Welcome to Samosa Capital’s evening briefing — the best way to stay up-to-date on India’s finance and markets. Today, we’re breaking down 2025 expectations for India, specifically for stock market performance, IPOs, the Union Budget, and GDP growth. Finally, we’ll close with Gupshup, a round-up of the most important headlines.

Have a question about India? Fill out this form and you could be featured in our newsletter.

If you have feedback on our newsletter or just want to chat about India, always feel free to reach out to me.

—Shreyas, [email protected]

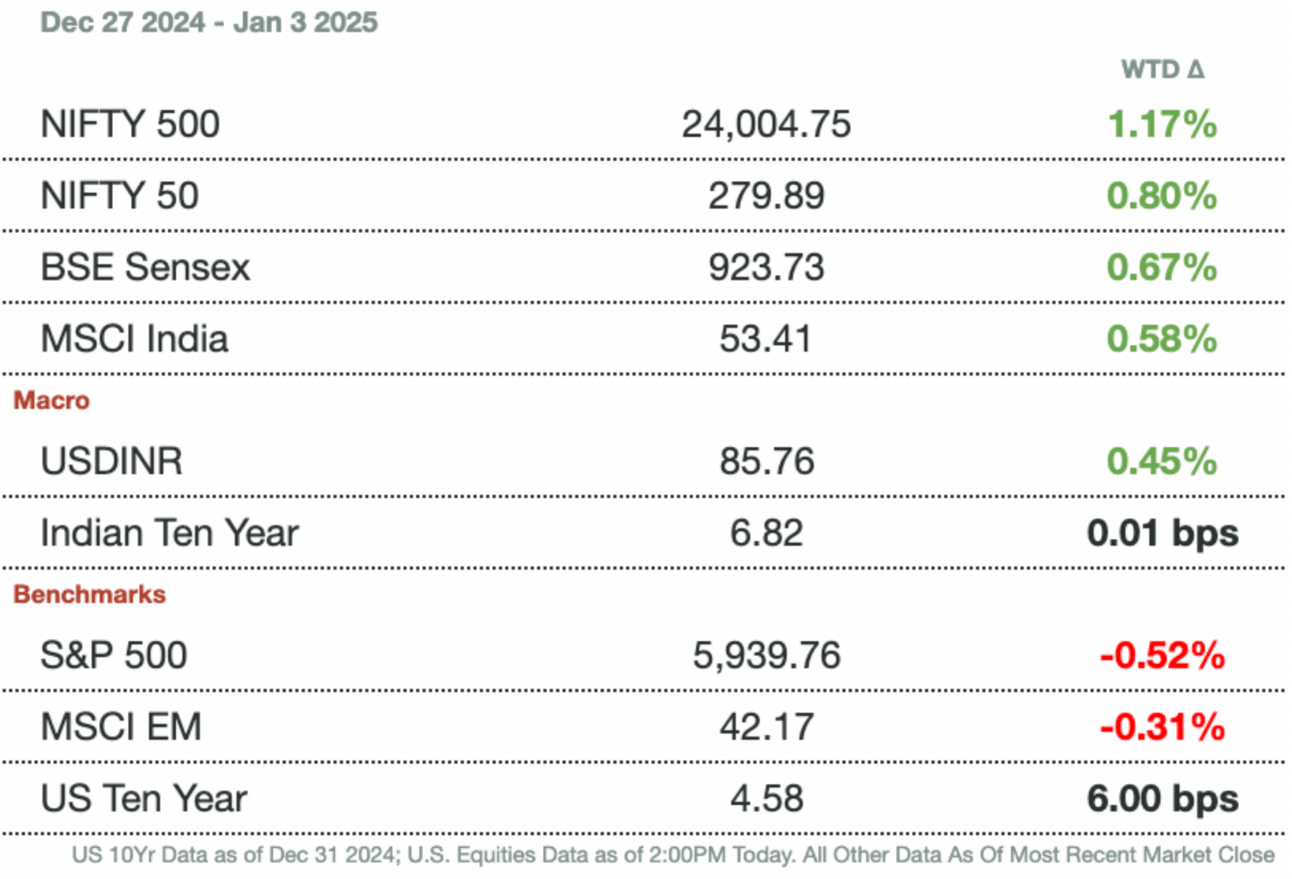

Market Update

Live Event

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

Get Ready for 2025

On February 1, Finance Minister Nirmala Sitharaman will present the Union Budget, shaping the country’s economic trajectory. For a developing country, the government still plays a significant role in the economy's direction and can pick winners and losers among industries it selects as economically vital. Still, India’s government expenditure is 28.62 percent, lower than the United States’ 36.26 percent.

Prime Minister Narendra Modi enters 2025 with thinner margins in the Lok Sabha than he has ever had before, as he faces a less-than-expected ~5 percent GDP growth in the latest quarter, high inflation, and structural issues like low foreign investment, systemic underemployment, and high youth unemployment.

Stock Market A poll of 61 portfolio managers found that the majority expect the Nifty50 to rise by single to mid-double-digit percentages in 2025, while 11 percent of respondents said they expect the Nifty50 to decline. The Nifty50 is up ~10 percent in the last year, less than half of the S&P500’s 26.3 percent in the same period. The Nifty500 is up 16.21 percent. INQQ, an ETF that tracks Indian internet companies, is up 20.5 percent in the last year.

In 2024, over 90 Indian companies raised $18.9 billion (₹1.62 trillion rupees), doubling 2023’s capital raise. India had the most companies IPO compared to anywhere else in the world. Analysts expect India to continue the momentum into 2025, with Narendra Solanki, the head of fundamental research at Anand Rathi, an investment bank, telling Mint that India’s 2025 IPO proceeds will easily cross ₹1 trillion rupees, or $12 billion. Tata Capital, LG, Jio, and the NSE are among the prominent names that are expected to IPO in 2025. Bloomberg expects at least 85 companies to raise $18 billion (₹1.5 trillion) via IPOs in 2025.

