $25 billion (₹2.2 trillion) y-t-d — offer further reassurance. Most Indian companies are expected to hit double-digit earnings later this year.

Sector specific: There is some volatility in software and pharma but the overall outlook is robust. Lower reliance on the US market, coupled with favorable domestic policies and the RBI’s proactive measures in cutting rates and injecting liquidity, bolsters this perspective. The relatively insulated export figures also make India overweight compared to regional rivals.

In an environment where the US continues to impose high tariffs on Chinese goods, India’s exposure remains modest; the nation accounted for just 2.7 percent of total US imports last year, in stark contrast to 14 percent for China and 15 percent for Mexico. Even with short-term export pressures potentially trimming the fiscal 2026 GDP growth projection by 0.3–0.4 percentage points from an anticipated 7.2 percent, the medium-term outlook remains positive under expectations of a timely trade agreement.

Moreover, the RBI’s aggressive monetary easing has not only supported the bond market but has also set the stage for increased government borrowing to fund vital infrastructure projects. With domestic investors showing unwavering support and a strategic policy framework in place, India appears poised to emerge as a relative outperformer amid the uncertainties of the US-China trade conflict.

India’s Polished Diamonds Hit Two-Decade Low.

India’s polished diamond exports plunged to their lowest level in nearly two decades in the 2024–25 fiscal year, as demand from key markets like the United States and China remained sluggish. According to the Gems and Jewellery Export Promotion Council (GJEPC), exports of cut and polished diamonds fell by 16.8 percent year-on-year to $13.3 billion, dragging down the country’s total gem and jewellery exports by 11.7 percent to $28.5 billion—a four-year low.

India, which processes about 90 percent of the world’s diamonds in cities like Surat, has long been a global hub for diamond cutting and polishing. But the sector is highly sensitive to global economic conditions, especially in the U.S., which accounts for over 30 percent of India’s gem and jewellery exports. Uncertainty around interest rates, inflation, and consumer spending in the West has led to more cautious buying behavior, hitting Indian exporters hard.

While March saw a modest 1 percent year-on-year rise in gem and jewellery exports, industry experts attribute that to a temporary rush by U.S. buyers and Indian exporters to beat a planned 27 percent tariff on Indian goods. Although Washington later delayed the tariffs by 90 days, the brief surge isn’t expected to offset the broader downturn. Rough diamond imports into India also fell sharply, down 24.3 percent to $10.8 billion, reflecting reduced processing activity.

Message from our sponsor.

Apple’s Starlink Update Sparks Huge Earning Opportunity

Apple just secretly added Starlink satellite support to iPhones through iOS 18.3.

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone already reaches +45M users that have earned over $325M, and that’s before global satellite coverage. With SpaceX eliminating "dead zones" worldwide, Mode's earning technology can now reach billions more.

Mode is now gearing up for a possible Nasdaq listing (ticker: MODE) but you can still invest in their pre-IPO offering at $0.30/share before their share price changes.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

Gupshup.

Macro

India's inflation in March is likely to be steady after 4 months of decline. Consumer prices for gold went up, offsetting the decrease seen in food and produce. For perspective, the economist poll projects inflation at 3.6 percent for March compared to 3.61 percent in February. Food prices also fell less than expected due to uneven rainfall patterns.

Equities

Managing director of Gitanjali Gems, Choksi, was arrested over a $1.8 billion (₹154.8) bank fraud. Punjab National Bank found fraud at one of its branch locations and filed charges, leading to the arrest. Choksi was arrested in Belgium and has filed for release, though India does have extradition rights against him.

Alts

BofA looks to rebuild the Indian IB team after various scandals. There were share sales and multiple senior banker resignations last year, but the bank is back in talks to fill senior roles. It currently ranks 7th for deal flow in India for equity capital market transactions, but does not even crack the top 10 for M&A advisory.

Indian gas firm GAIL is seeking a 26 percent stake in US LNG in addition to a 15-year import agreement. It wants a minority stake in an existing LNG project or one that can be commissioned by 2030. Overall, the goal is for 1 million metric tons of LNG on a free-on-board basis due to the import agreement; the deal would also have options to extend the period by 5-10 years.

Policy

India is eyeing to wrap up key aspects of the US FTA within 6 weeks. India is starting sector-specific talks today virtually with the US. Some sectors, like tech, do not require much negotiation, but agriculture and consumer retail will be tough negotiations for both sides. India has many tariffs and minimum price floors for farmers, which would cause short-term pain to roll back.

India and China are going to talk about resuming flights. So far, there has only been one round of talks. The Indian leader for the aviation branch of the government said there has been progress, but some disputes still remain. Direct cargo flights have continued even though passenger stopped.

See you Tuesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.