Hello. 16.6 billion. That’s how many transactions India’s Unified Payments Interface processed in October, a 12-month high. India leads in digital banking, bringing low-income into the fold of a rapidly expanding financial sector. We’ll explain more, and then close with Gupshup, a round-up of the most important headlines.

Seats are running out for our upcoming “Future of India” expert panel and networking event on Wednesday, February 12, 2025, in New York City. Buy now here, or earn a free ticket by sharing Samosa Capital with three friends.

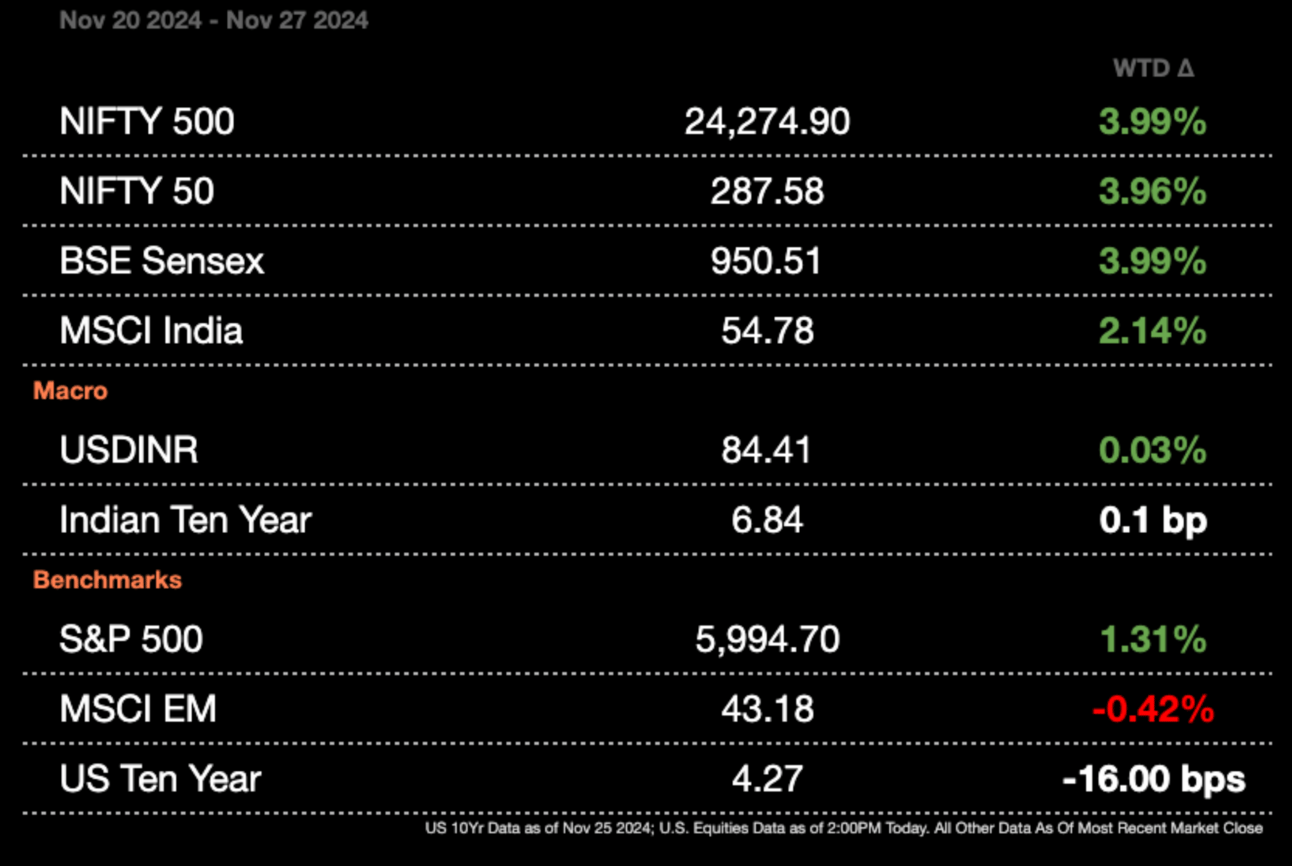

Markets

India's stock market faces a rocky road to recovery as high valuations and lackluster corporate earnings weigh on sentiment, compounded by recent Adani indictments, according to analysts. As a result, Nifty50 is down <1 percent MTD while the BSE index is up <1 percent. Some experts say that despite a decade of near-uninterrupted gains fueled by young, bullish investors, signs of an economic slowdown are starting to reveal cracks in the market's foundation.

Read here for an appendix on the above.

Explainer

India’s UPI Hits 16.6 Billion Transactions In October

Every Indian bank is now aboard the digital bandwagon, with mobile and internet banking becoming table stakes. Yet, it’s the next-level innovations that deserve applause: 75 percent of banks now offer online account opening, digital KYC, and doorstep banking. Digital lending is available at 60 percent of banks, payment aggregator services at 50 percent, and chatbots are fielding queries at 41 percent. Open banking has caught the imagination of 24 percent, and 10 percent are experimenting with Internet of Things tech. Unsurprisingly, private sector banks are leading the charge.

These upgrades aren’t just fancy features; they deliver efficiency in spades. AI-powered reviews of annual reports reveal jaw-dropping productivity gains. Banks have slashed compliance monitoring time by 50 percent, saved 14,500 person-days a month, and cut customer acquisition costs by 25-30 percent. Thanks to Aadhaar-powered KYC, opening a bank account now takes less than a day at half the cost.