Economic Growth and Budget Hopes India's GDP growth is forecasted at 6.5 percent for FY2025 (fiscal year ending March 2025), a significant drop from the 8.2 percent expansion in FY2024. The RBI’s projected annualized GDP growth rate for the next quarter, Q3, is 6.8. The projection for Q4 is 7.2 percent, FY 2025-2026 Q1 is 6.9 percent, and Q2 is 7.3 percent.

The Union Budget 2025-2026 is anticipated to set an optimistic tone for India's economic growth, focusing on key sectors such as infrastructure, healthcare, education, and technology. The budget is likely to introduce tax reforms aimed at simplifying the tax structure and broadening the tax base. The income tax exemption limit may be raised, potentially benefiting middle-income groups.

The fiscal deficit target for 2025-2026 is expected to be set at 5.9 percent of GDP, down from 6.4 percent in the previous year, reflecting the government's commitment to fiscal prudence and economic stability. Last year, Sitharaman’s Union Budget emphasized reducing the fiscal deficit to put India on track to raise its sovereign debt credit rating, currently a BBB- from Fitch and S&P, and a Baa3 from Moody’s. The government's focus on fiscal discipline and prudent monetary policy is anticipated to keep inflation around 4.5 percent, ensuring stable economic conditions and consumer confidence.

Structural Reforms on the Horizon One of the most anticipated reforms is the overhaul of India's six-decade-old income tax law. Expected amendments aim to simplify compliance, reduce litigation, and boost transparency. Additionally, the Modi government plans to shift fiscal targets from a fixed deficit to a debt-to-GDP ratio framework, enhancing flexibility for infrastructure investments while maintaining fiscal discipline. While only 1.6 percent of Indians paid any income tax in 2023, according to government data, a reformed tax code is expected to reduce regulatory pressure on businesses while increasing the government’s tax revenue.

