In partnership with

Institutional investments into Indian real estate grew tremendously last year to hit a record $8.5 billion (₹765.9 billion), a 30 percent y-o-y growth. Today, we explain what drove this and what to expect next.

If you have any questions about India, fill out this form or reach out to Shreyas at [email protected]

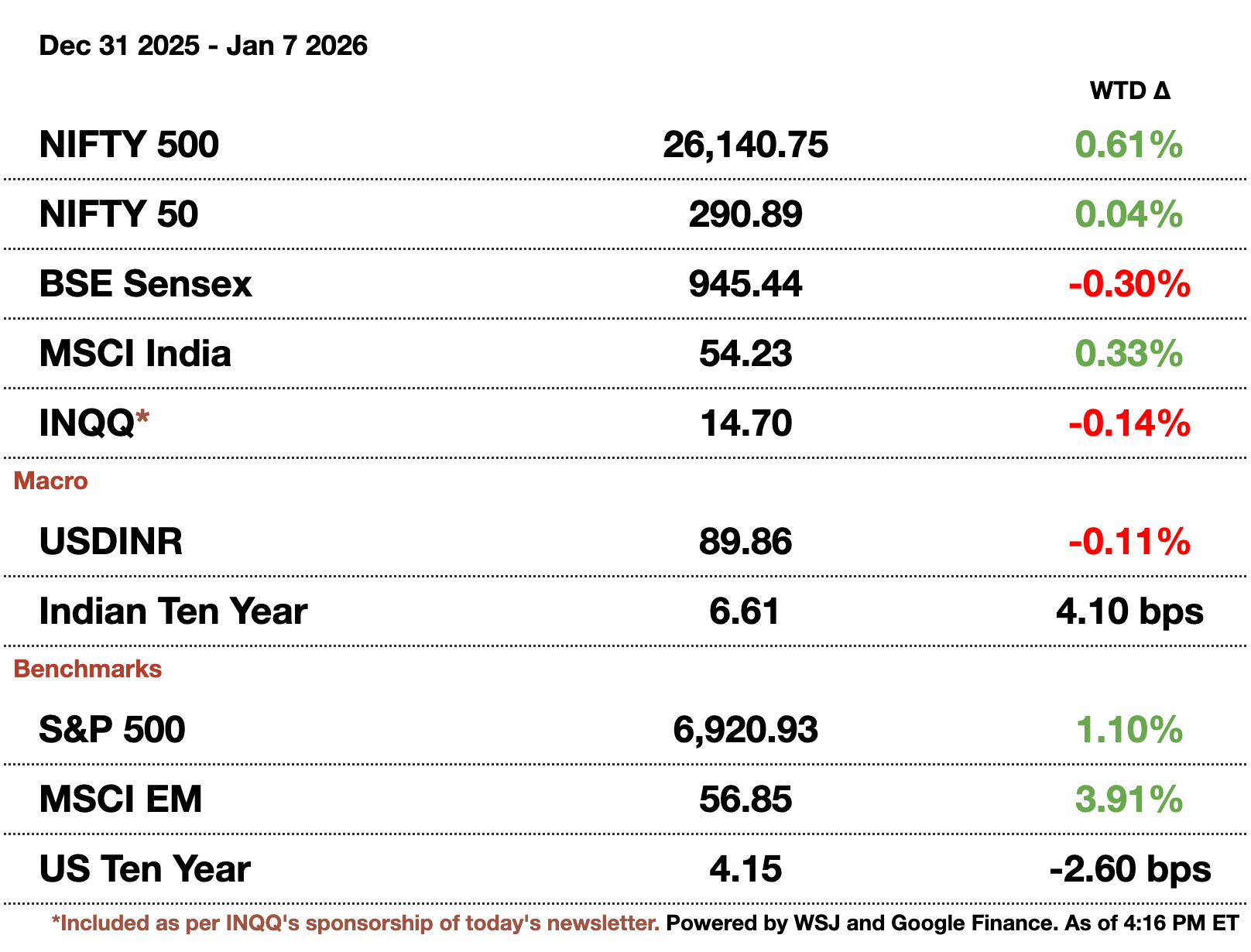

Macro

Russian oil cargoes meant for Reliance's refinery ended up discharging to Bharat Petroleum. Reliance has maintained that no deliveries are scheduled for this month while BPCL has not commented on the incident. It is possible that the ships updated their destinations closer to the ports.

This month could be decisive for exporters securing 1H26 trade contracts, making a trade deal vital.If a US deal is not reached, exporters will have to enter into punitive contracts or just lose access to the US markets. Textiles, leathers, and other finished goods manufacturers have received $5 billion (₹450.5 billion) from the government and have cut production up to 25 percent.

