China is accusing the U.S. of trying to sabotage warming India-China relations. Today, we explain what this means for India’s economy and U.S.-India relations.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

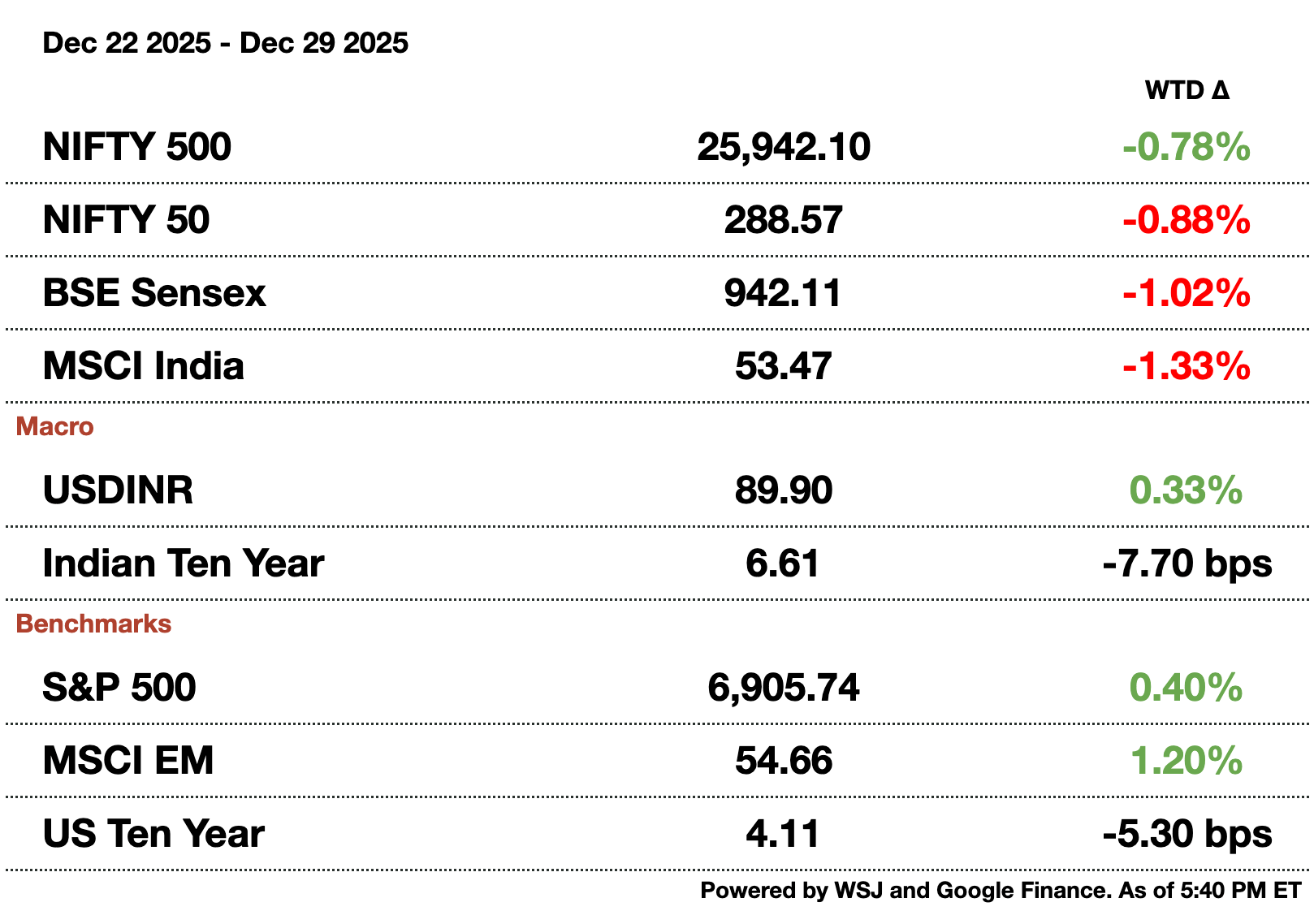

Macro

Nayara, an Indo-Russian oil refining company based in Mumbai, is pushing back refinery maintenance work as it restructures its sanction-plagued deals with Rosneft. EU companies are unwilling to work with the firm due to heavy Russian investment and oil imports. Nayara’s refinery was only used to process 400,000 barrels of Russian urals.

