Today’s deep dives: India’s GST cuts show positive impact on domestic demand. Amazon’s 14,000 layoffs are a warning sign for India. Mumbai proves it is becoming a capital markets hub for multinational corporations.

We want to talk to you! Just respond to this email and we’ll set up a time to learn more about how Samosa Capital can be more helpful in your work.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

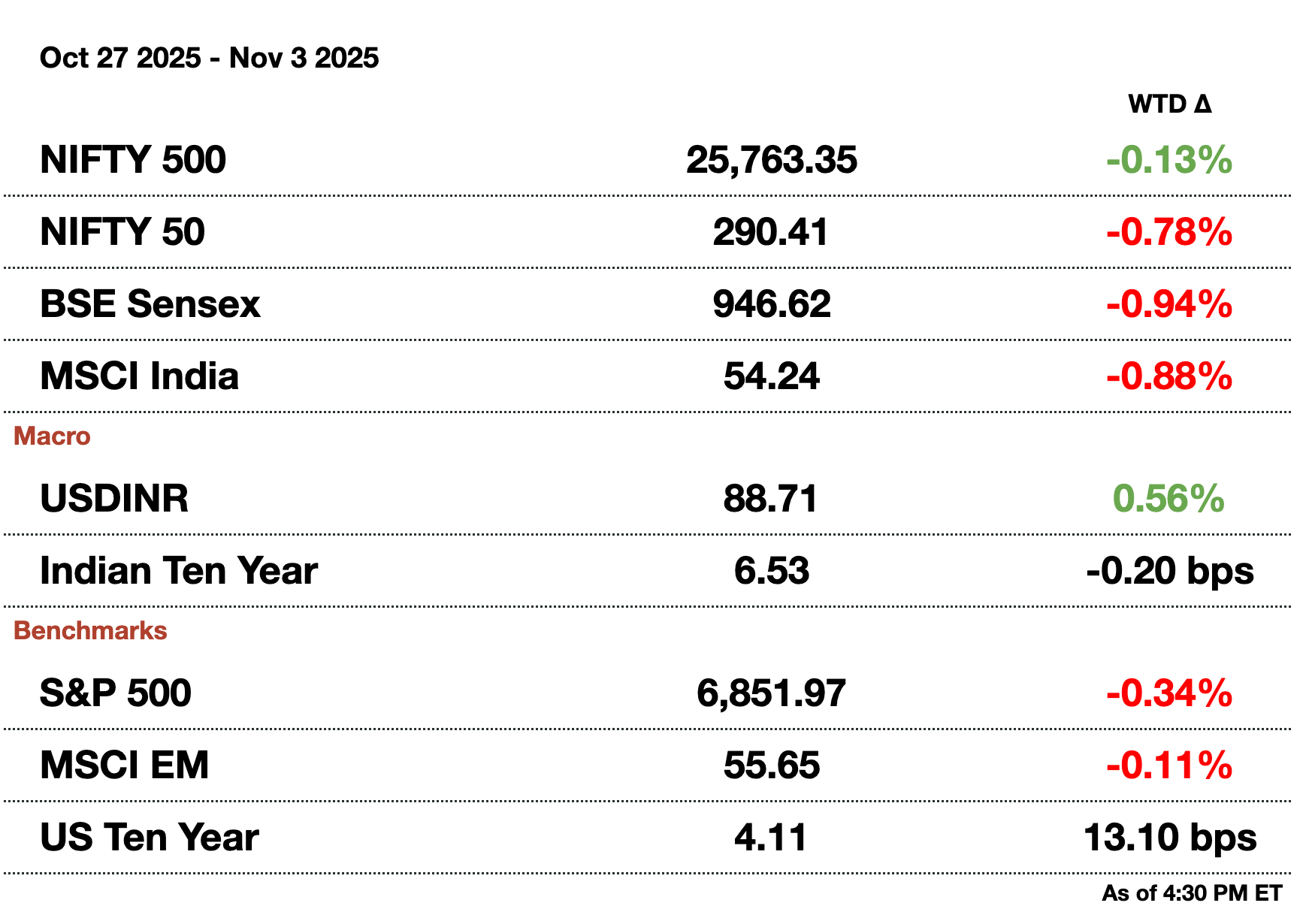

Macro

Pakistan's CPI was 6.2 percent from food prices jumping. The median estimate was 5.5 percent but flooding and geopolitical tensions with India and Afghanistan led to food rising. Rates remain at 11 percent and the central bank warns that inflation will continue to range from 5 to 7 percent.

