Good evening,

Welcome to the best way to stay up-to-date on India’s financial markets. Today, we’re discussing

Adani Group has quietly mounted a high-stakes campaign in Washington to head off criminal and civil charges

India offers zero-for-zero tariffs on select goods to U.S,

and Netflix reveals strong growth in India.

Then, we close with Gupshup, a round-up of the most important headlines.

Have a question you want us to answer? Fill out this form and you could be featured in our newsletter.

—Shreyas, [email protected]

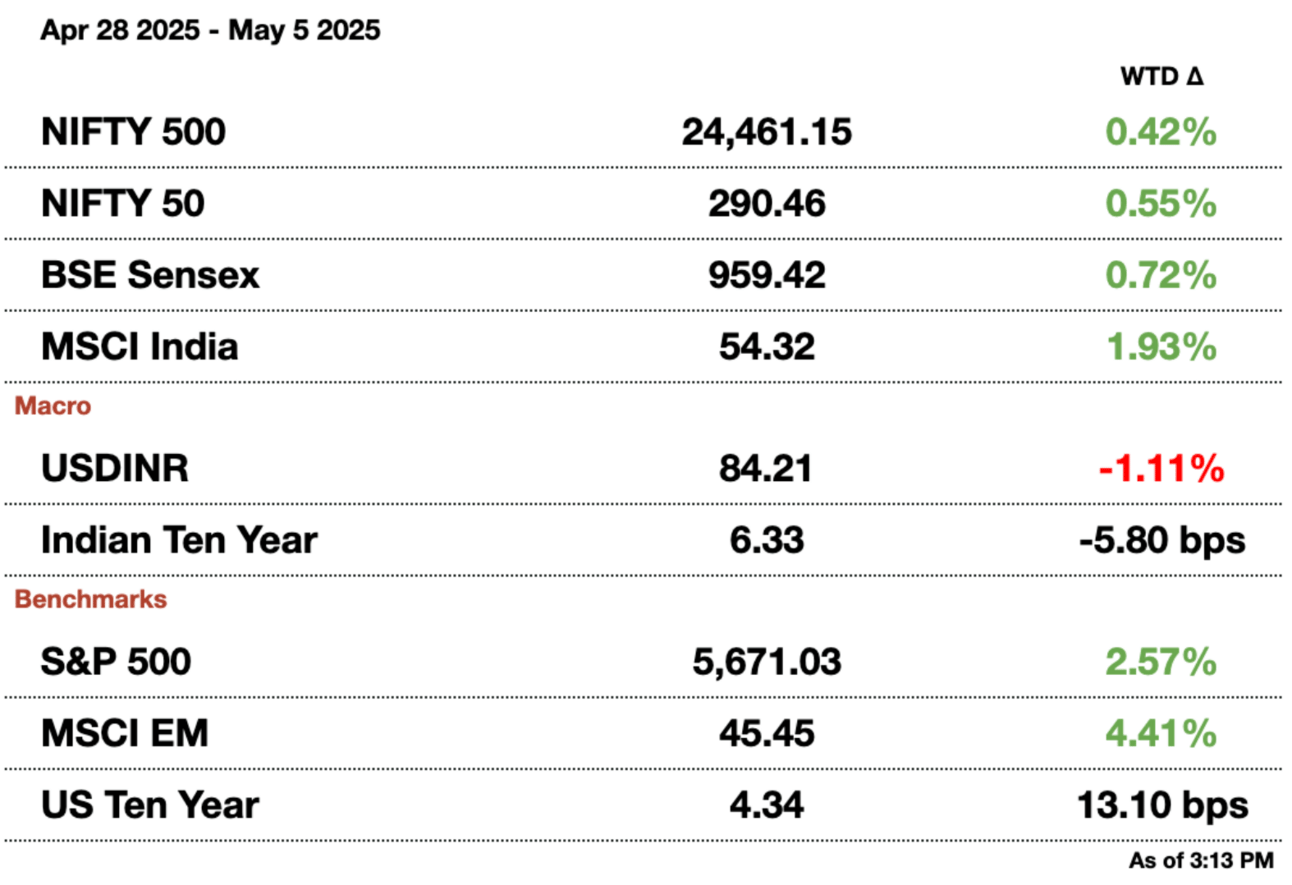

Market Update.

Adani Takes on Washington, D.C.