RBI Governor Malhotra expects inflation to remain benign barring any supply-side shocks, keeping rates low as well. He also reaffirmed India’s growth outlook speaking to the low inflation and 7+ percent growth in the country. Malhotra praised the RBI’s current rupee management system, saying the bank is only prioritizing curbing volatility, not targeting a specific exchange rate level.

Equities

Persistent foreign and domestic institutional selling led to small and mid-caps being down 5 percent for 2025. While the Nifty rose 9 percent, most companies experienced selloffs especially compared to their 2024 highs. Consistent inflows into mutual funds were not enough to stem the earnings downgrades and downbeat US trade deal news while insider selling led to an oversupply of shares at times.

Alts

AI is solving India's lack of radiologists by speeding up diagnoses from scans. India has only 20,000 radiologists for its massive population, less than the US. Qure.AI and 5C Network help identify abnormal readings in an hour versus the 48 normally required by a physician. Doctors still have to manually verify the reading due to false scans.

AST Spacemobile is launching its biggest satellite from India to challenge SpaceX.AST wants to serve customers who lack cellular service while ISRO is getting a boost in its space aspirations to build an orbital space station.

Policy

Jane Street has hired lobbyists for the first time as SEBI is close to publishing its investigation results. Firm reps have met with the Treasury and Commerce Departments to discuss its activities in India. The year-long case is expected to make major headwind with SEBI reports coming out detailing alleged wrongdoing and market manipulation.

Colorado’s Most-Awarded Brewery Did Something Totally Unique

Some companies make lofty promises to investors and never deliver. Others use those dollars to unlock new levels of scale.

That’s Westbound & Down’s story. Already Colorado’s most-awarded craft brewery, they opened their doors to investors for the first time to help open a flagship Denver-metro-area location.

With 2,800% distribution growth since 2019 and a retail partnership with Whole Foods, it’s no shock investors maxed out that campaign in less than 60 days.

But it’s what comes next that’s even more exciting. Fresh off Brewery of the Year honors at the 2025 Great American Beer Festival, W&D is scaling toward 4X distribution growth by 2028.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

Reach out to [email protected] to reach our audience and see your advertisement here.

A Record Year for IPOs, and How 2026 Will Surpass It

The IPO market hit a record year in the total amount raised at $22 billion (₹2 trillion) and had the highest number of companies going public (over 200) in 27 years. Notable names included Tata Capital and LG’s Indian conglomerate. Bankers see the pipeline into 2026 remaining strong which could lead to another record setting year.

All the while, stock exchanges had a lackluster year compared to peers, especially in terms of foreign investors leaving the market leaving just 17 percent foreign ownership for companies listed on the NSE. Tariffs from the US, conflict with Pakistan, and a lack of pure-play AI opportunities caused an exodus into other peer markets like China and southeast Asian countries. Geopolitics also weighed on corporate earnings and GDP expectations. Companies were still able to list even with record sizes. Tata raised $1.7 billion (₹152.2 billion) as this year’s largest while LG did $1.3 billion (₹116.4 billion). In total, 2024 and 2025 have raised over $43 billion (₹3.8 trillion) publicly and another $100 billion (₹9 trillion) in block trades and private placements.

Part of the continued growth in the two tumultuous years has been domestic capital expanding to 75 percent of IPO demand compared to just 50 percent in 2021. The main drivers have been mutual funds, insurers, and pension vehicles which have all been supported by inflows from everyday people to the tune of $5 billion (₹447.5 billion) per month. SEBI has opened markets up while the RBI has given banks and wealth managers more jurisdiction; savers have started preferring equities over property, gold, and bank deposits since the pandemic. In fact, the individual investors’ allocation of 35 percent of shares in most public offerings has consistently been filled.

The demand for equities has also led to the supply of IPOs and willing companies rising. A buoyant stock market has pushed valuations higher giving founders a way to cash out and an opportunity to raise capital for growth without incurring high interest given the restrictive RBI rates right now. Key industries have been financial services followed by consumer services. Financial services saw huge deregulation this year with more investment opportunities for funds, unlocked foreign capital for insurers and pensions, and the ability to compete in domestic M&A markets for banks. Consumer services companies are competing for slivers of market share by building distribution capabilities, something that requires large amounts of capital expenditure which an IPO easily allows for.

The challenge now is durable growth given earnings slowing while valuations rise. Over 50 percent of this year’s listings are trading below offer prices which could cause a 2026 slowdown by cautious investors and funds. At the same time, enthusiasm is high with Rothschild expecting at least 10 multinational firms like Coke to list in 2026 on top of expected domestic blockbusters like Jio, Flipkart, and the NSE.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.