Good afternoon,

Welcome to the best way to stay up-to-date on India’s financial markets. Here’s what’s in today’s newsletter:

India’s two most powerful industrial groups, Reliance Industries and the Adani Group, are joining forces,

India’s private refiners are tightening their grip on Russian Urals crude,

and India is ramping up efforts to secure long-term access to copper.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form, and you could be featured in our newsletter.

—Shreyas, [email protected]

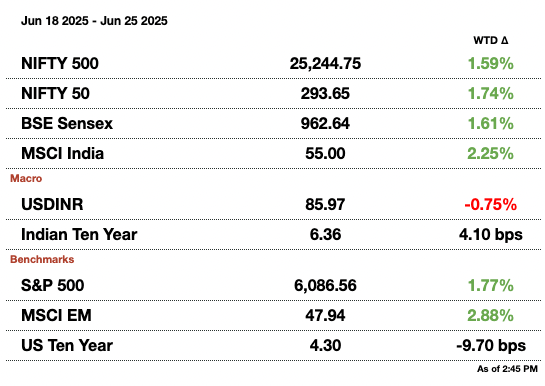

Market Update.

Ambani-Adani Fuel Alliance.

India’s two most powerful industrial groups, Reliance Industries and the Adani Group, are joining forces to expand their fuel retail footprint, signaling a broader shift in how private players are responding to structural bottlenecks in India’s tightly regulated energy sector.

Ambani (left) and Adani (right)

Under the agreement announced this week, Reliance’s Jio-bp venture will set up gasoline and diesel dispensers at Adani Total Gas’s compressed natural gas (CNG) stations, while Adani will install CNG facilities at Jio-bp outlets. The strategic partnership enables both companies to leverage each other’s physical infrastructure, improving cost-efficiency and extending reach in a market where 90 percent of fuel retail is still dominated by state-run oil marketing companies.

The collaboration comes at a time when India, the world’s third-largest oil consumer, is seeking to balance its ambitious energy transition targets with rising fuel demand. Yet private fuel retailers have long been constrained by price controls, which disproportionately impact non-state players during periods of volatile crude prices. By pooling resources, Reliance and Adani are signaling a pragmatic response to these systemic challenges—prioritizing scale, synergy, and supply chain optimization over head-to-head competition.

At a macro level, the alliance illustrates how India’s private sector is evolving from fragmented market participation toward collaborative models that align with national energy resilience goals. It also reflects a broader industrial policy moment: public-private competition is giving way to consolidation and convergence, particularly in capital-intensive sectors like energy, logistics, and infrastructure.

With both firms increasingly influential in shaping India’s decarbonization and energy diversification strategies, this move could mark the beginning of deeper cooperation, potentially extending to EV charging, green hydrogen, and beyond.

India’s Private Refiners Reshape Oil Trade.

India’s private refiners are tightening their grip on Russian Urals crude, cementing the country’s position as a key player in global oil markets. According to data from Kpler, India has taken in 231 million barrels of Urals so far in 2025, amounting to 80 percent of Russia’s total seaborne exports of the grade. Reliance Industries and Nayara Energy alone accounted for nearly 45 percent of Russia’s shipments, highlighting a strategic shift in India’s energy sourcing.

Reliance, now the world’s single largest buyer of Urals, has sharply increased its intake since signing a 10-year supply agreement with Russia. Urals now make up 36 percent of Reliance’s crude basket, up from just 10 percent in 2022. Nayara, which is part-owned by Russia’s Rosneft, has seen an even sharper rise, with the grade accounting for 72 percent of its intake.

This growing reliance on Russian oil reflects a broader trend: India’s private sector is exploiting geopolitical discounts to secure energy security and cost advantages. Meanwhile, state-owned refiners like Indian Oil and Bharat Petroleum are pursuing a more diversified strategy, tapping African and Middle Eastern sources due to currency and policy constraints.

The macroeconomic implications are significant. India’s trade balance benefits from cheaper crude, which helps moderate inflationary pressures and supports fiscal discipline. At the same time, increasing dependence on discounted Russian oil underscores the country’s diplomatic balancing act amid Western sanctions and volatile global energy markets.

Looking ahead, with OPEC+ hinting at greater production and Chinese demand weakening, India could further consolidate its role as the global swing buyer of crude. The assertive approach of its private refiners not only reshapes trade flows but also signals a maturing energy strategy aimed at long-term price stability and supply diversification.

India Rethinks Copper Strategy.

India is ramping up efforts to secure long-term access to copper as global supplies tighten and resource nationalism rises, posing risks to the country’s industrial ambitions and clean energy transition. According to a draft policy document and government officials cited by Reuters, New Delhi is exploring bilateral trade pacts, foreign investment, and overseas asset acquisitions to counter its heavy dependence on copper imports.

Currently, India imports more than 90 percent of its copper concentrate requirements, a figure projected to climb to 97 percent by 2047. Domestic output of refined copper stands at just 573,000 metric tons annually, while demand has surged to 1.8 million tons. The 2018 closure of Vedanta’s Sterlite Copper smelter significantly widened this gap, with imports rising to 1.2 million metric tons in the fiscal year ending March 2025.