The RBI's net dollar shorts rose to $59.4 billion (₹5.3 trillion), the highest since 1Q25. The level is still low showing that the RBI does not want to speculate too heavily while allowing for a gradual depreciation in the rupee if the market is moving in that direction.

The rupee, even with RBI intervention, continues to spiral down towards 89.The currency has been Asia’s worst performing this year due to the US’s focus on India plus a lack of RBI intervention earlier in the year.

Equities

Bharti Airtel saw profits soar by 89 percent to $765 million (₹67.9 billion) from new premium subscribers. Investors are now looking for the next wave of price hikes as the additional profit from July phone plan hikes start to wean off.

Lenskart's $821 million (₹73.1 billion) IPO selling out in 5 hours is sparking startup valuation concerns. The principal risk is that mutual funds may be paying too steep valuations for companies yet to establish profitability. The company is valued at 45x forward earnings.

BSE shares swung on Friday after reports say weekly option expiries could drop from 4 to 2. The SEBI Chairman later clarified that dropping expiries is just a rumor, helping to recover the stock. Derivatives traders are still on edge regarding the change, which would tank volume.

PayPal-backed Pine Labs seeks $439 million (₹39.1 billion) for its IPO. The payments provider based in Noida specializes in PoS terminals and operates in 4 countries.

A custom index tracking 10 AI-adjacent companies is up 30 percent since April.The lack of pureplay AI companies means investors have to focus on firms providing electricity, cooling, and construction materials. This also includes AI operators which Adani and Ambani are building.

Alts

HFT firms are continuing to hire even with SEBI cracking down on derivatives markets. Firms like Hudson River Trading are building out their Indian offices even with crackdowns on options contracts in the country.

Companies like Google, Amazon, and OpenAI will have invested over $100 billion (₹8.9 trillion) by 2027 in India. Interest is towards firms that supply power and equipment for AI.

In a rare move, DSP Asset Managers wrote a letter defending their Lenskart investment.The firm invested $10.1 million (₹900 million) as an anchor investor. Managers said they found management compelling with a strong business model but admitted they overpaid.

Policy

The cabinet is mulling over a $788 million (₹70 billion) expansion of its rare earth program. The plan to increase magnet manufacturing is triple its original size and works to combat China which currently dominates the space. Modi has called for the space to be democratic and not controlled by one entity after China started blocking the US from it.

Choose the Right AI Tools

With thousands of AI tools available, how do you know which ones are worth your money? Subscribe to Mindstream and get our expert guide comparing 40+ popular AI tools. Discover which free options rival paid versions and when upgrading is essential. Stop overspending on tools you don't need and find the perfect AI stack for your workflow.

Reach out to [email protected] to reach our audience and see your advertisement here.

1. GST Cut Shows Positive Impact on Consumer Demand

India’s sweeping cut on goods and services taxes (or GST) has ignited a revival in domestic demand, turning the recent festival period into a bellwether for consumption amid global trade headwinds. With the Modi government slashing rates across nearly 400 product categories from late September, households responded swiftly, unleashing an 8.5 percent y-o-y jump in spending during the month-long Navratri-to-Diwali festive cycle. Total sales crossed $67.4 billion (₹6 trillion).

The impact rippled most visibly through the consumer durables and automotive sectors, strong indicators of middle-class sentiment. India’s largest automakers experienced surging deliveries as tax-driven price cuts converged with festival-season buying. Maruti even resorted to Sunday production shifts to handle bookings, reflecting an uptick in first-time car buyers trading up from two-wheelers. That pattern held from jewelry and electronics to kitchen appliances.

Importantly, the rural economy participated in the upswing. Mahindra reported a 27 percent surge in tractor sales supported by favorable monsoon patterns boosting rural incomes, giving policymakers comfort that tax stimulus did not merely fuel urban discretionary spending but also supported broader demand normalization. Meanwhile, banks and card issuers highlighted broad-based spending growth across segments, reinforcing evidence of synchronized consumer participation.