Enter Unified Payments Interface, the crown jewel of India’s digital infrastructure. October 2024 saw a staggering 16.6 billion transactions—a 12-month surge buoyed by enhanced instant debit reversal success (now 86 percent, up from 77 percent last year). Add to this a growing suite of innovations: Open Credit Enablement Network (OCEN), Account Aggregators, and the Open Network for Digital Commerce (ONDC). ONDC, active in over 720 cities, clocked 49.72 million orders in March 2024.

Small businesses are also reaping the benefits. Trade Receivables Discounting System (TReDS) addresses the $618.4 billion (₹52.2 trillion) MSME credit gap, cutting funding costs by up to 2.5 percentage points. The value of invoices financed through TReDS has exploded 23-fold.

With 40 percent of rural India now online, digital is bridging gaps once deemed unbridgeable. One-third of households shop online, while embedded finance—think point-of-sale loans or credit in your grocery app—has grown from 2 percent to 9 percent of fintech funding in just four years. Globally, embedded finance is projected to grow at 25.4 percent CAGR, reaching $66.8 billion by 2032.

The government’s Direct Benefit Transfers program is in a league of its own. In 2024, $81.7 billion (₹6.9 trillion) flowed into 1.76 billion beneficiary accounts under 314 schemes. These DBTs have saved $41.5 billion (₹3.5 trillion) cumulatively. Public service e-transactions surged 56 percent year-on-year.

The Reserve Bank of India is the quiet architect behind this digital revolution. From piloting Central Bank Digital Currency to rolling out the Unified Lending Interface for simplified credit access, its initiatives are leading the world in the digitization of retail banking. On the global stage, India is pivotal in cross-border open finance projects like Project Nexus and Bridge.

Macro

India's plans to expand steel production capacity to 300 million metric tons by 2030 are under threat from falling prices caused by global dumping, the Ministry of Steel warned. The ministry cautioned that without adequate domestic capacity, the country risks becoming increasingly reliant on steel imports, impacting infrastructure development. (Reuters)

The Indian rupee weakened on Wednesday, weighed down by strong dollar demand from public sector banks linked to the expiry of currency futures and importers' month-end payments. Broader weakness in Asian currencies, including a 0.4 percent drop in the Indonesian rupiah, added to the pressure. (Economic Times)