Equities

Citi and JP Morgan opted out of the $1.4 billion (₹126.1 billion) SBI Funds IPO after only being offered 0.01 percent deal size fees. The banks described the fee as ‘rock-bottom’ compared to the average 1.8 percent given throughout 2025. Over 200 IPO deals are expected to go through this year, meaning that banks can afford to be selective.

Tata-owned Trent Ltd, which focuses on affordable clothing, sank 40 percent last year due to competition.Reliance and Birla both are entering the fray and urban demand has remained patchy; those reasons caused $20 billion (₹1.8 trillion) of its market cap to erode away. Revenue per square foot has fallen 16 percent, a key metric for any retail company.

Alts

Modulus Investment Managers is poaching senior UBS staff to build its private credit platform. Modulus has deployed $333 million (₹30 billion) so far in credit deals targeting a 17 percent IRR. The Asia-Pacific private credit market is expected to reach $92 billion (₹8.3 trillion) by 2027, nearly double 2024’s market value.

Quant Mutual Fund, a wealth manager in equity, debt, and hybrid funds, is poaching rival money managers.The firm manages $10.7 billion (₹968 billion) and is expanding.

Policy

A climate activist was arrested on liquor charges but is being investigated for receiving foreign funds to promote anti-fossil fuel agendas. Harjeet Singh may have received $667,500 (₹60 million) from foreign climate networks to promote the Fossil Fuel Non-Proliferation Treaty to end all use of fossil fuels in numerous countries.

Trump says Modi is 'unhappy with him' due to high tariffs.This episode continues the stressed relationship the two have had during Trump 2.0. Trump also commented on delays to the 68 ordered Apache helicopters meant for India, saying that Modi talked to him about those.

Invest in India's Tech Wave — The India Internet ETF (INQQ)

Eternal. NYKAA. Groww. Lenskart. Swiggy. Gain exposure to the “new age” technology leaders driving India's rise on the global stage -- all in a single trade. The India Internet ETF (NYSE: INQQ) allows investors to access a basket of innovative companies contributing to the future of the world’s most populous country.

From e-commerce to fintech to travel, the INQQ ETF taps into India’s rapidly expanding digital landscape and seeks to deliver a targeted way to participate in potential long-term growth. Invest with the INQQ ETF.

Reach out to [email protected] to reach our audience and see your advertisement here.

New residential buildings in Hyderabad, India

$8.5B Flows Into Indian Real Estate in 2025

Institutional investments into Indian real estate grew tremendously last year to hit a record $8.5 billion (₹765.9 billion), a 30 percent y-o-y growth. Domestic investments were key as they doubled to hit $4.8 billion (₹432.5 billion) accounting for 57 percent of real estate inflows. Foreign capital actually declined by 16 percent to hit $3.7 billion (₹333.4 billion) as further proof of the cautious investment thesis prescribed to India. Below are some other key reasons for why real estate is one of the fastest growing segments of India’s capital markets.

The domestic/foreign composition was significant in its shift this year. The doubling of domestic capital marks a change in how wealthy households and long-term capital views commercial property as a stronger investment opportunity. Tighter regulation and improved governance standards have led to transparency in the sector. Additionally, residential prices are already stretched which makes it so investors are broadening their focus beyond luxury housing into offices and retail space. While foreign investment fell 16 percent, the two largest deal announcements were both from Brookfield for data centers and global capability centers.

Another key driver is the growth of office properties. Investments into office assets doubled to $4.5 billion (₹405.5 billion) due to demand for GCCs, flexible workspaces (reminiscent of WeWork), and multinational firms expanding in India. Bengaluru alone received $2.2 billion (₹198.2 billion) in total investments, a 277 percent jump, as the city is becoming India’s hub for technology, services, and white-collar employment.

Luxury housing remains a hotspot with prices rising 19 percent in Delhi, 15 percent in Bangalore, and 13 percent in Hyderabad all y-o-y. Total housing growth in India is also split 51 percent towards luxury growth which will only grow further if interest rates are cut, leading to pent-up upward movement demand to spill out. Premium housing is defined as being worth at least $111,000 (₹10 million) or higher. Ahmedabad and Pune are also on their way to megacity status while 17 tier-2 cities are witnessing rapid growth to continue housing market growth.

India’s property market continues to defy investor warnings of being a bubble or overheating. If domestic and foreign capital continues to flow into the sector, the current real estate cycle will remain resilient especially given the infrastructure growth being seen across all of India now, not just the 5 or so existing megacities.

How helpful was today's newsletter?

See you tomorrow.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Sponsor the next newsletter to reach tens of thousands of U.S.-based business-savvy professionals. Reach out to [email protected].

Could your business use expert insights to power growth in India? Reach out to [email protected] for a free introductory call.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.