Still, the pickup has not been without friction. Implementation challenges around the new rates disrupted supply chains temporarily, as distributors rushed to liquidate inventory at pre-cut tax levels and consumers deferred major purchases to benefit from lower prices. Economists have cautioned that the strength in festival demand may partly reflect deferred spending rather than entirely new momentum, with a clearer read only emerging after December-January data smooths out base and timing effects. Likewise, structural constraints (soft labor markets and slower income growth) remain drags on long-term consumption.

The consumption recovery is still broadening into housing-linked segments like electricals and wiring which is an early indicator of durable demand recovery. If sustained, the narrative of India being domestic demand led can still return which would also cushion from recent geopolitical challenges.

2. Amazon Layoffs are a Warning for India

Amazon just laid off 14,000 corporate roles, something that should serve as a warning for India. What should worry New Delhi is not the limited direct impact on Amazon’s Indian workforce, but the nature of the roles being cut: finance, HR, marketing, and tech. These are not blue collar or junior analyst roles; they represent the early signs of AI penetrating the professional ladder that India’s young talent views as a gateway to rising incomes and global opportunity.

For a country with the world’s largest youth cohort (375 million people between ages 10 and 24) this shift hits the emerging middle-class aspiration that education can reliably deliver a white-collar job. Urban youth unemployment stands near 18.5 percent, and female labor force participation remains under 22 percent. Outsourcing hubs like Bengaluru and Hyderabad, long India’s competitive edge in global services, are already feeling pressure as large clients automate functions that once relied on young Indian graduates. If AI reaches scale before India completes its transition to a more advanced services economy, the country risks seeing its demographic dividend transform into a structural liability.

Just as mechanized textile production diminished India’s artisanal advantage during the Industrial Revolution, the current wave of language-based AI risks eroding the very cognitive roles that defined India’s integration into the global economy. Previous technology augmented skilled workers but now generative AI reverses that gain.

Yet if the risks are large, so are the stakes and the window of opportunity. India has a decade-plus before aging pressures converge. That means catalyzing foundational AI research instead of relying on imported models; demanding that IT giants reinvest into true innovation pipelines rather than buybacks; and deploying tax incentives to push domestic corporates toward AI-driven R&D. India’s strength has always been in scale and human capital and those advantages must continue to evolve.

Handled correctly, AI can expand productivity and accelerate the climb toward developed status. Mishandled, it could freeze social mobility, weaken services competitiveness, and turn a celebrated youth advantage into an economic drag.

3. Mumbai Becomes Multinational Capital Markets Hub

Mumbai

India's equity markets are entering a new strategic phase, where domestic liquidity and structural growth confidence are converging to redefine listing behavior among global firms. Rothschild expects 10+ multinationals to list in Mumbai in 2026. The city is starting to become a capital-formation center competing with New York, London, Seoul, and Singapore.

Retail flows, which historically oscillated with global sentiment, have become a stabilizing force thanks to SIPs, digital brokerage use, and the wealth accumulation underway in urban and semi-urban India. When a market can absorb $1–3 billion (₹89-267 billion) IPOs without foreign dependence it ceases to be just an EM equity story and begins to resemble a self-funded growth ecosystem. Asset managers, domestic pension pools, and family offices act as price-setting anchors while foreign institutions move into the role of price-takers.

The success of listings like Hyundai and LG signals that India is pricing global technology-adjacent consumer and manufacturing narratives at a premium relative to peers. Further strategic value is that multinationals listing in India embed themselves deeper into policy. They become invested in supply-chains, hiring, and capital allocation.

However, the acceleration also introduces fragility. High valuations are a double-edged sword. If India’s equity markets remain structurally expensive relative to global comparables, the risk is erosion of institutional trust. Also, if India takes on a larger role in global markets, there will inherently be more volatility. The challenge is to ensure that liquidity does not mask risk and that governance keeps pace with growth.

How helpful was today's newsletter?

See you tomorrow.

Written by Eshaan Chanda & Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.