Dollar selling from the RBI starves Indian banks of liquidity for the second time in two months with an index of banking liquidity swinging to the left due to FX outflows. When the RBI sells dollars, they have to buy the rupees generally from Indian banks or any offshore entities. Due to the US presidential election, FX interventions have risen dramatically. Banks were parking $23 billion (₹2 trillion) earlier in November in reverse repo facilities but are now borrowing$1.69 billion (₹141.98 billion). The increased borrowing has also pushed up overnight borrowing rates to 6.73 percent, higher than the current RBI policy rate. (BBG)

Equities

Adani Group faced fresh setbacks as Fitch and Moody downgraded outlooks on several group firms following U.S. bribery charges against founder Gautam Adani. With project reviews underway in India and Sri Lanka, Andhra Pradesh is reportedly poised to suspend a power deal, marking the first state-level response to the allegations. (Reuters)

TotalEnergies CEO Patrick Pouyanne stated the company can achieve its 2025 renewable energy goals without further collaboration with Adani Green Energy, despite their ongoing 3.8 GW of joint projects. TotalEnergies paused new investments with Adani following the news of U.S. indictments against key Adani executives. (Reuters)

NTPC Green Energy soared 14 percent in its market debut, reaching a valuation of $12 billion (₹1.02 trillion) as investors rallied behind India's clean energy push. The renewable arm of NTPC reported nearly doubled profits last year, alongside a 35 percent revenue boost, bolstering its appeal to the market. (Reuters)

The Indian government plans to restructure IFCI Ltd, a non-bank financial company focused on infrastructure investments, by halting its lending operations and transforming it into an infrastructure advisory firm. This shift aims to expand its services, including evaluating state and green infrastructure projects and follows a significant rise in its stock, which surged 121 percent this year, driven by a merger with its subsidiary, StockHolding Corp. of India. (Reuters)

Alts

Vedanta Resources has received $800 million in bids for two planned dollar bonds to refinance its 2028 debt, offering coupon rates of 10.25 percent on short-term bonds and 11.25 percent on longer-term ones. This marks the first such issuance by an Indian company following the indictment of Adani Group officials on fraud and bribery charges. (Reuters)

PAG lines up $375 million (₹31.5 billion) to buy out Manjushree Technopack. Manjushree is India’s largest manufacturer of rigid plastic packaging. PAG is acquiring the company from Advent in its largest Indian deal to date. The loan will be syndicated to the broader market through 4 banks after details are finalized. (BBG)

President Ruto of Kenya is blocked from privatizing the country’s airports to the Adani Group. Opponents of the deal have challenged it on the basis of the state’s leasing rights. The court blocking further privatization not only removes Adani from the running but all other potential suitors. Since the American indictment on Adani, Kenya has walked back over $2.6 billion (₹213 billion) in deals. (Al Jazeera)

Policy

India’s parliament ground to a halt for the second day as opposition lawmakers demanded discussion on U.S. bribery charges against billionaire Gautam Adani, whose conglomerate denies the allegations and vows legal action. The controversy has reignited accusations that Prime Minister Modi’s government is shielding Adani, a claim the ruling BJP has repeatedly dismissed. (Reuters)

India’s Parliament is set to reconvene to discuss the Banking Laws Bill, which the BJP-led majority intends to pass. The opposition party aims to amend the bill, seeking to impose restrictions on the powers granted to financial institutions. They may also push to link the amendment with allegations of corruption involving the Adani Group and questions surrounding the alleged misconduct of SEBI Chairperson Madhabi Puri Buch.(Economic Times).

India plans to amend its insurance laws to introduce a unified license for insurers, allowing them to offer life, general, and health insurance under a single entity, and increase the foreign direct investment limit from 74 percent to 100 percent. These changes aim to attract foreign investment and boost insurance penetration in the country. (Reuters)

See you Friday, and Happy Thanksgiving.

Written by Yash Tibrewal, Edited by Shreyas Sinha

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

1 USD = 84.41 Indian Rupee