Adani Group has quietly mounted a high-stakes campaign in Washington to head off criminal and civil charges. At issue are allegations that Adani orchestrated a $250 million (₹21.1 billion) bribery scheme to secure solar-power contracts in India, claims his companies vehemently deny. Since Trump’s victory, Adani’s surrogates have engaged senior Justice Department and White House officials, arguing that prosecuting him under the Foreign Corrupt Practices Act contradicts Mr. Trump’s “America First” agenda of protecting US business interests abroad.

Gautam Adani

A refresher: In October, a sealed federal indictment filed in Brooklyn accused Adani of securities fraud and conspiracy to commit wire fraud, alleging that they misled American lenders by falsely certifying compliance with anti-bribery laws. Simultaneously, the SEC filed a civil suit alleging parallel misconduct, seeking to bar the duo from US markets and impose steep penalties. Unlike a textbook FCPA case, prosecutors sidestepped direct bribery counts and instead zeroed in on alleged misrepresentations to banks and bond investors.

Adani’s defense team: Mark Filip, former Acting US Attorney General and now partner at Kirkland & Ellis, has led talks with the Brooklyn US Attorney’s Office, pressing for charge-folding in deference to evolving enforcement priorities. Simultaneously, BGR Group has lobbied the White House and congressional offices, emphasizing Adani’s public pledge to invest $10 billion (₹845 billion) in US projects and create 15,000 jobs. Senate lobbying disclosures confirm BGR’s registered role on India–US trade matters, underscoring how Adani’s fate has become one with broader bilateral economic diplomacy.

President Trump has openly criticized the FCPA as hampering US competitiveness with his February executive order freezing new FCPA actions pending guidelines. Since then, the DOJ has quietly dismissed a bribery case against Cognizant executives, citing similar concerns about undue economic damage. Adani’s team argues that his prosecution should be next in line for a Trump-era course correction, pointing to the administration’s willingness to let the case against New York Mayor Eric Adams collapse.

On Capitol Hill, a cohort of House Republicans has sent letters to Attorney General Bondi, calling for the immediate dismissal of the Adani indictment and an inquiry into the prosecutors’ decision to file. They frame the case as a threat echoing Vance and DNI Gabbard’s public assurances of solidarity with New Delhi’s counter-terrorism stance. Overhead, formal US–India trade talks are nearing a deal, raising the stakes: a high-profile prosecution of a Modi-aligned tycoon at this moment threatens to rattle bilateral goodwill, jeopardizing commitments on technology transfer, defense sales, and investment protections.

A successful lobbying effort could see the DOJ file a motion to dismiss on jurisdictional or policy grounds, effectively neutering the criminal case; the SEC, however, may press on with its civil suit, where evidentiary thresholds are lower. Even a partial victory would sharply reduce Adani’s legal and reputational risks in the United States. Conversely, any perception that the Trump White House intervened to shield a foreign billionaire could provoke a backlash from career prosecutors and congressional Democrats, who warned that selective enforcement undermines the rule of law.

India Offers Zero-for-Zero Tariffs to U.S.

India has offered a bold new trade proposal to the United States: a “zero-for-zero” tariff arrangement on select goods, including steel, auto components, and pharmaceuticals. The offer, made during high-level trade talks in Washington last month, is aimed at jumpstarting a bilateral trade deal between the two countries before the fall. Under the proposal, India would eliminate tariffs on certain U.S. imports—up to a defined quota—if Washington does the same for Indian goods in those sectors. Imports above that threshold would be subject to standard duties.

Vice President Vance and Prime Minister Modi met recently to discuss bilateral trade

The move is part of a broader effort to secure a partial trade agreement while the U.S. temporarily pauses enforcement of aggressive tariff policies under President Donald Trump. The administration had earlier imposed sweeping levies on foreign imports, triggering retaliation from major trading partners and disrupting global supply chains. India’s zero-for-zero offer is intended to create early wins and demonstrate goodwill amid prolonged trade tensions.

Sources familiar with the talks say India’s trade delegation is also open to relaxing its Quality Control Orders (QCOs)—a set of non-tariff regulatory standards that U.S. officials argue unfairly hinder American exports. India has dramatically increased the number of QCOs in recent years, from just 14 in 2014 to over 140 today. While originally intended to ensure consumer safety and product quality, critics claim they act as hidden trade barriers. India has indicated a willingness to review some of these, especially in sectors like chemicals and medical devices, and to consider a mutual recognition agreement that would align regulatory standards between the two countries.