The government is also expected to continue its focus on employment generation and skill development. The budget's emphasis on infrastructure, healthcare, and technology sectors is projected to generate approximately 10 million new jobs, addressing one of the critical challenges faced by the Indian economy. There will likely be a focus on skill development to equip the workforce with the necessary skills to meet the demands of a changing job market that requires IT services less and less.

Challenges Looming Large Global uncertainties, including trade disruptions and slowing foreign capital flows, remain pressing concerns. India's foreign direct and portfolio investments halved in the first half of FY2025, creating challenges for startups and equity markets. The government's ability to attract investments amid geopolitical tensions will be crucial.

US legislation could introduce additional volatility into global markets. Unpredictable trade tariffs and foreign relations may disrupt supply chains and elevate risk premiums across sectors, emphasizing the need for diversification and hedging strategies. In particular, QCOs pose a threat to US relations given their widespread nature. (Read yesterday’s newsletter for a QCO briefer).

However, India remains a prime destination for American companies to move supply chains to diversify their business away from China risks, most notably seen with Apple promising to produce a significant portion of its new iPhones and AirPods in India.

Key Sectors to Watch Manufacturing and services exports, public consumption, and private investment are expected to drive growth in 2025. However, rising bad loans in microfinance and consumer loans will require tighter credit quality scrutiny, especially with the RBI's expected shift to an "expected credit loss" model – essentially using more value-at-risk models rather than waiting until defaults start.

The IT and digital services sector continues to be a cornerstone of India's economic success, evolving beyond traditional software services into digital transformation, cloud computing, artificial intelligence, and cybersecurity. The renewable energy sector is poised for significant growth, with India aiming to achieve 450 GW of renewable energy capacity by 2030. This sector is expected to attract substantial investments and create new job opportunities since the sector still requires $200 billion (₹17.1 trillion).

Gupshup

Macro

Sugar prices rose since Indian production fell to 9.5 million tons. Highly liquid contracts rose just 3.3 percent to 19.90 cents per pound since September lows due to a 16 percent drop in production.

India's exports are expected to cross $800 billion (₹68.6 trillion) this upcoming year. Trade minister Piyush Goyal sees the export basket as continually growing with IT services continuing to lead the pack. He also brushed off growing imports as a sign of Indian economic growth.

Equities

Kotak Mahindra Milind Nagnur steps down from COO and CTO posts. Nagnur cited personal reasons; note that the RBI has sanctioned Kotak since his tenure started. The sanctions include lessening credit card issuance and restricting clients from joining mobile channels.

Dabur estimates low-single-digit sales growth next quarter for its home goods. Dabur makes home goods such as toothpaste to honey but expects overall subdued sales growth. While other market analysts project 4.8 percent, Dabur predicts revenue growth to be lower due to subdued demand for healthcare and beverage products.

Criminal and civil charges against Adani have been relegated to one judge. All 3 cases will now be fought together given the similarity in the charges brought. Adani Group continues to deny all the allegations.

Alts

A Modi ally in Andhra Pradesh confirmed that power purchase agreements with Adani will stay in place. Even though the agreements with Adani Power are under review by the US, the chief minister said he needs solid proof of wrongdoing before he will consider vetoing the deals.

Policy

India argues that H1B visas benefit both countries in response to online arguments to cut H1B recipients. India’s foreign ministry spokesman Randhir Jaiswal said that the growing technological and economic ties of both countries require worker mobility. Indians currently receive 78 percent of the nearly 300,000 annual H1Bs issued.

India's trade minister Piyush Goyal looks forward to strengthening trade ties with the Trump admin. She noted that under PM Modi, India has grown bilateral trade with the US under every single president. 2023-2024 trade numbered $118 billion (₹10.1 trillion) with India registering a trade surplus of $32 billion (₹2.7 trillion). Industry estimates show that trade could grow by another $50 billion (₹4.3 trillion) if economic cooperation is achieved.

See you Monday.

Written by Yash Tibrewal. Edited by Shreyas Sinha.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.