India is now engaging key producers such as Chile’s Codelco and Australia’s BHP to explore setting up local smelting and refining facilities. The government is also seeking to include copper supply guarantees in free trade agreements with Chile and Peru, though both countries already have strong supply commitments to China, complicating India’s access.

Macro-level concerns are intensifying. As countries like Indonesia and China restrict exports of strategic minerals, India is increasingly exposed to supply shocks. The draft policy calls for state-run firms like Khanij Bidesh India Ltd to acquire copper and other critical mineral assets in countries including Chile, Peru, and Mongolia.

Copper is essential for India’s infrastructure, power transmission, and electric vehicle goals. Without secure access, industrial growth and decarbonization efforts could be at risk. The government’s evolving strategy reflects a growing awareness that mineral security is now central to long-term economic resilience and geopolitical autonomy.

Gupshup.

Macro

Indian shares climbed on Wednesday, with the Nifty and Sensex hitting multi-month highs, driven by gains in Reliance Industries and IT stocks. A ceasefire between Israel and Iran boosted global risk sentiment, further lifting markets.

The Indian rupee strengthened slightly as easing geopolitical tensions and falling U.S. yields boosted Asian markets. Forward premiums also rose after the RBI announced a liquidity withdrawal plan, lifting short-term and long-term rates.

China and India are reducing their imports of Indonesian thermal coal in favor of higher-calorific value coal from other sources, as falling global prices make energy-dense coal more competitive.

India’s Nuclear Power Corporation (NPCIL) has extended the deadline to September 30, 2025, for companies to submit proposals to set up 220 MW small nuclear reactors, reflecting growing industrial interest in cleaner energy. NPCIL will now review proposals on a rolling basis, with several firms already engaged in collaboration.

India’s central bank, the Reserve Bank of India, sold a net $1.66 billion (₹142.7 billion) in the spot forex market in April, according to its monthly bulletin. Despite challenges like U.S. trade policy changes and India-Pakistan tensions, the rupee strengthened due to equity inflows and increased dollar sales by exporters.

Equities

Vodafone Idea is seeking $2.9 billion (₹249.4 billion) in loans to upgrade its network and regain market share, with SBI likely leading the funding consortium. The 10-year loan mix of domestic and foreign debt aims to support capital spending amid ongoing subscriber losses and hopes of government relief.

Shares of MCX jumped to a record high after UBS projected over 20 percent upside, citing strong commodity price volatility and new product launches. The exchange's stock is up nearly 40 percent this year, with UBS highlighting continued leadership despite rising competition.

HDB Financial’s $1.4 billion (₹120.4 billion) IPO opens today amid weak performance in India’s IPO market, with nearly half of 2025 listings trading below issue price. Investors are watching it closely as the broader BSE IPO index is down over 5 percent this year, its worst start since 2022.

JSW Steel has filed a review petition with India’s Supreme Court challenging the rejection of its $2.3 billion (₹197.8 billion) takeover plan for Bhushan Power and Steel, after the court ordered the company’s liquidation last month but temporarily halted the proceedings.

Bharat Biotech and GSK will cut the price of their malaria vaccine to below $5 per dose by 2028, more than halving its current cost, as GSK transfers production technology to Bharat, which will fully produce the vaccine by then.

Alts

State Bank of India has picked six banks, including Citi, HSBC, and Morgan Stanley, to manage a $3 billion (₹258 billion) share sale, one of the country's largest equity raises. The move comes as Indian bank stocks near record highs, prompting renewed fundraising efforts.

Flying anxiety in India has surged after the fatal Air India Flight 171 crash, with therapy centers like Bengaluru’s Cockpit Vista seeing a tenfold increase in inquiries. Experts say nonstop media coverage and graphic crash visuals are heightening fears, while travel agents report a dip in bookings and growing passenger avoidance of Boeing aircraft.

India's National Stock Exchange has offered to pay $160 million (₹13.9 billion) to settle a legal dispute with the markets regulator, clearing the way for its long-delayed IPO, marking the largest such settlement in India’s history.

Policy

The Reserve Bank of India will drain $11.6 billion (₹1 trillion) via a reverse repo auction on June 27 to prevent overnight rates from falling too low and fueling inflation. The move aims to support growth while reinforcing policy transmission and maintaining control over short-term borrowing costs.

India’s economy remains resilient despite global trade and geopolitical disruptions, the RBI said in its June bulletin. The central bank cited low inflation as a reason behind its recent rate and reserve ratio cuts to support growth.

The Reserve Bank of India will extend the interbank call money market trading hours by two hours to 7:00 p.m. IST starting July 1, and will also extend market repo and tri-party repo hours to 4:00 p.m. IST from August 1.

India’s markets regulator, SEBI, has instructed stock exchanges to ensure trading members follow through on “corrective actions” after inspections found violations, according to a BSE circular. The inspections, done jointly with exchanges, did not specify the timing or nature of the violations.

See you Thursday.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.