This push for a partial deal comes amid broader geopolitical shifts and economic pressures. The U.S. economy recently showed signs of contraction, and Trump has hinted that several trade deals—including one with India—could be finalized within weeks. India, along with other Asian economies like Japan and South Korea, has been actively negotiating interim agreements in an attempt to shield its exports from future tariff hikes.

Whether the zero-for-zero proposal and QCO compromise will be part of a final agreement remains unclear. Still, the offer signals India’s intent to be a proactive player in reshaping its trade relationship with the U.S., prioritizing pragmatic, sector-specific cooperation over sweeping but elusive trade pacts.

Netflix Reports Growth in India.

Netflix’s $2 billion economic impact in India (2021–2024) highlights its deep integration into the local entertainment scene, with 3 billion hours of Indian content viewed in 2024 alone by both local and global audiences.

Promotional material from Netflix showcasing Netflix-made Indian movies

Netflix is rejecting Mumbai’s traditional studio model. By commissioning projects from more than 100 cities and employing over 25,000 local crew members, Netflix is effectively underwriting a decentralized production model that fosters talent development across geography, rather than concentrating opportunities in Mumbai’s traditional studios. That geographic breadth translates into wider economic spillovers across the service industry. The $2 billion (₹169 billion) figure undercounts these ripple effects, since it focuses only on production spend. Ancillary gains of boosting tourism and energizing regional film hubs multiply the value of that investment.

At the same time, Netflix’s intensive push has injected new competition into a media landscape long dominated by entrenched players like JioHotstar and Amazon Prime. By betting heavily on premium, locally produced originals, Netflix is elevating consumer expectations for production values, script sophistication, and marketing heft. Incumbents must now match not only the budgets but also the creative risks that Netflix has shown a willingness to take. The viewership milestone also hints at an export opportunity. When Netflix’s regional slate finds success domestically, it gains an inherent competitive advantage in international markets where algorithms can surface subtitles or dubbed versions to curious audiences.

Yet this model carries risks. Heavy reliance on foreign capital and platform-driven financing can crowd out smaller independent producers who lack global distribution channels. Netflix will need to balance volume with sustainability, ensuring that production fees flow fairly through the ecosystem and that a diversity of voices continue to find a platform.

Message from our sponsor.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

Gupshup.

Macro

Saudi Arabia's push into Indian refining is stalling over an undersupply of crude to Indian companies. India wants the country to have a 20 percent share in oil for two Indian refineries to allow Saudi ownership stakes. This would be the third proposed project from Saudi Arabia in India that would fail due to underinvestment from the Saudi Arabian side.

Equities

Investors expect Eternal (Zomato) to outperform Swiggy. Blinkit, an Eternal company, has been losing company cash recently but is planning on slowing warehouse expansion, which should protect earnings. Swiggy also faced pain in the market with delivery earnings falling, but has less space to pivot operations.

Godrej Properties' net income beat analyst expectations, but sectoral challenges remain a worry. Cautious guidance reflects that the near-term outlook for developers will likely be poor. Signs of a slowdown in home sales have weighed on the NSERealty Index, which is down 16 percent on the year.

Alts

Turnover of GIFT Nifty derivatives contracts hit $100 billion (₹8.5 trillion) for the month of April, with 2.2 million contracts traded. The trade volume came from an influx of foreign investors in April. GIFT City is much more open for foreign investment, allowing for more option turnover as well.

SBI, India's largest bank, is mulling a $3 billion (₹250 billion) equity or debt raise. They are most likely learning towards equity, given that the shares are trading at all-time highs since the sector is shielded from tariffs. The raise will likely happen in 1Q26 in multiple tranches, though more specific data is not available.

Policy

A potential conflict with Pakistan would be economically disastrous for both countries. India is in the midst of creating a trade deal with the US, while Pakistan continually needs more loans from the IMF. Both pacts could be under duress, given the economic leverage that the US and US-backed IMF hold over both countries. India also appears less investor-friendly if dragged into conflict with a regional neighbor.

India recalls its envoy to the IMF for continually disagreeing with the fund's analysis. KV Subramaniam was always in disagreement, calling the IMF’s growth estimates continually inaccurate. He also lashed out against the IMF, calling excessive monetary policy intervention harmful.

Pakistan tested missiles as war tension rises. There was a long-range missile test, with the Ministry of External Affairs citing that the test was conducted to gauge navigation systems and maneuverability features. Indian officials said such tests only raise tensions and that Pakistan is being provocative.

See you Tuesday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.